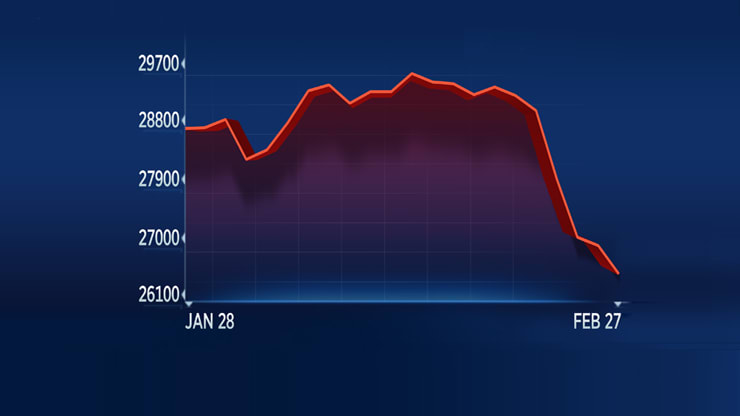

Stocks fell sharply once again on Thursday as investors worried the coronavirus may be spreading in the U.S. A slew of corporate and analyst warnings also dragged down the major averages.

The Dow Jones Industrial Average plummeted 529 points, or 2%. The S&P 500 slid 2.1% while the Nasdaq Composite dropped 2.4%.

Those losses put the Dow in correction territory, down 10% from its from its record close to where it’s trading at now. The S&P 500 was in correction territory on an intraday basis. It took the Dow just 10 sessions to tumble from its all-time high. The S&P 500 and Nasdaq set record highs last week.

But despite the market’s rapid fall, the S&P 500 is trading at levels not seen since October.

The CDC confirmed on Wednesday the first U.S. coronavirus case of unknown origin in Northern California, indicating possible “community spread” of the disease. The CDC doesn’t know exactly how the patient, a California resident, contracted the virus.

“We’re extremely cautious in the short term,” said Tom Hainlin, global investment strategist at Ascent Private Capital Management. “No one really seems to be an expert on the coronavirus. We haven’t seen anything like this really in our investing lifetimes.”

Apple, Disney and Visa were among the worst-performing Dow stocks, dropping at least 3% each. AMD and Nvidia fell 4% and 4.2%, respectively. Meanwhile, Gilead Sciences climbed 1.9% after the company announced the start of two studies for a possible coronavirus treatment.

Investors also loaded up on U.S. bonds, pushing yields on longer-term debt to record lows. Gold prices rose 0.6% to $1,653.50 per ounce.

President Donald Trump tried to assuage concerns over the outbreak. Trump said in a news conference Wednesday night the risk of coronavirus to people in the U.S. is still “very low.” He added the U.S. is going to “spend whatever’s appropriate” to deal with the virus. Trump also put Vice President Mike Pence in charge of the U.S. response to the coronavirus. The president added stocks should recover from their recent swoon.

Worries over how the coronavirus will impact corporate profits and global economic growth have roiled the U.S. stock market this week as the number of confirmed cases increases. South Korea has confirmed a total of more than 1,700 cases. About 400 people have contracted the virus in Italy.

The outbreak has also led several companies to issue warnings about its earnings and revenues.

Microsoft warned Wednesday it will not meet its revenue guidance for a key segment. In a statement, its supply chain is “returning to normal operations at a slower pace than anticipated,” which led the tech giant to cut its forecast for its personal computing division. Personal computing accounted for 36% of Microsoft’s overall revenue during the previous quarter. Microsoft shares were down 4%.

PayPal also issued a warning about its outlook. The stock traded 1.3% lower.

“US companies will generate no earnings growth in 2020,” David Kostin, Goldman Sachs’ chief U.S. equity strategist, said in a note.

Trump’s comments, Microsoft and Goldman’s warnings came after the Dow fell more than 100 points on Wednesday, adding to its massive decline for this week. Through Wednesday’s close, the Dow has lost more than 2,000 points this week.

The Dow has also fallen more than 8% from its record high set earlier this month.

“As this week’s selling has progressed, we have seen some evidence of increased caution on the part of investors,” said Willie Delwiche, investment strategist at Baird. “Investors are shifting away from excessive optimism but there is still little evidence of fear overwhelming complacency. Bottoms are typically processes punctuated by climactic events and seeing breadth indicators stabilize would be an encouraging sign that such a process is underway.”

Bond prices, in turn, have surged this week.

The benchmark 10-year Treasury yield dipped below 1.25% on Thursday, hitting a record low. Earlier this month, the benchmark rate traded above 1.4%. The 30-year bond rate is also trading at an all-time low. Yields move inversely to prices.

“We’ve hit a pocket of fear,” said Gregory Faranello, head of U.S. rates trading at AmeriVet Securities. “This is a big deal … If this flows into the U.S., we could be in trouble because, let’s face it, the U.S. consumer is what’s holding this thing together.”

Subscribe to CNBC PRO for exclusive insights and analysis, and live business day programming from around the world.