Major indexes in Asia were mostly higher on Friday although the Australian benchmark tracked lower. Wall Street, for its part, closed its Thursday session with slight losses amid political concerns.

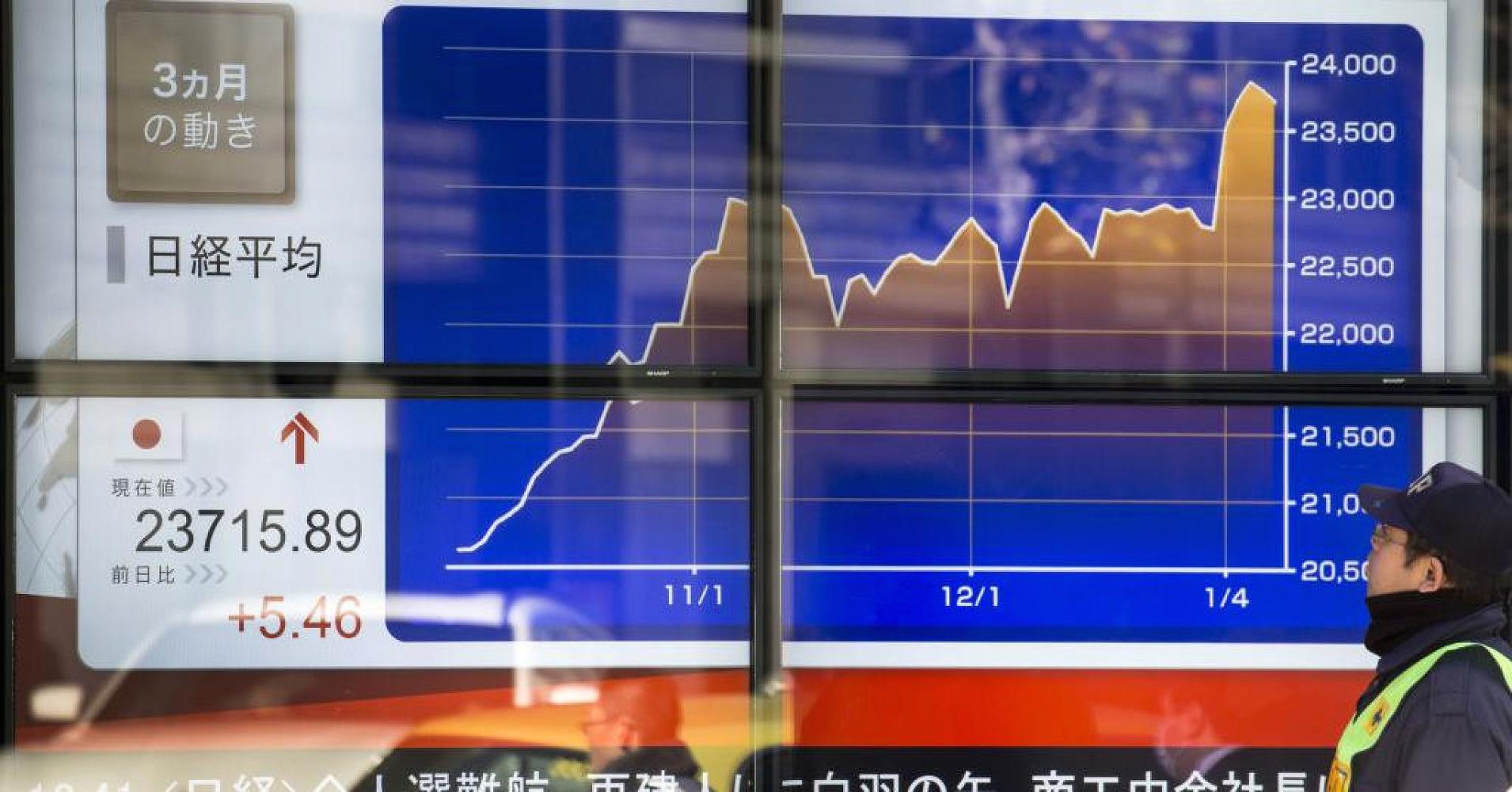

Japan’s benchmark Nikkei 225 index rose 0.22 percent in early trade. The index had touched a fresh 26-year high in the last session, but pulled back from that level later in the day.

Automakers and financials were mostly higher on Friday. Mitsubishi Motors rose 1.29 percent, outperforming other major auto stocks, with heavyweight Toyota higher by 0.12 percent in the morning. Among technology names, Nintendo rose 2.5 percent, extending gains following its Thursday release of new Nintendo Switch accessories.

In South Korea, the Kospi tacked on 0.17 percent. Automakers were in positive territory, although technology and manufacturing plays traded mixed. Index heavyweight Samsung Electronics rose 0.36 percent in early trade while rival SK Hynix was lower by 0.27 percent.

Down Under, the S&P/ASX 200 was little changed, trading 0.06 percent below the flat line. Major mining stocks were lower in the early going, with Rio Tinto losing 0.63 percent and BHP edging down by 0.06 percent.

U.S. stocks closed lower on Thursday as investors focused on the likelihood of a government shutdown. That came despite corporates stateside posting solid quarterly earnings: As of Wednesday, 78 percent of S&P 500 companies that have reported topped expectations, according to Thomson Reuters I/B/E/S.

Still, the immediate focus for markets stateside remained a Friday deadline for the U.S. Congress to pass a stopgap funding bill.

In light of that, the Dow Jones industrial average declined 0.37 percent, or 97.84 points, to close at 26,017.81.

The dollar was steady after edging down in the last session ahead of the looming Friday deadline stateside. The dollar index, which tracks the U.S. currency against six major peers, traded at 90.495 at 8:27 a.m. HK/SIN after falling as low as 90.113 overnight.

Weakness in the dollar saw the euro and British pound hold onto overnight gains. The greenback also drifted lower against the yen to fetch 110.87, compared to Thursday’s close of 111.05.

The Australian dollar rose to trade at $0.8019 in the wake of strong China economic data released in the previous session.

Japan’s SoftBank Group on Thurday became Uber’s largest shareholder after it officially closed a high-profile deal with the ride-hailing company. The deal had valued Uber at around $48 billion, which was a discount to a previous valuation of nearly $70 billion. SoftBank shares were off by 0.4 percent in early trade, underperforming most other Japanese tech stocks, which traded higher.

Meanwhile, Ping An Insurance Group has raised almost $1 billion in funding ahead of a planned listing of a medical data unit, Reuters reported, citing sources. Ping An said in a Thursday statement that it was “proactively developing” technologies that supported its main business, but advised “caution when dealing in the securities” of the company.

Here’s the economic calendar for Friday (all times in HK/SIN):

- 9:30 a.m.: China fourth-quarter industrial capacity utilization

- 4:45 p.m.: Hong Kong business confidence