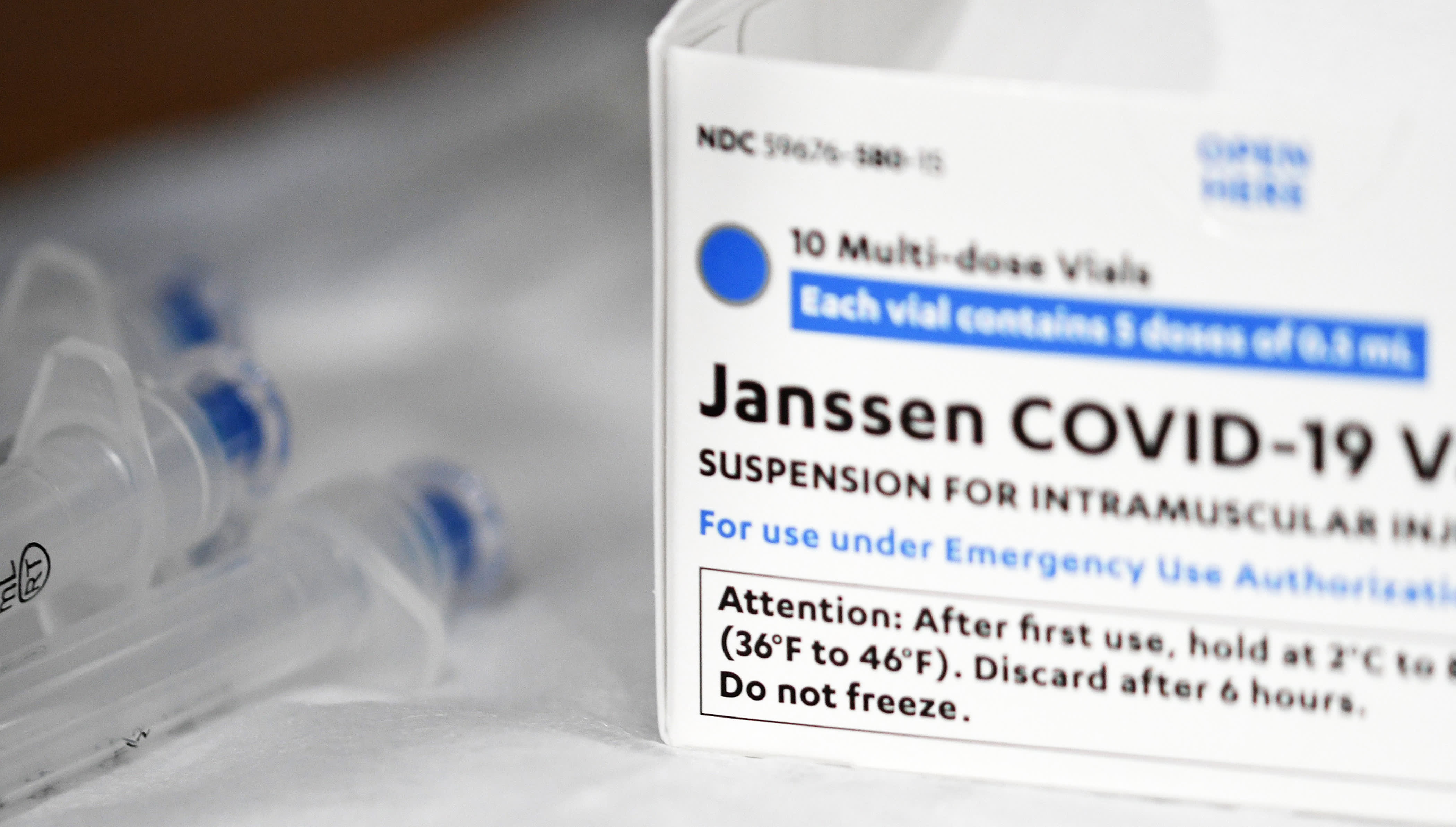

Syringes and a box of Johnson & Johnson vaccine.

Paul Hennessy | SOPA Images | LightRocket | Getty Images

Johnson & Johnson on Tuesday lowered its full-year sales and earnings outlook, and stopped providing Covid-19 vaccine sales guidance due to a global supply surplus and demand uncertainty.

J&J is now forecasting 2022 sales of $94.8 billion to $95.8 billion, about one billion dollars lower than the guidance provided in January. The company lowered its full-year adjusted earnings per share by 25 cents to between $10.15 to $10.35, from a previous forecast of $10.40 to $10.60.

J&J reported first-quarter sales of $23.4 billion, slightly missing Wall Street expectations but growing 5% over the same quarter last year. The company posted earnings of $2.67 cents per share, a 3.1% increase over the same period of 2021 and beating expectations. J&J reported net income of $5.15 billion, a nearly 17% decrease over the first quarter of 2021.

The company sold $457 million of its Covid vaccine globally.

Here’s how J&J performed compared with what Wall Street expected, based on analysts’ average estimates compiled by Refinitiv:

- Adjusted EPS: $2.67 per share, vs. $2.58 expected

- Revenue: $23.4 billion, vs. $23.6 billion expected

J&J reported $12.87 billion in pharmaceutical sales, an increase of 6.3% over the same quarter last year. The company’s medical devices business grew by 5.9% to $6.97 billion in sales compared to the first quarter of 2021. Sales at J&J’s consumer health business, which it is spinning off into a separate publicly traded company, declined 1.5% to $3.57 billion compared to the same period last year.

“Our first quarter results demonstrate strong performance across the enterprise, despite macro-economic headwinds,” said CEO Joaquin Duato in a press release. “Looking ahead, I remain confident in the future of Johnson & Johnson as we continue advancing our portfolio and innovative pipeline.”

J&J’s board has approved a 6.6% quarterly dividend increase to $1.13 due to the company’s strong 2021 performance, Duato said.