Market watchers see few opportunities for oil prices to rally — but plenty of room for them to fall — after a critical meeting of energy ministers later this week.

About two dozen oil exporters, including top producers Saudi Arabia and Russia, meet on Thursday in Vienna to discuss extending a deal to keep 1.8 million barrels a day off the market. The historic agreement has helped to reverse a three-year oil price downturn that wiped out hundreds of thousands of energy jobs and piled financial pressure on both free market American drillers and countries dependent on oil revenue.

The market largely expects the 14-member OPEC cartel and a group of other producers led by Russia to extend the deal, which began in January and expires in March, through the end of 2018.

But just days before meeting, Russia has not committed to the nine-month extension, raising concerns that OPEC could settle for a shorter extension or push off a decision altogether. Either of those scenarios would spark a sell-off, analysts say, but oil prices will probably struggle to grind higher from recent 2½-year highs even if OPEC lives up to expectations.

Here’s how analysts expect markets to move under three scenarios.

Andy Lipow, president of Lipow Oil Associates, expects OPEC to lock down the nine-month extension. But he also expects a pullback on the news.

The reason: Hedge funds have recently increased their long positions in oil futures, or bets that prices will keep rising. That makes prices vulnerable to a slide because traders often book profits by selling high. At the same time, the number of oil rigs operating in U.S. oil fields crept up in November, a trend that tends to weigh on prices.

“The market has gotten very, very long and as a result you can have some profit-taking triggered by the increase in the rig count on Friday,” Lipow said.

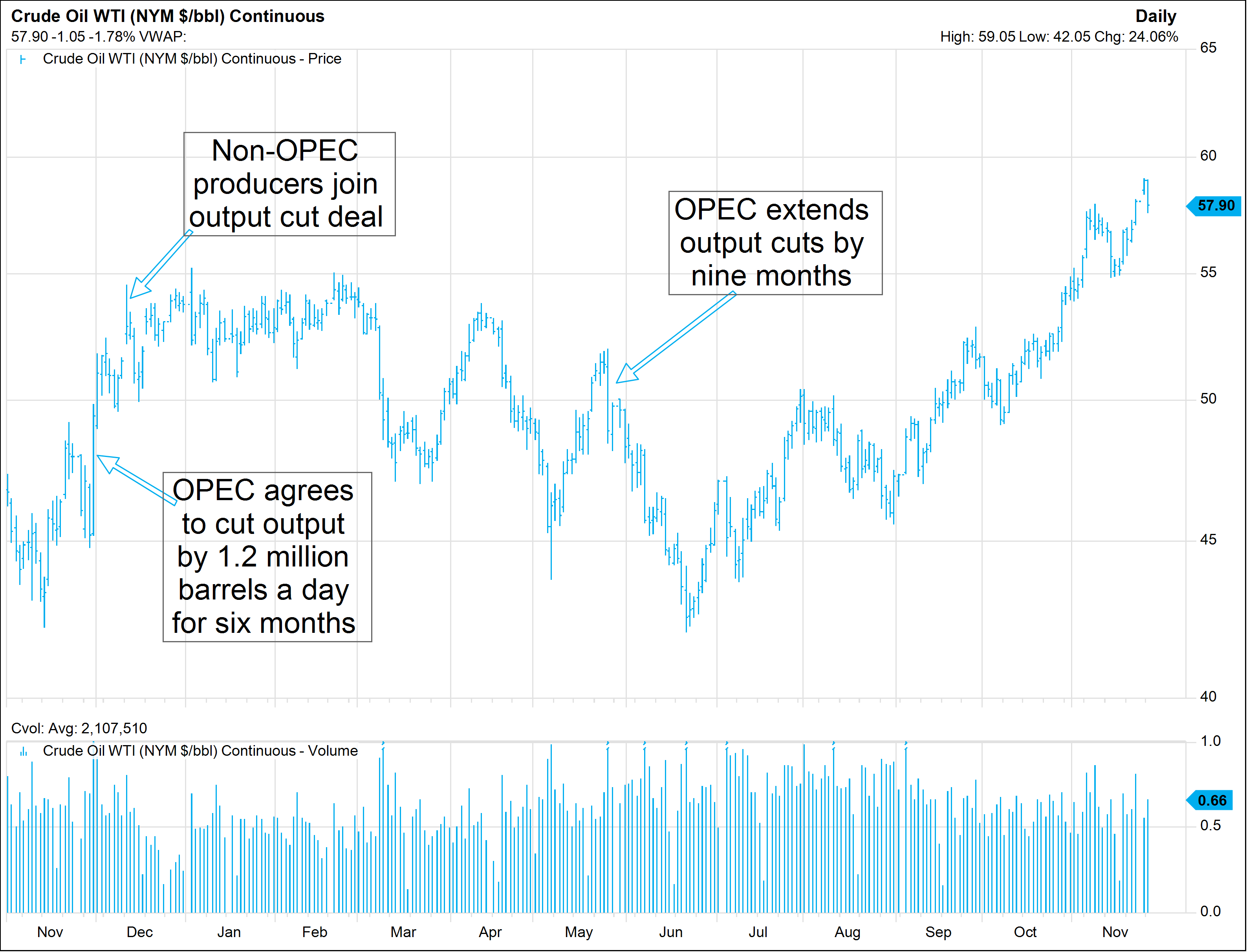

U.S. crude performance since Nov. 1, 2016

Tom Kloza, global head of energy analysis at Oil Price Information Service, also thinks a nine-month extension has been baked into prices, making it hard for U.S. West Texas Intermediate crude to rally beyond Friday’s 2017 intraday high of $59.05.

“We may look back at Black Friday as the as-good-as-it-gets number for U.S. producers,” he said.

U.S. crude could take another run at the $59 per barrel level, but OPEC would have to get the messaging just right, said John Kilduff, founding partner at energy hedge fund Again Capital. That includes a show of unity among regional geopolitical rivals Saudi Arabia and Iran and a clear signal that OPEC will force member countries Libya and Nigeria to cap their output after giving them a pass this year.

However, Kilduff thinks OPEC will only be able to commit Russia to a six-month extension.

He said the country’s energy companies have pushed back on Russian Energy Minister Alexander Novak and President Vladimir Putin as U.S. producers pick up market share in Asia, an important oil growth market. Russian energy giants are concerned that extending the cuts prematurely could leave the market undersupplied, causing a spike in prices that leads to another crash.

“If they do go six months I would expect them to spin it and say they’re going to review it next year,” Kilduff said. “That’s going to be seen as a disappointment.”

In that scenario, Kilduff sees oil prices falling back to the mid-$50 range.

Barclays expects either a six- or nine-month extension but says the market is asking the wrong question. Michael Cohen, the investment bank’s head of energy markets research, says traders should be asking whether exporters will be held to the same production caps they agreed to last year.

“It would be a misguided assumption in our view to expect the group’s production quotas to remain set in stone in 2018,” Cohen said in a research note Monday. “The sustainability of the deal depends on how much longer Saudi Arabia, Russia, Iran and Kuwait are willing to sacrifice market share in the pursuit of revenue and market stability.”

Barclays says the worst-case scenario would be energy ministers announcing they’ll put off the decision until the first quarter of next year, when the current deal expires. In that case, international benchmark Brent crude oil is likely to fall from current levels near $64 to the mid-$50 range.

However, Barclays thinks a strong market backdrop will support prices beyond the short term.

Tamar Essner, director of energy and utilities at Nasdaq Corporate Solutions, said it would certainly be bearish for oil prices if exporters conclude the meeting without extending the deal. But she says the market is better positioned to absorb the shock today than it was in May, when an initial nine-month extension was a “no-brainer.”

That’s because OPEC has made substantial progress boosting oil prices and driving down global crude stockpiles since then. Still, Essner believes markets could see a repeat of the sell-off that followed May’s extension.

“It looks really similar in setup to where we were in May,” she said. “OPEC did exactly what they telegraphed and nothing more, and we lost everything we gained,” she said.