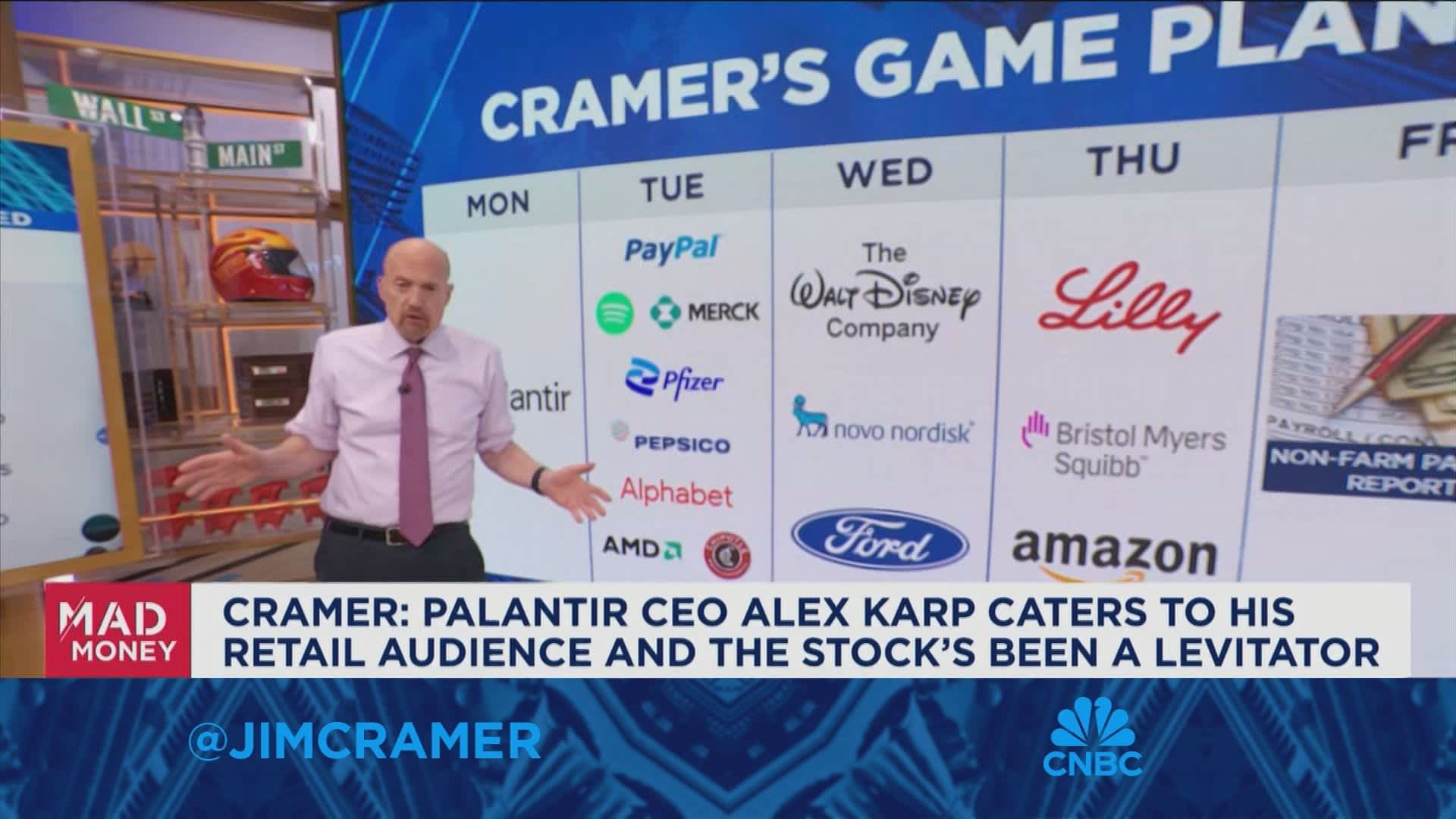

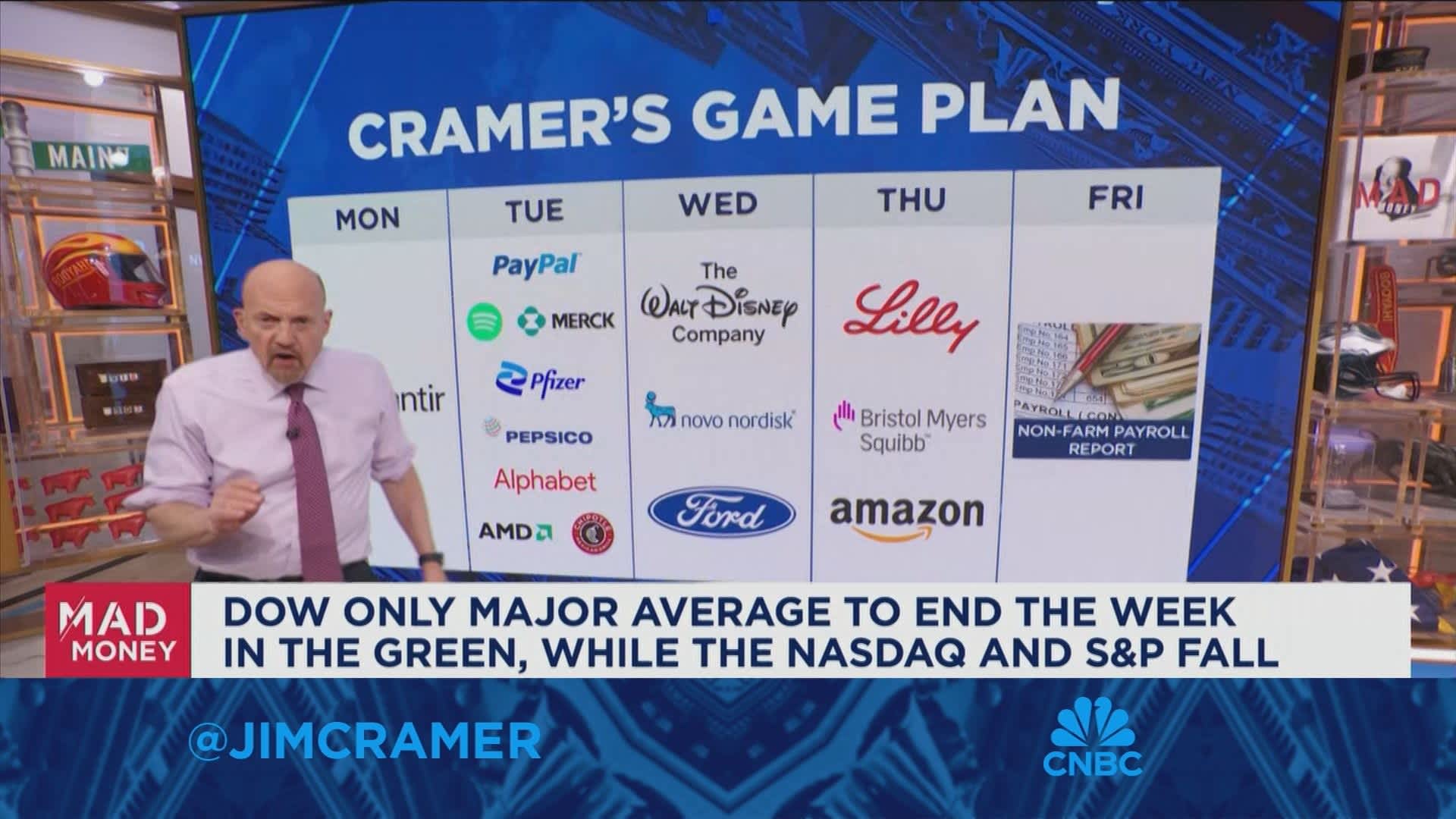

CNBC’s Jim Cramer on Friday walked investors through an earnings-heavy week, highlighting reports from Amazon, Alphabet, Eli Lilly and Palantir, as well as a key inflation metric from the Labor Department. He said it’s wise to refrain from sudden moves next week as there won’t be enough time to digest such a large amount of information.

“When you get a week that’s packed with important earnings reports and the monthly employment report plus the tariff news, you’re usually better off sitting on your hands,” he said. “Because there’s just too much data for any individual to process,”

Palantir is set to report Monday after close, and Cramer pointed out that the data company has been especially favored by the Pentagon as it helps companies and the government use resources more efficiently. He suggested it’s likely the stock continues to climb, noting that some investors are fond of CEO Alex Karp.

Tuesday is packed with earnings reports. Cramer expects PayPal and Spotify to have great quarters. He noted that Spotify has a successful subscription model that usually helps top Wall Street estimates. Drug giants Merck and Pfizer will also release their numbers. Merck’s could be good, he said, and if Pfizer can report positive news about its cancer dugs, that stock could run.

PepsiCo and Chipotle also report on Tuesday. According to Cramer, the packaged food stocks have had a tough time since GLP-1 weight loss drugs became popular, especially PepsiCo, known for its soft drinks and snacks. He called the Mexican fast food chain a great growth stock in the restaurant sector and suggested now could be a chance to invest before shares move higher.

Plus, Alphabet and Advanced Micro Devices have earnings are on deck Tuesday. Cramer said the Google parent’s stock could rise if it reports solid growth in its cloud infrastructure business. He also wondered what AMD will have to say in the wake of breakthrough news from China’s artificial intelligence startup DeepSeek, which could make AMD’s chips are more desirable.

On Wednesday are reports from Walt Disney, Novo Nordisk and Ford. Disney could be a buy before earnings, Cramer said, even as the fires in Los Angeles likely hurt the quarter. He said he’ll be waiting to see how Novo Nordisk’s GLP-1 weight loss and diabetes drugs are doing, and that Ford stock has been disappointing lately.

Thursday brings results from more drug stocks, Eli Lilly and Bristol Myers Squibb, as well as Amazon. Cramer said he needs more details from Eli Lilly that suggest next year will be successful, and he’s optimistic about Bristol Myers’s new schizophrenia drug. Cramer added that he’s expecting positive earnings from Amazon, but investors might want to wait until after it reports to buy the stock.

On Friday, the Labor Department will release the nonfarm payroll report, an inflation metric that’s important to the Federal Reserve. If the data suggests strong growth in employment and wages, it may be unlikely the central bank will cut rates in the first half of the year, Cramer said.

Sign up now for the CNBC Investing Club to follow Jim Cramer’s every move in the market.

Disclaimer The CNBC Investing Club Charitable Trust holds shares of Amazon, Alphabet, Eli Lilly, Walt Disney and Bristol Myers.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer’s world? Hit him up!

Mad Money Twitter – Jim Cramer Twitter – Facebook – Instagram

Questions, comments, suggestions for the “Mad Money” website? madcap@cnbc.com