The U.S. Securities and Exchange Commission obtained an emergency freeze of $27 million in profits from stock sales involving the CEO of cryptocurrency company Longfin and three other affiliated individuals, the agency said in a statement Friday.

Longfin’s stock was halted on the Nasdaq as of 10:01 a.m. ET on the SEC alert after jumping more than 47 percent.

The freeze was to prevent three shareholders from moving money overseas, the SEC said.

“We acted quickly to prevent more than $27 million in alleged illicit trading profits from being transferred out of the country,” Robert Cohen, Chief of the SEC Enforcement Division’s Cyber Unit said in the statement. “Preventing defendants from transferring this money offshore will ensure that these funds remain available as the case continues.”

Amro Izzelden “Andy” Altahawi, Dorababu Penumarthi, and Suresh Tammineedi allegedly sold large blocks of their restricted Longfin shares illegally to the public shortly after the company acquired a “purported” cryptocurrency business and began trading on the Nasdaq, according to the SEC complaint.

The SEC claims Longfin CEO and Chairman Venkat Meenavalli caused the company to issue unregistered shares to the three individuals so they could sell them.

The small company that has attracted controversy over its ties to cryptocurrency, and its CEO said this week that he is not going to sell his shares while he is fighting $1.4 billion in bets against the stock by short-sellers.

“I’m not going to sell [for] the next three years,” Meenavalli said Wednesday on CNBC’s “Fast Money” as he was rigorously questioned about stock sales and inconsistencies about his business.

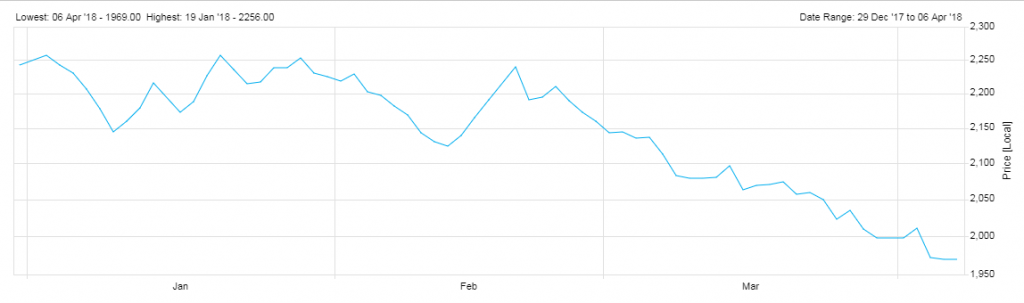

The stock has fallen more than 90 percent from an all-time high hit in December, and volatility has picked up in the last two weeks following several negative headlines, including a tweet from noted short-seller Andrew Left’s Citron Research.

— This is developing news. Check back for updates.

— CNBC’s Evelyn Cheng contributed to this report.