President Trump discusses the ongoing arguments between Saudi Arabia and Russia and says the low cost of oil is harmful to the industry.

Get all the latest news on coronavirus and more delivered daily to your inbox. Sign up here.

Continue Reading Below

(Reuters) – Whiting Petroleum Corp said on Wednesday it filed for Chapter 11 bankruptcy, the first major casualty of a free fall in crude prices to $20 per barrel last month.

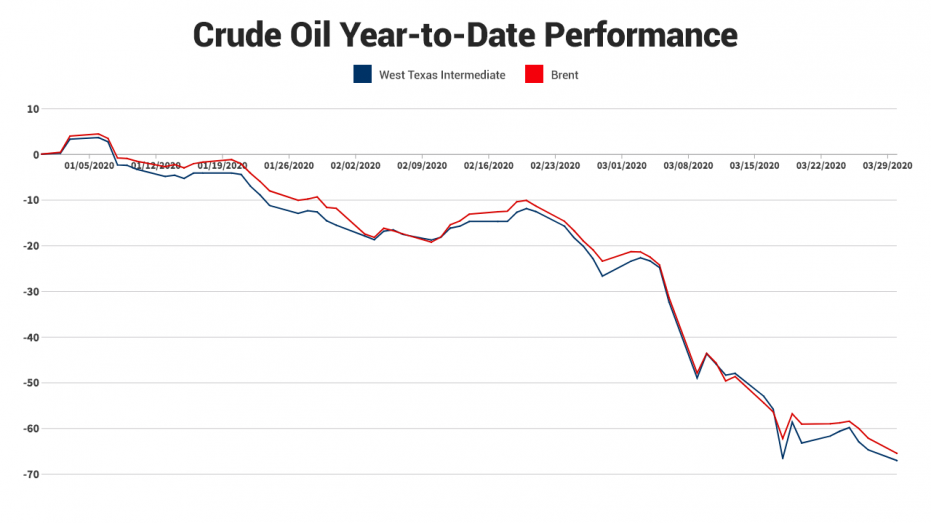

Oil and gas producers have been scrambling to restructure their debt as the economic fallout of the coronavirus pandemic and an oil price war between Russia and Saudi Arabia have led to a 50% drop in crude prices since the beginning of March.

Whiting said it had reached an agreement with some of its creditors to cut its debt by about $2.2 billion through an exchange of some of its notes for 97% of new equity in the reorganized company. Existing shareholders will own 3% of the company.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| WLL | WHITING PETROLEUM CORP | 0.36 | -0.31 | -46.52% |

The company had $2.8 billion in debt as of Dec. 31 and more than $585 million in cash on its balance sheet.

OIL’S RECORD CORONAVIRUS SLIDE IS NOWHERE NEAR BOTTOM

Whiting, which was expected to produce about 42 million barrels of oil equivalent in 2020, said it would continue to operate its business in the normal course without material disruption to its vendors, partners or employees.

It currently expects to have sufficient liquidity to meet its financial obligations during the restructuring without the need for additional financing.

CORONAVIRUS PUSHES GAS PRICES BELOW $2 FOR FIRST TIME IN 4 YEARS

Moelis & Company is acting as a financial adviser to Whiting, while Alvarez & Marsal is its restructuring adviser.

PJT Partners is acting as financial adviser for creditors.

CLICK HERE TO READ MORE ON FOX BUSINESS

(Reporting by Arathy S Nair in Bengaluru; Editing by Shailesh Kuber and Anil D’Silva)