General Motors is poised to recoup ground it lost to Tesla and prove to investors that it’s not a “dying dinosaur” in the age of high-tech automobiles, according to a top Wall Street firm.

Barclays raised its rating on GM’s shares to overweight from neutral on Friday, predicting that the company will recast itself in electrification and self-driving technology with the help of key investments.

“With GM making significant progress on electrification and autonomy, just as Tesla faces issues ramping production, we expect the narrative to shift toward our view that GM may not be the ‘dinosaur’ that its low multiple would imply,” wrote Barclays analyst Brian Johnson. “We see potential for investors, both auto and non-auto, to view GM’s progress and Tesla’s production challenges as a sign that some of Tesla’s market cap needs to go back to GM.”

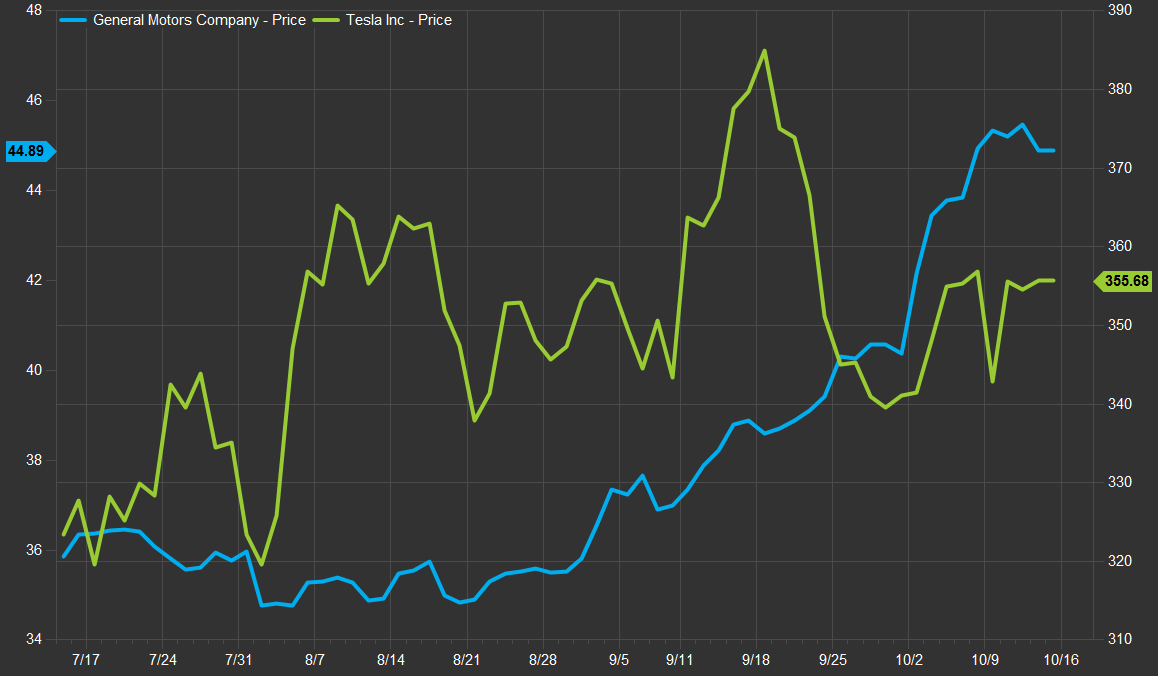

Shares of GM traded 1 percent higher in premarket trading after the analyst’s note came out. Since January, GM shares are up 30 percent versus the 66 percent gain in Tesla shares but the trend may be flipping. GM stock is up 34 percent over the past six months as more analysts laud the company’s investments in autonomous technology. In contrast, Tesla is up 17 percent in six months.

The analyst increased his price target to $55 from $41. The new target is 23 percent higher than Thursday’s closing price.

UBS reiterated its buy rating on GM earlier this week, “surprised” by how quickly the company has expanded its self-driving fleet. Both the Barclays and UBS reports come a month after Deutsche Bank’s September upgrade that argued that General Motors, not Tesla, is a better bet on the autonomous vehicle future.

GM vs Tesla shares 3-month chart

Source: FactSet

“Even if Tesla is able to maintain a lead in battery costs,” Johnson said, traditional automakers “may ultimately hold a cost advantage over Tesla when considering scale advantages and manufacturing expertise.”

Johnson also downgraded Ford to equal weight from overweight in the same note, saying that the firm needs “much more work” to compete.

“While Ford has put out a target to produce high-volume level 4 autonomous cars by 2021 in a ride-sharing environment, we suspect this target has been discounted by investors,” said the analyst. “By not creating a separate brand or model for electrics, Ford has allowed the consumer to see a sharp price difference between powertrains for the same model – implying a price premium purely for electrification.”