Well-known hedge-fund managers such as David Tepper and Dan Loeb get much of the attention, but there are lower-profile stars that are performing even better and beating the market.

CNBC used Symmetric.io, a top hedge-fund tracking firm, to find the best under-the-radar managers and which stocks they recently bought, according to filings.

Four times a year, hedge funds file their long positions with the Securities and Exchange Commission, and the information is released to the public 45 days after each quarter ends.

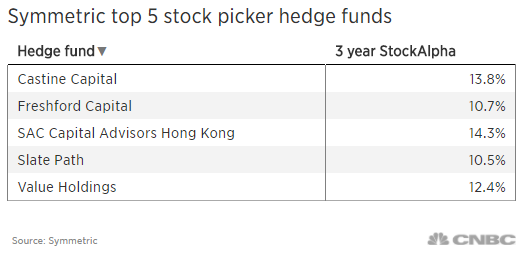

With the recently released March quarter filing data, Symmetric.io graded the stock-picking ability of nearly 1,000 hedge funds in its database with a proprietary indicator called StockAlpha. It is derived by comparing the performance of equities in the fund with that of a sector ETF.

Here are the top five stock-picking hedge funds measured by StockAlpha, many of them run by managers who are not household names.

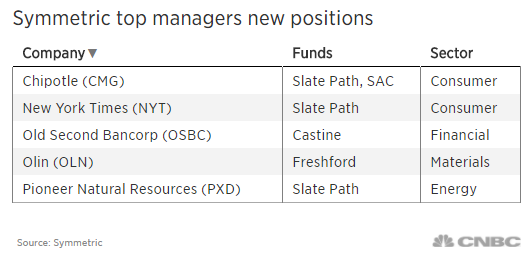

Some investors focus on the stocks in which funds are taking new positions because it may mean the managers see an overlooked opportunity.

Here are some new stock additions from the top five stock pickers.

The top-performing hedge funds added positions in Chipotle and The New York Times in the March quarter.