‘Tis the season to be jolly. Yet, stress is the prevailing emotion.

The vast majority, or roughly 70%, of adults are stressed about the upcoming holiday season, mostly thanks to money woes, according to a survey from Country Financial.

If money were no object, half of those surveyed said that having one of their debts, such as their mortgage, credit card or student loan balance, completely paid off would be at the top of their holiday wish list — versus just 19% who wanted a vacation or luxury item. Country Financial polled more than 1,000 adults in October.

However, paying down debt is no small feat. The average person said they would need $58,673, on average, to be totally free of all their cumulative debts this season, Country Financial found. It’s a tab that has only increased in recent years and shows no signs of slowing.

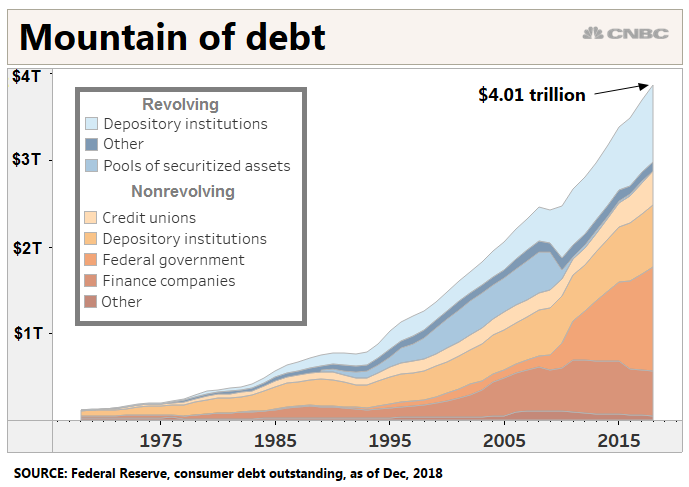

Altogether, outstanding consumer debt already exceeds $4 trillion, according to the Federal Reserve.

There are good and bad types of debt, said Troy Frerichs, a vice president at Country Financial. “It’s the discretionary debt can get you into trouble.”

Credit cards, in particular, are one of the most expensive ways to borrow money. Because card issuers charge much higher interest rates than other types of lenders, carrying a credit card balance can quickly escalate out of control.

More from Your Money Your Future:

Here’s how much you can save toward retirement in 2020

The hidden benefits of a Roth IRA conversion

Don’t miss the tax advantages of this savings account

Despite being worried about debt, consumers will still spend an average of $1,679 on gifts this year, 75% more than last year, according to a separate survey by Experian, which polled more than 1,100 shoppers.

That’s a hefty additional expense considering that credit card interest rates are down just slightly from record highs. The average card interest rate is 17.25%, according to CreditCards.com’s latest report.

If shoppers increased their spending to $1,500 this year and only made the minimum payments, it would take over eight years to pay off while racking up $1,217 in interest, said Ted Rossman, industry analyst at CreditCards.com.