With one of the longest bull markets in history showing little sign of slowing down, Leuthold Group’s Doug Ramsey shared his view that it has more room to run with CNBC PRO’s Mike Santoli.

“I’ve got to say it’s acting very youthful. I mean, we’ve joked that at a time when the bull would normally maybe need a mortician, this is one that could need a pediatrician,” said Ramsey. “When we talk about these cracks that we typically observe prior to a major market top, we’d like to see a number of them. … Not a specific number, not a certain measure or two or three, it’s just a plethora of things that tend to break down in advance of the major market high. And we just haven’t seen that.”

Ramsey is chief investment officer and a portfolio manager at The Leuthold Group. Before joining the Leuthold team, he was chief investment officer of Treis Capital, where he managed equity portfolios and published equity research. The strategist oversees Leuthold’s Major Trend Index, which evaluates the underlying health of the financial markets.

And while Ramsey told CNBC that he wouldn’t be surprised to see the bull charge onward, he did hedge his bets given what he sees as expensive valuations.

“It is now the longest cyclical bull market on record. We’re closing in on potentially a ninth birthday next March,” he explained. “It’s now the second-most expensive market of all time: We’re still, on most measures — not all — but on most measures we’re still well below the highs that we made in March of 2000, we’re certainly above the secular highs of the 1965-66. We’re even above the famed 1929 high of pre-Depression.”

“I’m not trying to insinuate anything there, but it is a very expensive market.”

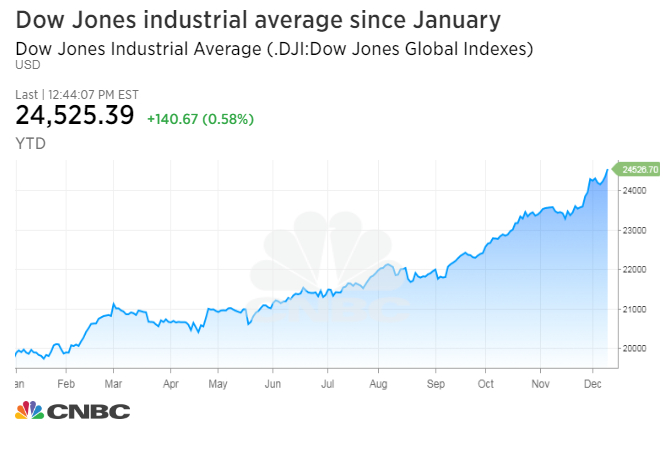

To be sure, Ramsey isn’t alone in his caution around market valuations. The S&P 500 has had a remarkable year – up 19 percent – while the Dow Jones industrial average added more than 150 points intraday Tuesday to trade at an all-time high above 24,000. Technology has outperformed any other sector in the S&P with a nearly 40 percent climb, with health care and financials claiming the No. 2 and 3 spots, respectively.

But despite the equity marathon, the strategist remains bullish, arguing that the markets have a good handle on what to expect from the Federal Reserve going forward.

“Market internals are really aware of the impact that Fed tightening is going to show up, whether it’s rates – and they aren’t up a whole lot here off of their lows from two years ago, but they’re up a point,” he said. “You also have a slowdown observing the growth rates of the money supplies. I mean M2 money supply is only 5 percent now year over year – that’s a six-year low in terms of monetary growth.”