A trader works in S&P 500 stock index options pit at the Chicago Board Options Exchange (CBOE) in Chicago, Illinois.

Jim Young | Bloomberg | Getty Images

A rare phenomenon with a great track record is taking place in the market and it shows that U.S. stocks offer much more value than bonds.

In August, the dividend yield for the S&P 500 index, at 1.89%, was higher than the yield of a 10-year Treasury, at 1.5%, for the first time since 2016. According to Bank of America, stocks have significantly outperformed bonds 94% of the time that this has happened historically.

“Stocks are a ‘no brainer’ vs. bonds,” Bank of America analyst Savita Subramanian wrote to investors on Monday about the phenomenon.

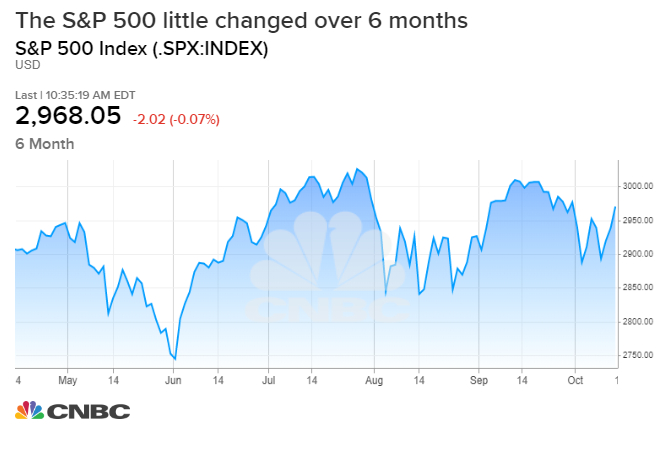

Subramanian’s note features as further evidence for Bank of America’s position that U.S. investors should favor stocks over bonds more than they historically do. Typical wisdom has investors make use of a “60/40” portfolio, which allocates 60% of investment to stocks and 40% to bonds. And, with the S&P 500 trading just 2% higher over the last six months, investors may be tempted to stick to that strategy.

But Bank of America’s finding points out that, even without the price changing, investors should much more heavily favor stocks for the dividend yield.

“Stocks still look cheap on growth and cash flow,” Subramanian said.

– CNBC’s Michael Bloom contributed to this report.