Stocks fell sharply in volatile trading Thursday as investors worried the coronavirus may be spreading in the U.S. A slew of corporate and analyst warnings on the virus also dragged down the major averages.

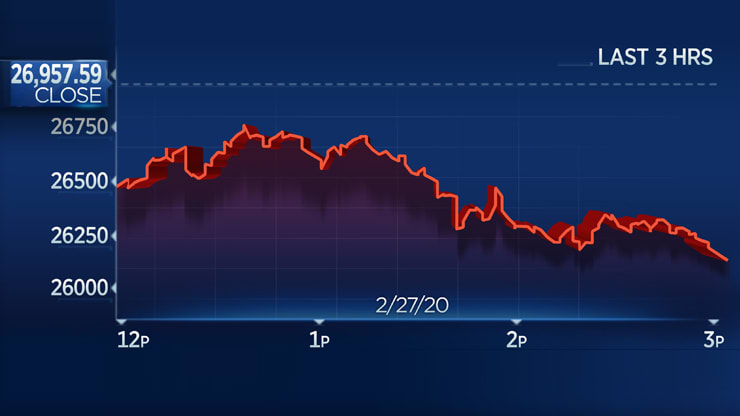

The Dow Jones Industrial Average was down 761 points, or 2.8%, after plummeting more than 900 points earlier in the session. The S&P 500 slid 2.8% while the Nasdaq Composite dropped 3%. The Dow was on pace for its worst weekly performance since the financial crisis, falling more than 8% this week, along with the S&P 500.

Those losses put the Dow in correction territory, down more than 10% from its record close. The S&P 500 dipped into correction territory on an intraday basis. It took the Dow just 10 sessions to tumble from its all-time high into a correction. The S&P 500 and Nasdaq set record highs last week.

Despite the market’s rapid fall, the S&P 500 has retreated only back to levels hit last October.

The CDC confirmed on Wednesday the first U.S. coronavirus case of unknown origin in Northern California, indicating possible “community spread” of the disease. The patient had no travel history or contacts that would have put the person at risk, the CDC said. On Thursday, California Gov. Gavin Newsom said the state is monitoring 8,400 people for coronavirus.

“We’re extremely cautious in the short term,” said Tom Hainlin, global investment strategist at Ascent Private Capital Management. “No one really seems to be an expert on the coronavirus. We haven’t seen anything like this really in our investing lifetimes.”

Apple, Intel and Procter & Gamble were among the worst-performing Dow stocks Thursday, dropping at least 3% each. AMD and Nvidia fell 6.2% and 2.5%, respectively.

President Donald Trump tried to assuage concerns over the outbreak on Wednesday. At a White House news conference, he said the risk of coronavirus to people in the U.S. is still “very low” but added that the U.S. is going to “spend whatever’s appropriate.” Trump also put Vice President Mike Pence in charge of the U.S. response to the coronavirus and said markets should soon recover.

Worries over how the coronavirus will impact corporate profits and global economic growth roiled the U.S. stock market all week as the number of confirmed cases increases. South Korea has confirmed a total of more than 1,700 cases. More than 600 people have contracted the virus in Italy.

The outbreak has also led several companies to issue warnings about its earnings and revenues.

Microsoft said Wednesday it will not meet its revenue guidance for a key segment. It said its supply chain is “returning to normal operations at a slower pace than anticipated,” which led the tech giant to cut its forecast for its personal computing division. Personal computing accounted for 36% of Microsoft’s overall revenue during the previous quarter. Microsoft shares were down 3%.

PayPal also issued a warning about its outlook. The stock traded 1.4% higher.

“US companies will generate no earnings growth in 2020,” David Kostin, Goldman Sachs’ chief U.S. equity strategist, said in a note. “Our reduced profit forecasts reflect the severe decline in Chinese economic activity in 1Q, lower end-demand for US exporters, disruption to the supply chain for many US firms, a slowdown in US economic activity, and elevated business uncertainty.”

The S&P 500 was on pace Thursday to post a six-day losing streak, which would be its longest daily slide since August. The Dow also headed for a sixth consecutive loss. That would be the 30-stock average’s longest losing streak since 2018.

Trump’s comments, Microsoft and Goldman’s warnings came after the Dow fell more than 100 points on Wednesday, adding to its massive decline for this week. Through Wednesday’s close, the Dow has lost more than 2,000 points this week.

The Dow has also fallen more than 8% from its record high set earlier this month.

“As this week’s selling has progressed, we have seen some evidence of increased caution on the part of investors,” said Willie Delwiche, investment strategist at Baird. “Investors are shifting away from excessive optimism but there is still little evidence of fear overwhelming complacency. Bottoms are typically processes punctuated by climactic events and seeing breadth indicators stabilize would be an encouraging sign that such a process is underway.”

Bond prices, in turn, have surged this week.

The benchmark 10-year Treasury yield dipped below 1.25% on Thursday, hitting a record low, before rebounding. Earlier this month, the benchmark rate traded above 1.4%. The 30-year bond rate is also trading at an all-time low. Yields move inversely to prices.

“We’ve hit a pocket of fear,” said Gregory Faranello, head of U.S. rates trading at AmeriVet Securities. “This is a big deal. … If this flows into the U.S., we could be in trouble because, let’s face it, the U.S. consumer is what’s holding this thing together.”

Subscribe to CNBC PRO for exclusive insights and analysis, and live business day programming from around the world.