The Trump administration made waves on Thursday by announcing it will open virtually all federal offshore waters to oil and gas drilling. But it’s not yet certain whether drillers have much interest in dipping their toes into uncharted waters.

New offshore drilling projects can take up to a decade to develop and cost billions of dollars. Interior Secretary Ryan Zinke is proposing the biggest ever lease sale at a time when oil prices remain in a range that makes new offshore developments a questionable prospect.

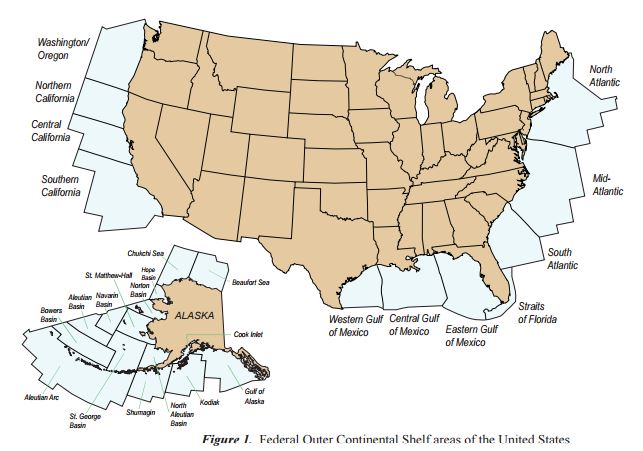

The proposal puts 90 percent of the U.S. outer continental shelf on the block, including the Atlantic, Pacific and eastern Gulf of Mexico, areas where the government hasn’t offered leases since the 1980s. In some cases, the seismic data on oil and gas reserves beneath the waters is 30 years old.

Those areas also lack the vast infrastructure that has emerged around the U.S. offshore drilling hub in the central Gulf of Mexico.

“You have to put in a huge amount of infrastructure, and the return of investment on such infrastructure is not there. The price of oil is too low,” said John McNabb, former chairman and CEO of Willbros, one of the largest energy infrastructure contractors in the world.

At the same time, opportunities in U.S. onshore shale fields, where production can be started up and shut down quickly, is competing for drillers’ dollars, said McNabb, who also served on Trump’s council of corporate advisers.

That kind of production is attractive in today’s unpredictable oil market, where U.S. crude fell from more than $100 a barrel in 2014 to a low of $26 in 2016 before bouncing around the $40 to $60 range last year.

U.S. outer continental shelf

Even within the Gulf of Mexico, there is limited infrastructure in the western region, said Imran Khan, who leads Wood Mackenzie’s commercial valuation team for oil and gas projects in the Gulf. In the eastern waters straddling Florida, much of which is under a drilling moratorium through 2022, little exploratory drilling has been done and much of the seismic data is old, he added.

“In the current commodity pricing environment, I don’t see a lot of appetite on laying down new infrastructure,” he told CNBC.

There are significant reserves of oil and gas in the Atlantic and Pacific oceans, but current measures of technically recoverable resources in the Gulf of Mexico are far larger, according to figures from the Bureau of Ocean Energy Management, the arm of the Interior Department that oversees leasing in the U.S. outer continental shelf.

Offshore drillers also depend on an onshore supply chain of equipment fabricators and service companies, said Wood Mackenzie senior research analyst William Turner. Shipping construction materials from the U.S. Gulf Coast to Atlantic waters could be a time-consuming and expensive prospect for drillers.

“These vessels don’t move very fast, so you want to have the onshore construction facilities close to your region,” he said.

Establishing that infrastructure along the East and West coasts could prove challenging. Politicians up and down both coasts have come out in opposition to the plan.

@FLGovScott: Governor Scott’s Statement on Trump Administration’s Plan on Offshore Oil Drilling

@GovPressOffice: Pacific Coast Governors Condemn Federal Decision to Expand Offshore Drilling

States control the first thee miles of shallow water, and the federal government has jurisdiction beyond that, explains Grady Hurley, an oilfield and maritime attorney at law firm Jones Walker. Within state waters and lands, the state regulates industry and commerce.

“The state can make it difficult to provide the support services in order to maintain production and also to gain production,” he said. “For the most part, companies don’t want to operate where they’re not welcomed and where there’s other opportunities.”

That’s why it’s crucial for the industry to start a dialogue with coastal politicians and communities to highlight it’s safety record, says Hurley.

Drillers and oilfield services companies are certainly glad for the opportunity the Trump administration is giving them, but it’s not yet certain what they’ll make of it, Hurley said.

“It doesn’t mean that because the East Coast is opened up or there’s potential in California, it’s going to be a gold rush,” he said. “It just doesn’t work that way in the industry.”