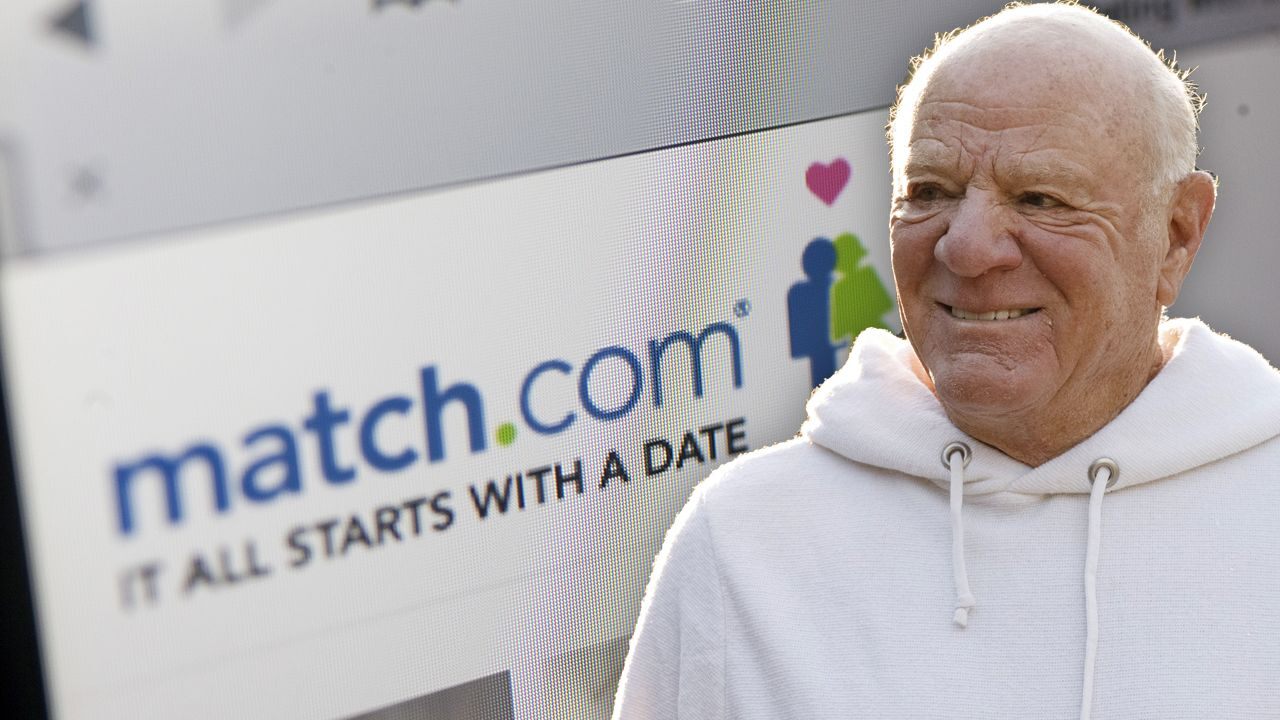

IAC and Expedia Chairman Barry Diller talks about the Match spinoff in an exclusive interview with Maria Bartiromo.

IAC and Match Group are breaking up.

Continue Reading Below

The media and internet company announced Thursday morning that it will fully separate its Match Group unit, which owns dating apps Match, Tinder, OKCupid and Plenty of Fish.

Shares of both Match Group and IAC rallied on the news.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| MTCH | MATCH GROUP INC. | 71.24 | +0.20 | +0.28% |

| IAC | IAC/INTERACTIVECORP | 221.21 | -2.03 | -0.91% |

IAC shareholders will have direct ownership of Match Group after the separation, and receive $3 a share cash in consideration. Cash saved when investors opt to take their payout only in shares will go to IAC. Holders of IAC common shares and IAC Class B will receive equivalent interest in the new Match and the post spin-off IAC.

TRUMP’S ECONOMY HAS US CONSUMERS BRIMMING WITH CONFIDENCE AMID GLOBAL GLOOM

“We’ve long said IAC is the ‘anti-conglomerate’ – we’re not empire builders,” Chairman and Senior Executive Barry Diller said in a statement. “We’ve always separated out our businesses as they’ve grown in scale and maturity and soon Match Group, as the seventh spin-off, will join an impressive group of IAC progeny collectively worth $58 billion today.”

IAC expects a tax-free separation to occur in the second quarter of 2020. Following the deal’s closing, IAC CEO Joey Levin will initially serve as executive chairman of Match Group and IAC CFO Glenn Schiffman will serve on the board of directors.

IAC can choose to sell up to $1.5 billion of new Match Group equity and would receive the proceeds of such a sale. IAC shareholders would see their stake in the new Match Group be reduced by the corresponding amount.

As part of the deal, Match Group will buy two buildings in Los Angeles that occupied mostly by Tinder, paying $120 million in stock.

Match Group was sued by the Federal Trade Commission in September for allegedly using “fake accounts created by fraudsters” to lure new paying members to Match.com between 2013 and the middle of 2018. The FTC alleged 500,000 paying members signed up as a result of the scheme.

Match Group has denied the claims, saying they are filled with “completely meritless allegations supported by consciously misleading figures.”

CLICK HERE TO READ MORE ON FOX BUSINESS

Match Group shares have gained 66.6 percent this year while IAC shares are up 24.6 percent. The S&P 500 is higher by 27.3 percent.