Here are the premium credit card perks that really matter.

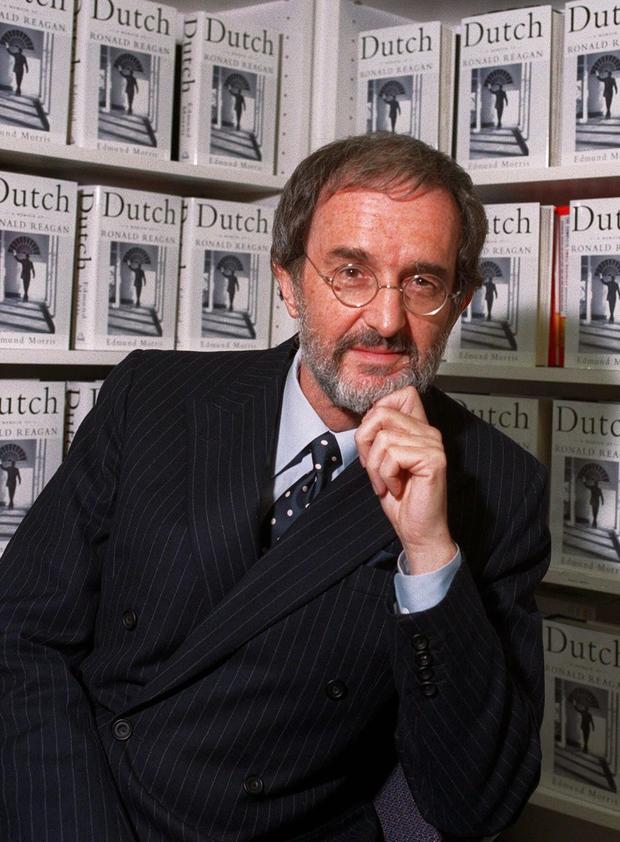

Image source: Getty Images.

Continue Reading Below

If you’re planning to apply for a premium credit card, then you’re probably wondering how to pick the right one.

After all, a premium credit card is in some ways an investment. You’re paying an annual fee that could be well over $250 in hopes of getting far more value back from the card. Anytime you’re spending that kind of money, you want to be sure you’re making the right decision.

Premium credit cards are certainly feature-rich, but not all of those benefits are game-changers. To figure out which premium card is the best fit for you, you’ll need to know what to look for.

1. Versatile points

Every premium credit card earns a certain type of points, and the points that a card earns determines what the redemption options are. It’s important that you check out a card’s redemption options to verify that you can easily redeem your points and that you can get a good value for those points in the process.

Advertisement

Many premium credit cards are part of a rewards program, such as Chase Ultimate Rewards® or American Express Membership Rewards®. These programs generally let you either transfer your points to travel partners for award bookings or redeem your points towards travel at a fixed rate. With this type of premium card, make sure you check the following:

- Travel partners — Which airlines and/or hotels are partners in the card’s rewards program? You should get a card with multiple transfer partners that you can use.

- Fixed-rate redemptions — Can you redeem your points at a fixed rate towards travel purchases, and if so, what will the rate be? This option makes a card’s points much more versatile.

There are also premium airline and hotel credit cards. With these types of cards, you can use your points to make award bookings with that airline/hotel and any of its partners. Since your redemption options will be more limited, you’d only want to get one of these cards if you use that airline/hotel frequently.

2. A high rewards rate

The more points you can earn when you use your card, the more valuable that card will be. Fortunately, high rewards rates are commonplace among all the top credit cards. Most premium cards will earn more rewards in specific spending categories, such as 3 points per $1 spent on dining.

There are two important factors to consider here:

- The bonus categories (ideally, these will be categories where you spend money regularly)

- The points earned in each bonus category

Pro tip: More bonus categories isn’t always better. Let’s say Card A earns 3 points per $1 on airfare and hotels, and Card B earns 3 points per $1 on travel. Card A has more bonus categories, but Card B has a much broader bonus category that will cover everything Card A does and more (travel also typically includes parking, vacation rentals, and taxis, to name just a few things).

3. Travel credits you can use

While premium credit cards have big annual fees, most also have travel credits that can help you recoup some of what you pay for the card.

These travel credits cover a specific category of travel-related purchases. Some are broad categories, such as airfare or even any sort of travel expense. Others are more specific, such as airline fees or Uber rides. When you use your card in that category, you’ll receive a statement credit for the purchase until you’ve used up your entire travel credit.

The question to ask yourself here is, “Can I use this credit without changing my lifestyle/spending habits?” An annual travel credit for $100 will be easy enough for most people to use. On the other hand, if a card gets you $15 per month in Uber credits, you may have a tougher time using that if you don’t take Uber very often.

4. Sign-up bonus

A bonus is your ticket to a large balance of points in a short amount of time. Sign-up bonuses usually consist of an amount, a spending minimum you must reach to receive your bonus, and a timeframe to hit that spending minimum. For example, a card could have bonus terms of, “Receive 50,000 points after spending $4,000 in three months.”

Some cards also have multiple tiers of bonuses. In that case, you’d receive a certain amount of points after hitting one spending minimum, and then even more points if you hit another spending minimum within another timeframe.

You never want to miss out on a sign-up bonus, so what’s most important here is verifying that you’ll be able to spend enough to reach the minimum.

5. Valuable extras

Last but not least, look for any extra features that a premium credit card has that could push it to the top of your list. Several premium cards have unique extras that can add quite a bit to their value, provided it’s a benefit you’ll use.

For example, a card could offer a complimentary elite status with specific hotels, multiple free checked bags on flights with an airline, or an extra night free on paid hotel stays. These are the types of extras that could be worth hundreds of dollars or absolutely nothing, depending on whether you can use them.

Finding the perfect premium credit card

Premium credit cards have gotten much more popular in recent years, so you’ll have quite a few to choose from. If you base your decision on the features above, you’ll be able to find the card that gets you the most bang for your buck.