There’s a strange divergence in the market that according to TradingAnalysis.com founder Todd Gordon could rock global currency markets.

The U.S. 10-year Treasury yield hit 3 percent on Tuesday, which it hasn’t done since January 2014. According to the trader, this suggests a changing economic outlook that can be felt globally.

“Ten-year yields are pushing up above 3 percent, that’s putting a bid into the U.S. dollar and out of the safe haven currency, which is the yen,” he said Tuesday on CNBC’s “Trading Nation.”

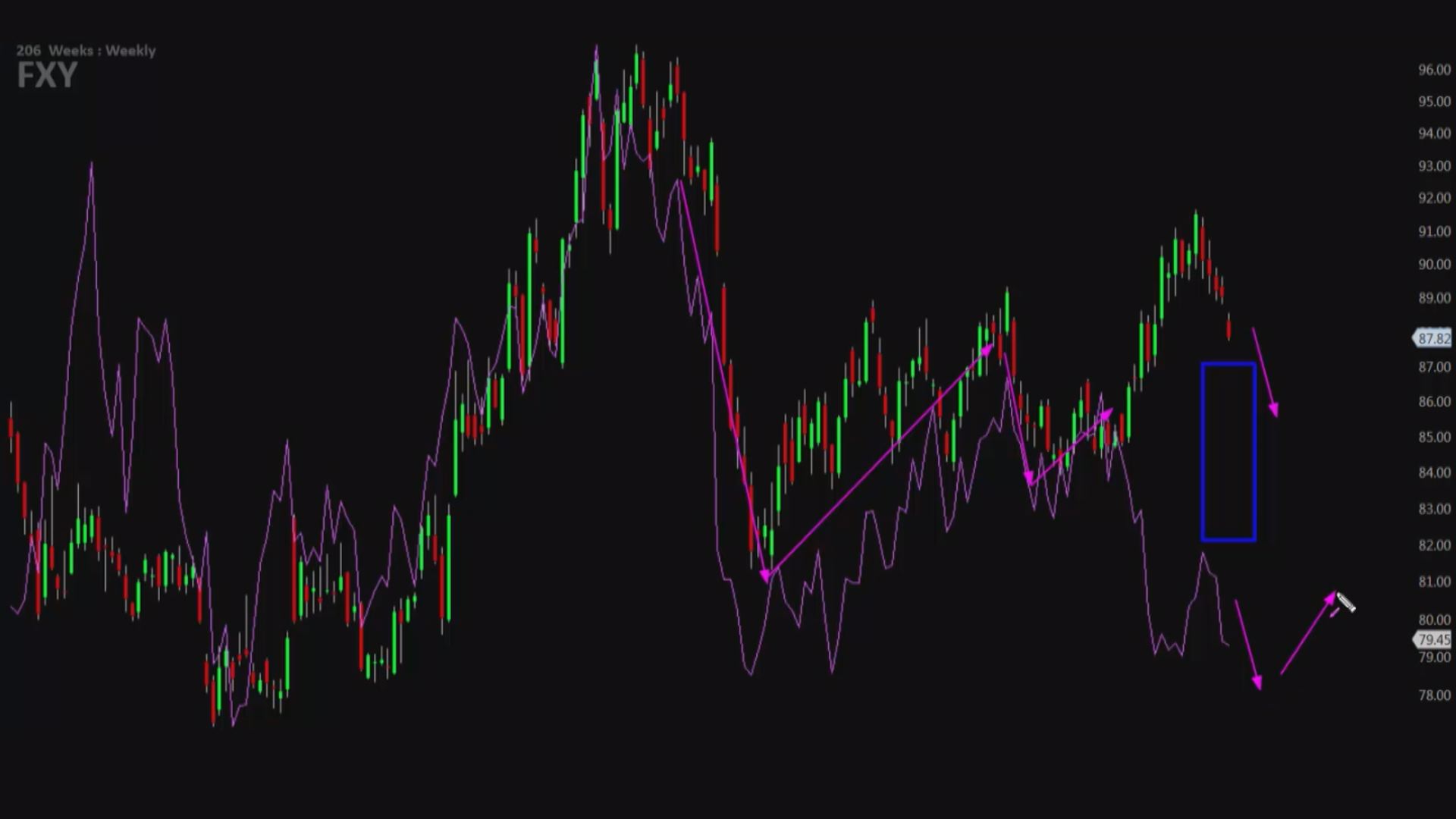

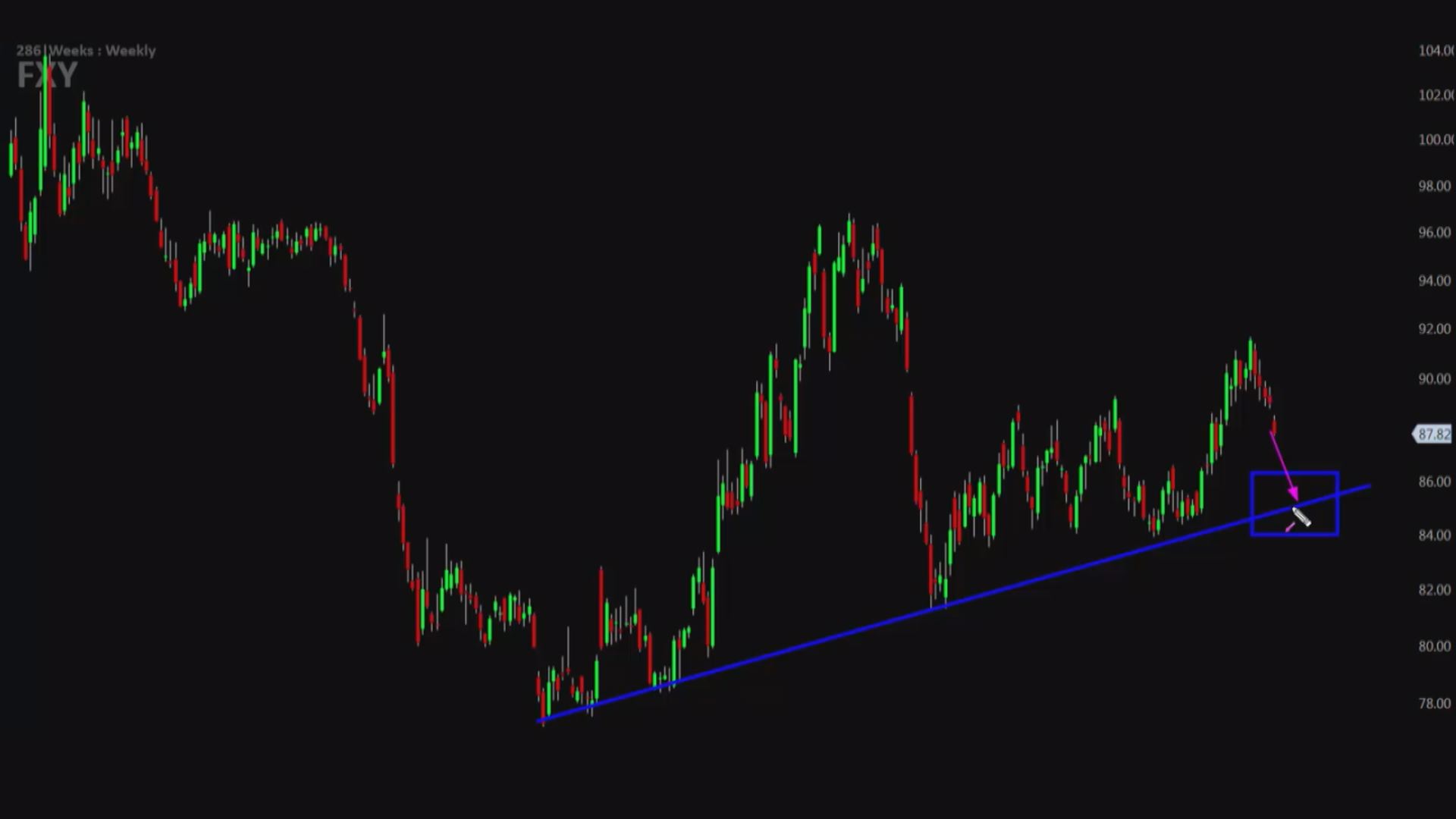

But in the charts, Gordon points out that the Japanese yen and 20+ Year Bond ETF (TLT) have just broken out of a pattern that from a technical standpoint suggests the yen could see an even bigger fall. While the yen-tracking ETF (FXY) and the TLT traded together throughout 2016 and 2017, Gordon noted that they have recently begun to diverge and trade inversely to each other.

However, Gordon also believes the divergence is about to end. Gordon sees TLT eventually rising, implying that bond yields could fall further, which would essentially pull the yen down with it.

To determine how low FXY could go, Gordon looked at an uptrend line that has been in place for FXY for over a year. He sees FXY falling back to that support line at around the $85 to $86 level.

To profit from that potential move, Gordon wants to buy the June monthly 87-strike put and sell the June monthly 85-strike put for 45 cents, or $45 per options contract. Should FXY fall and close below $85 on June 15 expiration, Gordon could make up to $155 on the trade.

But should FXY close above $87, Gordon could lose the $45 premium he paid to make the trade.