Despite bitcoin‘s immense gain in popularity, Wall Street’s top economists and market strategists remain unconvinced.

Eighty percent of respondents to the December CNBC Fed Survey said the current valuation of bitcoin is a bubble. Only 2 percent of respondents said the valuation is based on fundamentals, and 17 percent responded that they don’t know or are unsure.

In 2017 alone, bitcoin’s price has jumped more than 1,000 percent, according to CoinDesk’s bitcoin price index. After launching on Sunday evening on the Cboe Futures Exchange, bitcoin futures surged nearly 20 percent, to $18,545, on their first full day of trading, according to the January futures contract.

“We remain cautious on current domestic equity valuations even though we see very few areas that look cheap, and see a speculative quality to assets overall at this point (see Bitcoin…),” wrote John Roberts, Director of Research at Hilliard Lyons.

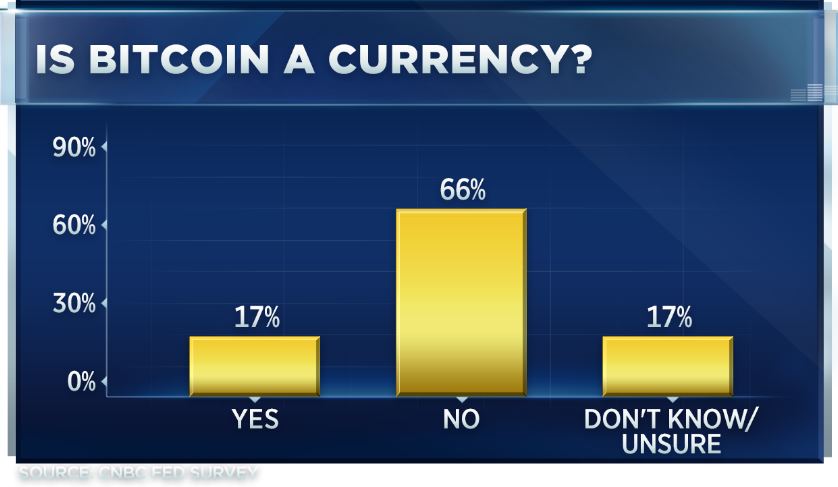

Wall Street also does not seem convinced of bitcoin’s role as a currency. Of the 44 economists, fund managers and strategists surveyed last week, 66 percent said bitcoin does not qualify under the definition of a currency, while 17 percent said it does.

Unlike bitcoin, when it comes to the stock market, market participants are not resoundingly alarmed about valuations.

Sixty-six percent said they do not believe valuations are at a level where the Fed needs to raise rates to cool the market, compared to 24 percent who said the Fed should hike rates to cool the market.

Wall Street is also not convinced the Fed is worried about stock market valuations. Five percent said Fed members are “very concerned” about valuations, versus 20 percent who said Fed members are “not at all concerned.” A 68 percent majority said the average Fed member is “somewhat concerned.”

Still, domestic stock valuations are looking frothy, warned Scott Wren, Wells Fargo Investment Institute’s senior global equity strategist. This is “unless you assume margins will expand meaningfully in the coming two years and earnings growth will accelerate meaningfully from here in 2018/19 (this is in addition to any tax reform).” Wren says both scenarios seem unlikely.

The survey forecasts the S&P 500 to reach 2,775 on average by the end of 2018 and 2,862 by the end of 2019.