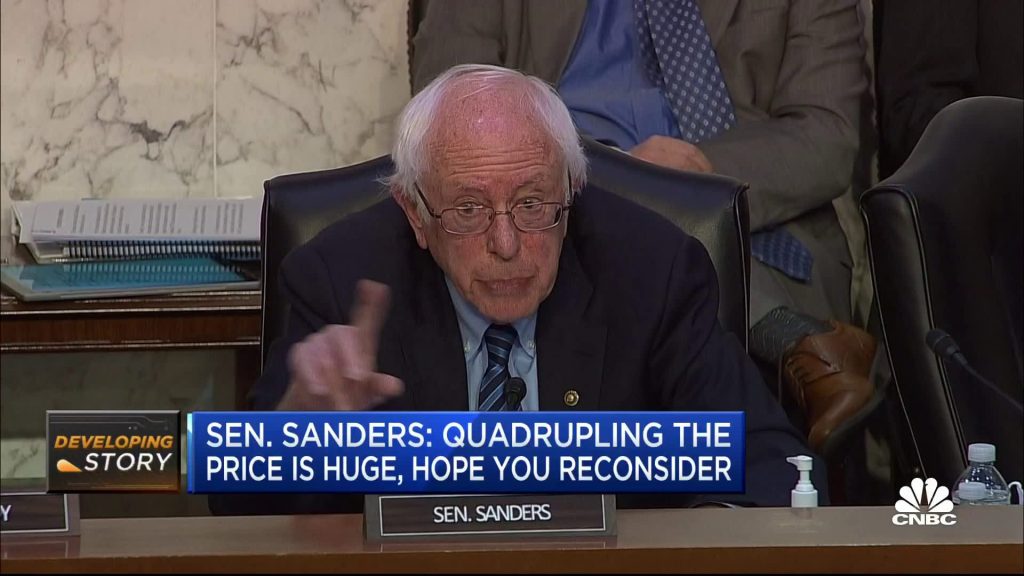

U.S. Secretary of the Treasury testifies before the Senate Appropriations Subcommittee on Financial Services March 22, 2023 in Washington, DC.

Win Mcnamee | Getty Images

WASHINGTON — Federal bank regulators are prepared to do whatever is needed to “ensure that depositors’ savings remain safe” in U.S. banks, Treasury Secretary Janet Yellen told members of the Senate Appropriations Committee on Wednesday.

Yellen is likely to face tough questions from senators about the federal response to two bank failures earlier this month: California-based Silicon Valley Bank on March 10 and New York-based Signature bank just two days later.

In the hours after the banks collapsed, she and top Treasury officials determined the situation posed a danger to “the broader banking system and the American economy” and required them to take emergency actions “designed to mitigate risks to the banking system,” Yellen told lawmakers.

These actions included guarantees on uninsured deposits at the failed banks, and the creation of new liquidity sources for smaller banks experiencing a rush of withdrawals. Thanks in large part to these actions, “aggregate deposit outflows from regional banks have stabilized,” Yellen told a bankers group Tuesday.

But while the trends are moving in the right direction, the amount of money banks borrowed in the week ending March 15 from the Fed’s discount window set a new record at $153 billion, according to the Fed’s weekly report, a sum that suggests the banking sector is not quite stable yet.

Amid ongoing instability, both Democrats and Republicans in Congress want to know whether uninsured deposits at banks that fail in the future will be covered the same way they were at SVB and Signature.

Yellen and her deputies have so far said any blanket guarantee of uninsured deposits would require extraordinary circumstances, and likely an act of Congress.

But there is precedent for such a move: In March of 2020, Congress authorized the Federal Deposit Insurance Corporation to lift the $250,000 limit on insured deposits in order to prevent bank runs triggered by pandemic conditions.

Yellen appeared before the subcommittee on financial services and general government, which is chaired by Maryland Democratic Sen. Chris Van Hollen.