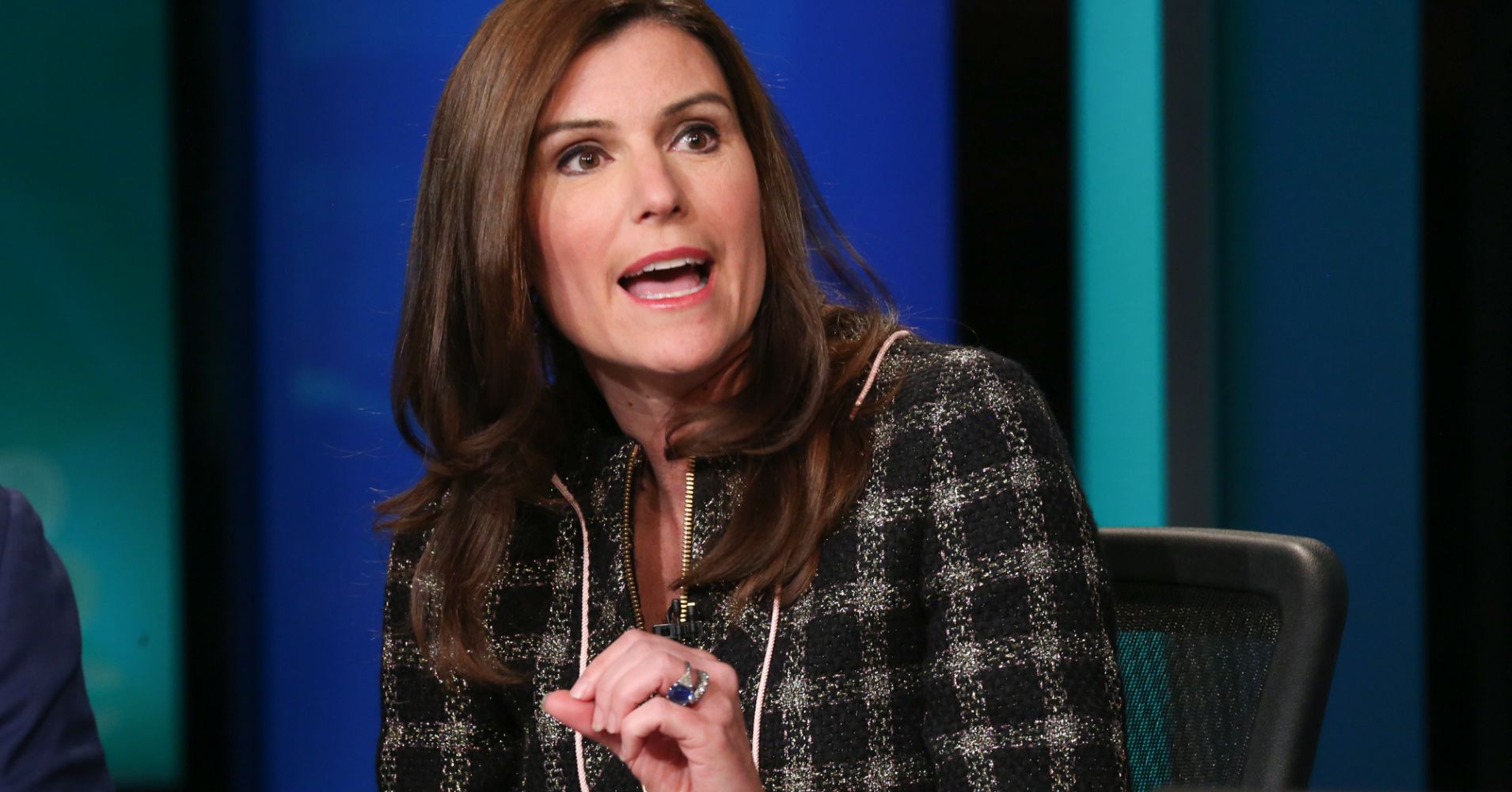

The head of Wells Fargo Asset Management, Kristi Mitchem, believes active management may see a resurgence over the coming years as a number of risks appear across the market.

“I think this is a micro-market. I think this is a security-specific market, where you want to be intentional about which securities you buy and in which countries you actually purchase them,” Mitchem said. “There is the prospect for risk coming from a number of places.”

“I’m talking about active managers getting active,” she added. “I think that really does point to a market and a regime in which active management can definitely outperform over the next several years.”

Mitchem, who previously served as executive vice president at State Street Global Advisors, isolated a number of areas she considers risky for equity markets. Among the hazards she listed was a “misstep” by the Federal Reserve in its plan to gradually increase the federal funds rate.

“There is the prospect for risk coming from a number of places,” she argued. “Certainly there’s always the prospect that the Fed missteps, gets ahead of itself in some way; labor costs, another potential issue, June numbers we know came in at 2.7 percent.”

“Of course, the big thing is trade policy. We think we’re at a place now we’re going to get accommodative negotiation-type trade policy, but an all-out trade war could put a lot of what we’re seeing in terms of positive momentum in question and maybe even change the trajectory of the economy.”

Wells Fargo Asset Management manages over $380 billion, according to the company’s website.