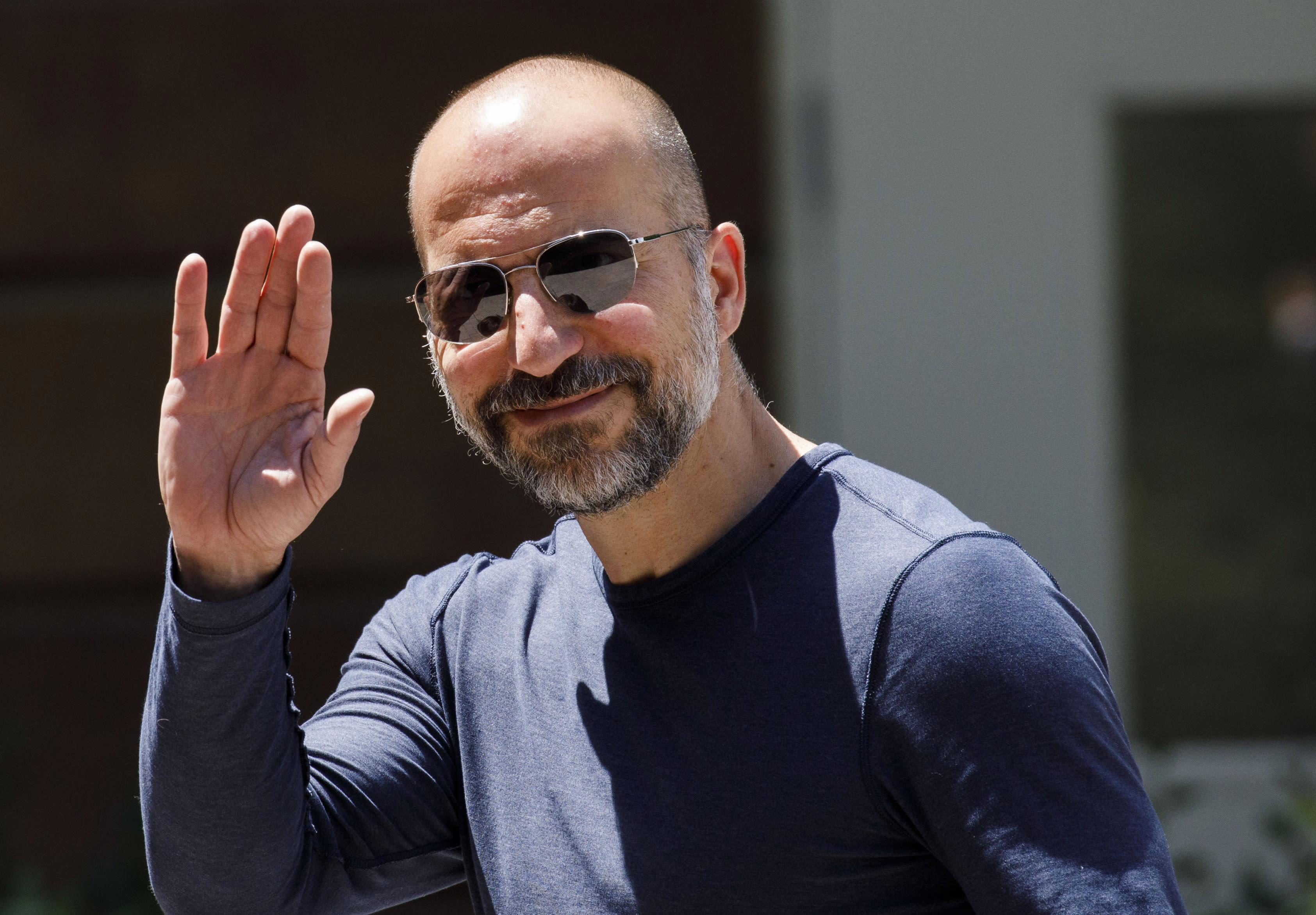

Dara Khosrowshahi

Patrick T. Fallon | Bloomberg | Getty Images

Shares of Uber fell more than 6% in pre-market trading on Wednesday as investors await the company’s IPO lockup agreement to expire.

Wednesday is the first time since Uber’s IPO in May that insiders can sell the stock and analysts have warned it could put near-term pressure on the shares. Roughly 90% of Uber’s stock will be available for sale, according to analysts at MKM Partners.

Uber’s lockup expiration may not be as volatile as some analysts are expecting, since many pre-IPO shareholders are underwater. The stock has fallen more than 37% since Uber went public at $45 earlier this year. Shares closed at an all-time low of $28.02 on Tuesday after the company reported over $1 billion in net losses in its third-quarter results.

Additionally, investors will be waiting to see if some of the biggest buyers of Uber’s pre-IPO shares will participate when the lockup expires, like SoftBank, Morgan Stanley and Fidelity, among others. Wedbush analysts estimated that 763 million shares will unlock on Wednesday, with 25% of them being sold by early-stage private investors.

–CNBC’s Ari Levy contributed to this story.