A Johnson & Johnson building is shown in Irvine, California.

Mike Blake | Reuters

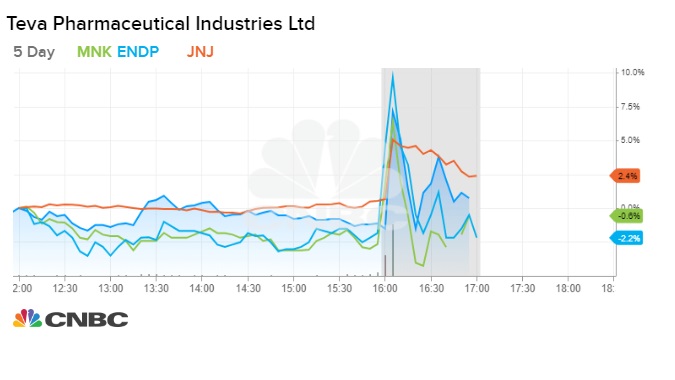

Shares of major pharmaceutical companies surged in after-hours trading Monday following a smaller-than-expected fine for Johnson & Johnson.

An Oklahoma judge ordered the company to pay the state $572 million — significantly less than the $17 billion in penalties sought in the trial. This was the first U.S. case attempting to hold a drug-maker accountable for fueling the opioid epidemic.

Shares of Johnson & Johnson rallied more than 5% on the news, resulting in a $13.5 billion market cap gain after hours. Drugmaker Teva Pharmaceutical rose 5%, while Endo International jumped 3% on the news. Mallinckrodt initially jumped 7% but gave back gains shortly after.

Teva Pharmaceutical and Purdue Pharma, the privately held maker of OxyContin that taken the brunt of the public’s blame for the drug crisis, settled with the state before the trial began. Neither company admitted to any wrongdoing. J&J was the only defendant left in the seven-week trial.

In the landmark ruling Monday, judge Thad Balkman called the drug crisis an “imminent danger and menace” and said Johnson & Johnson and its pharmaceutical subsidiary Janssen “caused an opioid crisis that’s evidenced by increased rates of addiction, overdose deaths and neonatal abstinence syndrome.”

In an emailed statement to CNBC, Johnson & Johnson said it plans to appeal the case.

“Janssen did not cause the opioid crisis in Oklahoma, and neither the facts nor the law support this outcome,” Johnson & Johnson general counsel Michael Ullmann said in a statement. “We recognize the opioid crisis is a tremendously complex public health issue and we have deep sympathy for everyone affected. We are working with partners to find ways to help those in need.”

— CNBC’s Berkeley Lovelace contributed reporting.