Stocks surged on Tuesday as optimism grew about the reopening of the economy and a potential coronavirus vaccine.

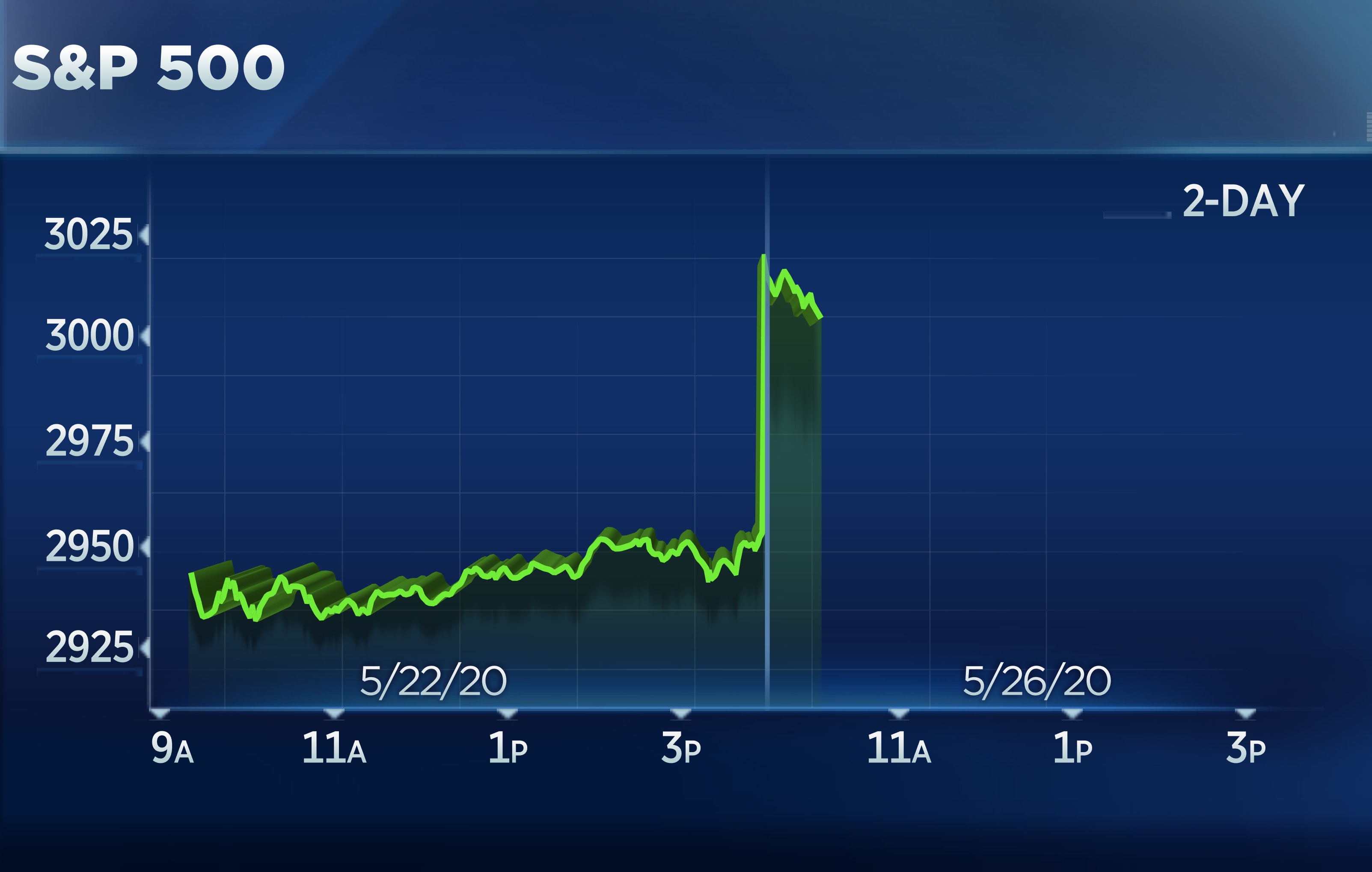

The S&P 500 rallied 1.9%, breaking above 3,000 for the first time since March 5. The Dow Jones Industrial Average rose 577 points, or 2.4%. The 30-stock average also traded at levels not seen since early March, jumping above 25,000. The Nasdaq Composite advanced 1.5% and was less than 4% removed from a record set in February.

Here’s what market participants were watching:

- American biotech company Novavax said Monday it started the first human study of its experimental coronavirus vaccine. The company said it expects initial results on safety and immune responses in July. Last week, another biotech Moderna reported positive development on its vaccine trial where all 45 participants had developed coronavirus antibodies. There are 10 vaccines in clinical evaluation and 114 in pre-clinical evaluation, according to a running tally by Fundstrat.

- Economic activity continued to pick up as states begin opening up their economies. Some of the biggest gainers were directly tied to the reopening. Carnival shares jumped 10.8%. MGM Resorts climbed 8.9%. United Airlines and Southwest Airlines rose more than 9% each.

- The S&P 500 exceeded its 200-day moving average for the first time since March 6. Many technical analysts look at that moving average as a sign of the long-term trend. Rising above it could signal a change in long-term trend from bearish to bullish.

“As of this writing, the virus appears to be coming under control,” said Bruce Bittles, chief investment strategist at Baird, in a note to clients. “Lockdowns have been relaxed and we have not seen a resurgence in the virus.”

“A return to a bull market in stocks and a return to economic growth are dependent in large part upon the containment of the virus which will allow businesses to re-open and consumers to resume their spending habits,” said Bittles. “The market seems to be pricing in a quick economic recovery (V-shape) which would help explain the recent rally.”

Data out Tuesday also reinforced the belief that the economy has hit its bottom amid the pandemic. A measure of consumer confidence jumped to 86.6 this month from 85.7 in April, according to the Conference Board. Economists polled by Dow Jones expected consumer confidence of 82.3 in May.

Meanwhile, new home sales in April also topped estimates. Sales of new U.S. single-family homes increased by 623,000 last month, beating estimates of 490,000, according to Dow Jones.

Southwest got a boost from a UBS upgrade to buy. The analyst said the airline has a “clearer path for domestic travel recovery.” Separately, Macy’s said it has seen “greater demand than we expected” in its reopened stores. Macy’s shares gained 6.4%.

President Donald Trump tweeted about Tuesday’s rally, saying: “Stock Market up BIG, DOW crosses 25,000. S&P 500 over 3000. States should open up ASAP. The Transition to Greatness has started, ahead of schedule. There will be ups and downs, but next year will be one of the best ever!”

The moves Tuesday followed a solid week for Wall Street that saw the 30-stock Dow rise 3.3%, posting its best weekly performance since April. The S&P 500 and Nasdaq also climbed more than 3% last week.

The S&P 500 entered Tuesday’s session up more than 34% from a March 23 low.

“Next month we will know Bank stress test results; whether oil prices are a bounce or something more sustained; and if we have moved out of COVID season or into a second wave,” Christopher Harvey, Wells Fargo’s head of equity strategy, said in a note. “If things break positively, we would expect to see a healthy rotation toward cyclicals, smaller caps, and value stocks.”

The number of coronavirus cases in the U.S. topped more than 1.6 million as deaths rose to more than 97,000, a tally from Johns Hopkins University showed as of Monday.

Meanwhile, investors kept an eye on the U.S.-China tensions, which showed signs of escalation over the weekend. White House National Security Advisor Robert O’Brien said Sunday the U.S. will likely impose sanctions on China if Beijing implements national security law that would give it greater control over autonomous Hong Kong.

Subscribe to CNBC PRO for exclusive insights and analysis, and live business day programming from around the world.