Nvidia (NVDA) has demonstrated this week that both its chips and budding software offerings are integral to the future of artificial intelligence, bolstering the Club case in the semiconductor holding and prompting a slate of endorsements from Wall Street analysts. At the company’s annual technology conference for developers this week, Nvidia officially launched its DGX Cloud — a supercomputer accessible via web browser that can be used to train models behind generative AI applications like ChatGPT. It also unveiled a set of cloud services that make it easier for Nvidia’s enterprise customers to build customized AI models, along with several new hardware elements. That foray into software should provide Nvidia with a recurring revenue stream that’s less prone to the boom-and-bust cycles inherent to semiconductor hardware sales, while making its technology accessible to more industries. Of 15 bank notes surveyed this week, 13 firms have a buy rating or equivalent on Nvidia, citing its AI capabilities. While some analysts have questioned Nvidia’s high valuation, they all appear to agree that Nvidia is at the heart of artificial intelligence. We think the valuation is justified but would, of course, welcome some consolidation in the stock and look to buy up more shares on a pullback. But, longer term, Nvidia’s AI applications portend significant upside for the stock in the years to come. Nvidia stock closed up roughly 1% Wednesday, at $264.68 a share. Here’s a run-down of the latest research from Wall Street on the chipmaker. Bernstein Reiterated an outperform, or buy, rating and price target of $265 per share. Bernstein expects generative AI will drive upside in both the near- and long term. Nvidia, the analysts wrote, is the “purest way to play” the generative AI opportunity, as “their hardware appears uniquely suited to handle the massive increase in compute intensity generative AI drives.” Nvidia’s CUDA proprietary software platform allows users to optimize the company’s graphic processing units (GPUs), the analysts explained. “We struggle to see how anyone else can compete with NVDA’s ecosystem, even if they could manage to come closer on the hardware side,” they wrote. Wells Fargo Reiterated overweight, or buy, rating and raised its price target to $320 per share, from $275. Nvidia’s addressable market share is expanding as new products come to market and the company moves deeper into the software and services segment, the analysts argued. Goldman Sachs Reiterated a buy rating and price target $275 per share. The analysts said they are “incrementally positive” on the stock, with new announcements this week set to “solidify Nvidia’s position as the key enabler of AI in the cloud and across a broad spectrum” of sectors, including health care, automobiles and logistics. BMO Capital Markets Reiterated an outperform, or buy, rating and raised its price target to $305 per share, from $255. The analysts called out the “ongoing evolution” of Nvidia’s business model, as it moves deeper into the software and services space, while highlighting the sub-theme of sustainability in Nvidia’s offerings. They noted that Nvidia is not just a beneficiary of AI but a key enabler. Raymond James Reiterated a strong buy rating – one level above buy — and price target of $290 per share. The analysts estimated that Nvidia’s push into cloud services will provide a roughly $1 billion-per-year incremental revenue opportunity over the next two-to-three years. Morgan Stanley Reiterated an overweight, or buy, rating and price target of $304 per share. Nvidia’s conference “demonstrate[d] the breadth of opportunities, both in terms of expanding presence in existing markets…but more significantly expanding beyond chips and cards to systems, software, and cloud services,” the analysts wrote. Bank of America Reiterated an outperform, or buy, rating and raised its price target to $310 per share, from $275. Calling it their “top compute pick,” the analysts said the “scope/ambition” of Nvidia’s announcements this week “reinforces [Nvidia’s] dominance in the nascent generative AI/large language model market that could reshape the existing tech industry and usher in disruptive startups.” The company’s vision and scale should ultimately “accelerate the adoption of LLMs by enterprises in almost every end-market,” they wrote. Stifel Reiterated a hold rating and maintained a price target of $225 per share. The analysts maintained their hold rating and below-market price target on the belief that the near-term drivers are “well understood” by the market. But they acknowledged that Nvidia is “amongst the best positioned companies to benefit from accelerated AI-focused spending.” UBS The bank said its buy rating and $270-per-share price target are “under review pending further analysis.” The analysts believe that the further expansion of Nvidia’s business model to include “broad new sources of recurring software/services revenue” is enough to support shares even after the strong year-to-date rally. “It’s hard to say the stock is underappreciated, but the fact is that this is still a very small company in the context of the transformational AI opportunity,” they added. JPMorgan Reiterated an overweight, or buy, rating and price target of $250 per share. Nvidia is becoming a “one-stop solution provider” for a customer’s AI and accelerated computing needs — be they hardware, or software, the analysts wrote. Nvidia, they argued, remains “1-2 steps ahead of its competitors in accelerated computing silicon/systems, software, and ecosystems.” Barclays Reiterated an overweight, or buy, rating and price target of $275 per share. In this new age of generative AI and large language models, Nvidia “remains well ahead of the competition,” the analysts wrote. Credit Suisse Reiterated an outperform, or buy, rating and price target of $275 per share. The analysts called Nvidia their “top pick” due to the company’s leadership in AI and are “most excited about Nvidia’s efforts to monetize software.” They added: “While it remains very difficult to quantify AI growth at this point, we believe there is enough growth from product cycles/content over the next 12-24 months…to keep the stock moving. Given its position in AI, we continue to believe NVDA is a tough stock to not own.” Evercore ISI Reiterated an outperform, or buy, rating and price target of $300 per share. “Overall, a few surprise positive developments, but in our view this event was largely as expected and primarily served to increase confidence in NVDA’s positioning as the arms dealer and enabler of AI adoption across every industry,” the analysts wrote of Nvidia’s conference. “Generative AI is marking an inflection point for AI and we continue to view NVDA as best positioned to capitalize on this dynamic,” they added. KeyBanc Reiterated an overweight, or buy, rating and price target of $280 per share. The analysts cited “increased confidence” in the company’s leadership status, saying Nvidia is in the best position to “monetize AI across all fronts including hardware, software, service, and systems.” Deutsche Bank Reiterated a hold rating, while increasing its price target to $220 per share, from $200. Despite concerns over Nvidia’s high valuation, the analysts maintained the view that the chipmaker is “the undisputed leader in providing AI silicon (and perhaps software?), a position that seems unlikely to be meaningfully challenged any time soon.” Note: Some of the ratings may appear to be at odds with the stated price targets. This is not uncommon and, in general, simply means that one of the two is set to change, as the analysts refine their models, conduct further research and factor in industry updates. That’s a dynamic that can also be seen at the Club. That’s why the commentary in an analyst note or in a Club story is more relevant than any rating or price target. (Jim Cramer’s Charitable Trust is long NVDA. See here for a full list of the stocks.) As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade. THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY , TOGETHER WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.

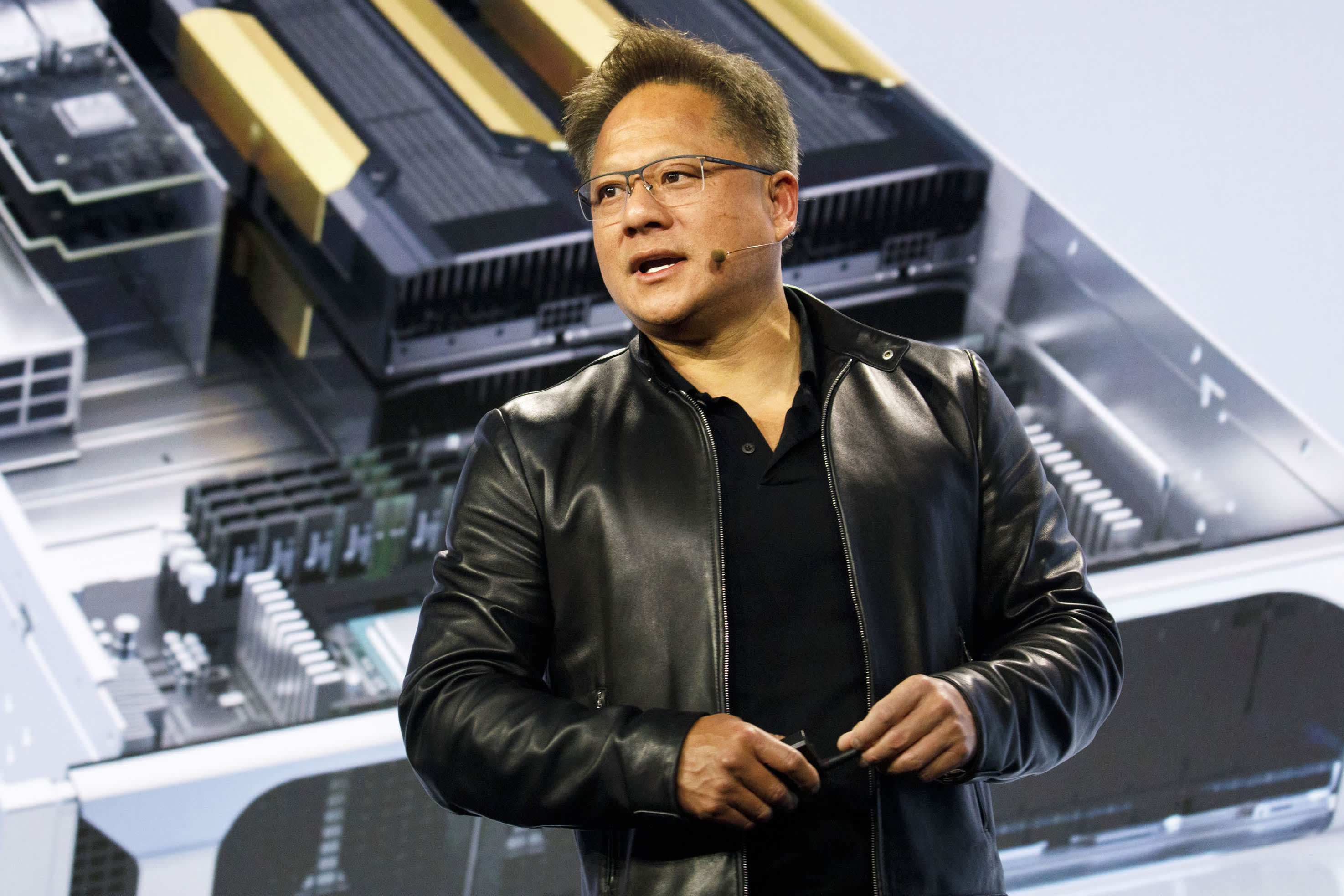

Jen-Hsun Huang, president and chief executive officer of Nvidia Corp., announces the EGX Edge Supercomputing Platform during the company’s event at Mobile World Congress Americas in Los Angeles, California, Oct. 21, 2019.

Patrick T. Fallon | Bloomberg | Getty Images

Nvidia (NVDA) has demonstrated this week that both its chips and budding software offerings are integral to the future of artificial intelligence, bolstering the Club case in the semiconductor holding and prompting a slate of endorsements from Wall Street analysts.