CNBC’s Jim Cramer on Monday described how he thinks froth is disrupting the market. He believes that trendier stocks need to cool off before others can bounce back.

“Once these frothy momentum stocks come in enough, then we will finally be in a much more straightforward world, a world where what tends to rally is not the sizzle, but the steak,” Cramer said.

After a humbling sell-off on Friday, the indexes struggled to find their footing during Monday’s session. By close, the S&P 500 slid 0.5%, the Nasdaq Composite lost 1.21% and the Dow Jones Industrial Average clinched a 0.08% gain. According to Cramer, last week saw too much froth — when prices rise sharply primarily due to speculation and hype — and not enough “prudence,” which is key for smart investing.

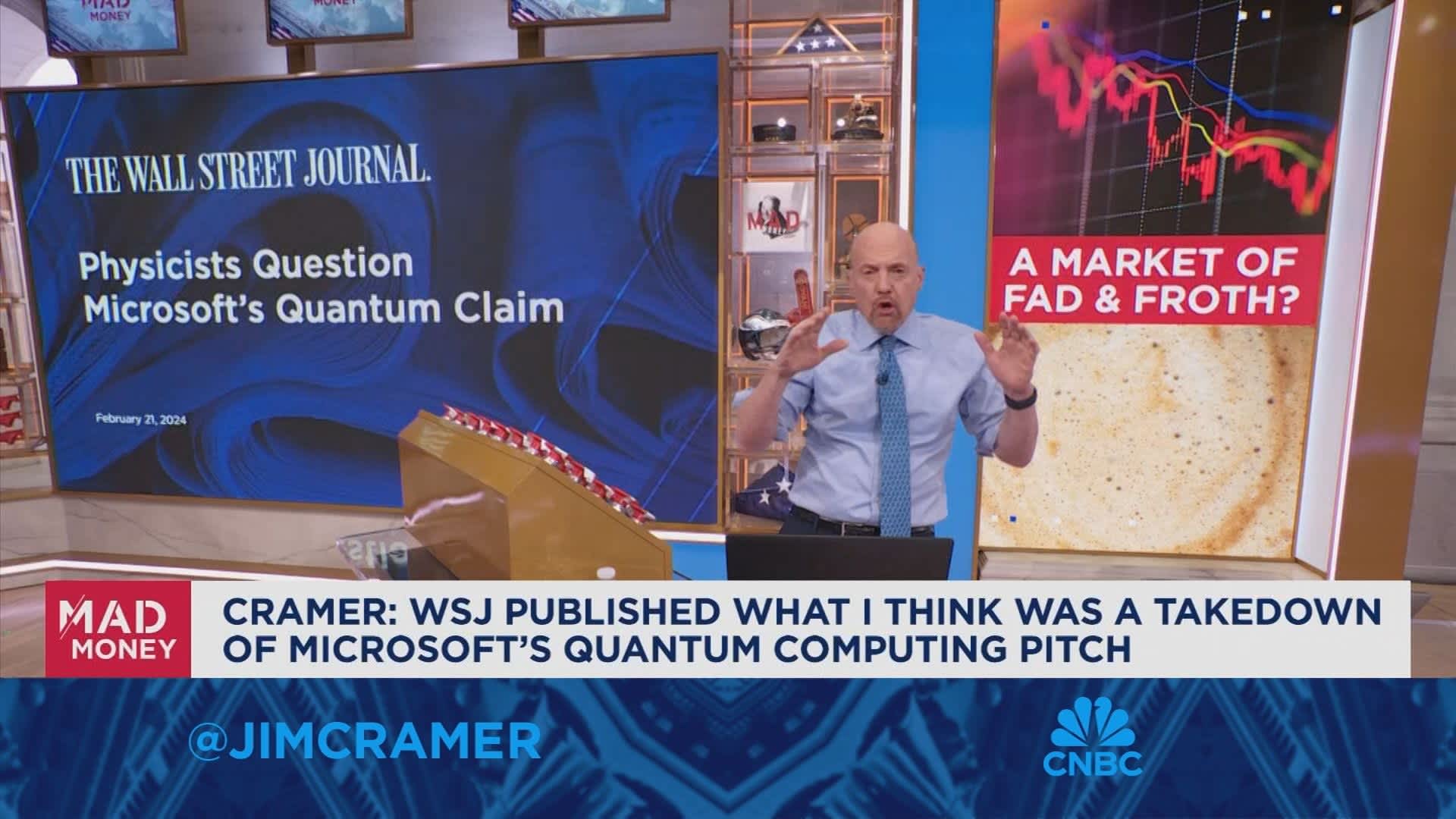

Some of froth seems to have fallen flat on Monday, Cramer said, as investors start to want stocks with more staying power. He attributed some recent losses to a more uncertain sentiment about quantum computing after Microsoft announced a breakthrough in the field that stirred excitement. But an article in the Wall Street Journal suggested physicists are questioning the validity of that claim, and this may have sewn doubt about the theme’s prospects, Cramer said.

Stocks related to the data center also took a hit, Cramer said, naming stocks like Vistra and Constellation Energy. These declines could have been due to Wall Street’s fears that Microsoft will cut capital expenditures on data centers, he continued.

“Until [the froth] is slain and its ingredients, including everything that’s still bathing in the glow of the now curtailed data center business, we can’t find terra firma,” Cramer said.