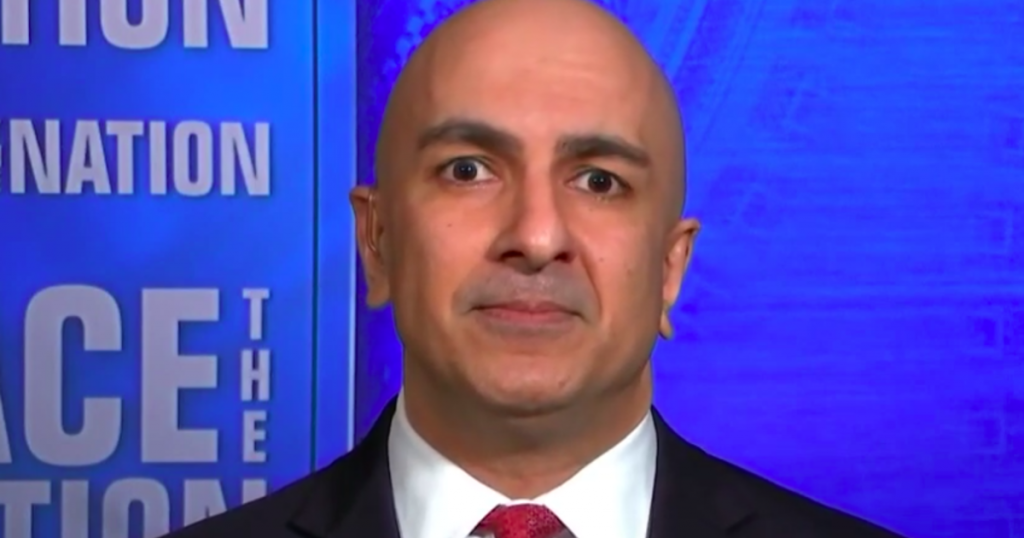

FILE PHOTO: Federal Reserve Vice Chairman Richard Clarida, boards a bus to tour South Dallas as part of a community outreach by U.S. central bankers, in Dallas, Texas, U.S., February 25, 2019. REUTERS/Ann Saphir

June 19, 2020

By Jonnelle Marte

(Reuters) – The Federal Reserve is far from meeting its dual mandate of targeting inflation and maximum employment and there is more the central bank can do to support the U.S. economy, Fed vice chair Richard Clarida said on Friday.

“We’ve taken very aggressive, proactive actions,” Clarida said during an interview with Fox Business. “There’s more that we can do, I think there’s more that we will do.”

Clarida said there is no limit to the Fed’s potential purchases of Treasury securities or mortgage-backed securities, and he reiterated the view shared by other Fed officials that negative interest rates would not be appropriate for the U.S. Despite low inflation, officials are not thinking about lowering the Fed’s 2% target, Clarida said.

When asked about the Fed’s purchases of corporate bonds and exchange-traded funds that invest in corporate bonds, Clarida said the goal of the purchases is to “support good market functioning.”

Earlier this week, the Fed started purchasing individual corporate bonds through the secondary market corporate credit facility, using an index that provides broad market exposure, focused mostly on high quality companies. Previously, it required companies to apply for direct bond purchases.

Clarida said he did not think the purchases were fueling new bubbles but that the Fed would stay attuned for potential risks. “When the economy has recovered and is back on its feet we will be willing to pull back from these programs, but that’s down the road,” he said.

(Reporting by Jonnelle Marte; Editing by Chizu Nomiyama)