David Solomon, Goldman Sachs

Andrew Harrer | Bloomberg | Getty Images

Goldman Sachs is scheduled to report second-quarter earnings before the market opens Tuesday.

Here’s what Wall Street expects:

- Earnings: $4.89 per share, forecast by Refinitiv

- Revenue: $8.828 billion, forecast by Refinitiv

- Total investment banking revenue: $1.767 billion, according to FactSet

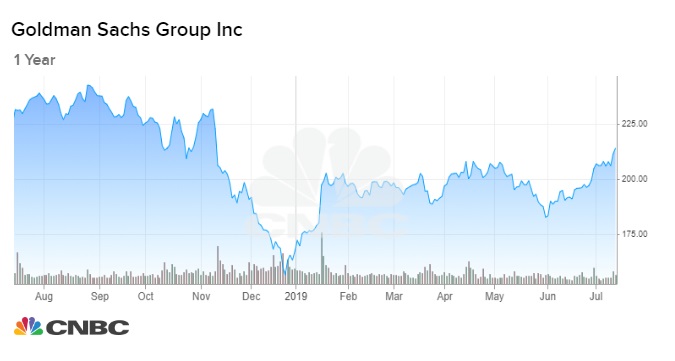

Goldman posted first-quarter revenue below Wall Street estimates as executives cited tougher market conditions for the firm’s trading and investing divisions. But the shares have rallied this year anyway with the stock up 26% this year compared to a 17% gain and 12% increase for shares of rivals JP Morgan Chase and Morgan Stanley respectively.

Of the six biggest U.S. banks, Goldman Sachs is the most dependent on Wall Street activities like trading. But the bank — historically known for its list of wealthy corporate and hedge fund clients — also moved into consumer finance three years ago with its Marcus business. Goldman’s consumer arm, which offers high-interest savings and personal loans, and has gathered about $48 billion in deposits and made $5 billion in loans so far.

The New York bank announced its first credit card with Apple in March. Analysts will be looking for any more detail of what the Apple deal may eventually mean for Goldman’s bottom line.

After passing the Federal Reserve’s annual stress test in late June, Goldman increased its dividend by nearly 50% to $1.25 per share from 85 cents a share and authorized a $7 billion stock repurchase program, up from $5 billion a year ago.

This report marks CEO David Solomon’s third quarter running the bank. He is expected to field questions about the capital markets environment and a widely expected July Federal Reserve interest rate cut, which could put pressure on the bank’s lending business.

Analysts will also be looking for any updates on the bank’s ongoing 1MDB scandal, in which an ex-Goldman partner admitted to helping a Malaysian financier loot an investment fund of billions of dollars. Uncertainty from the investigations has weighed on Goldman’s stock, especially in 2018 when it was the worst performer of the top six banks.

This is breaking news. Please check back for updates.

— CNBC’s Hugh son contributed reporting.