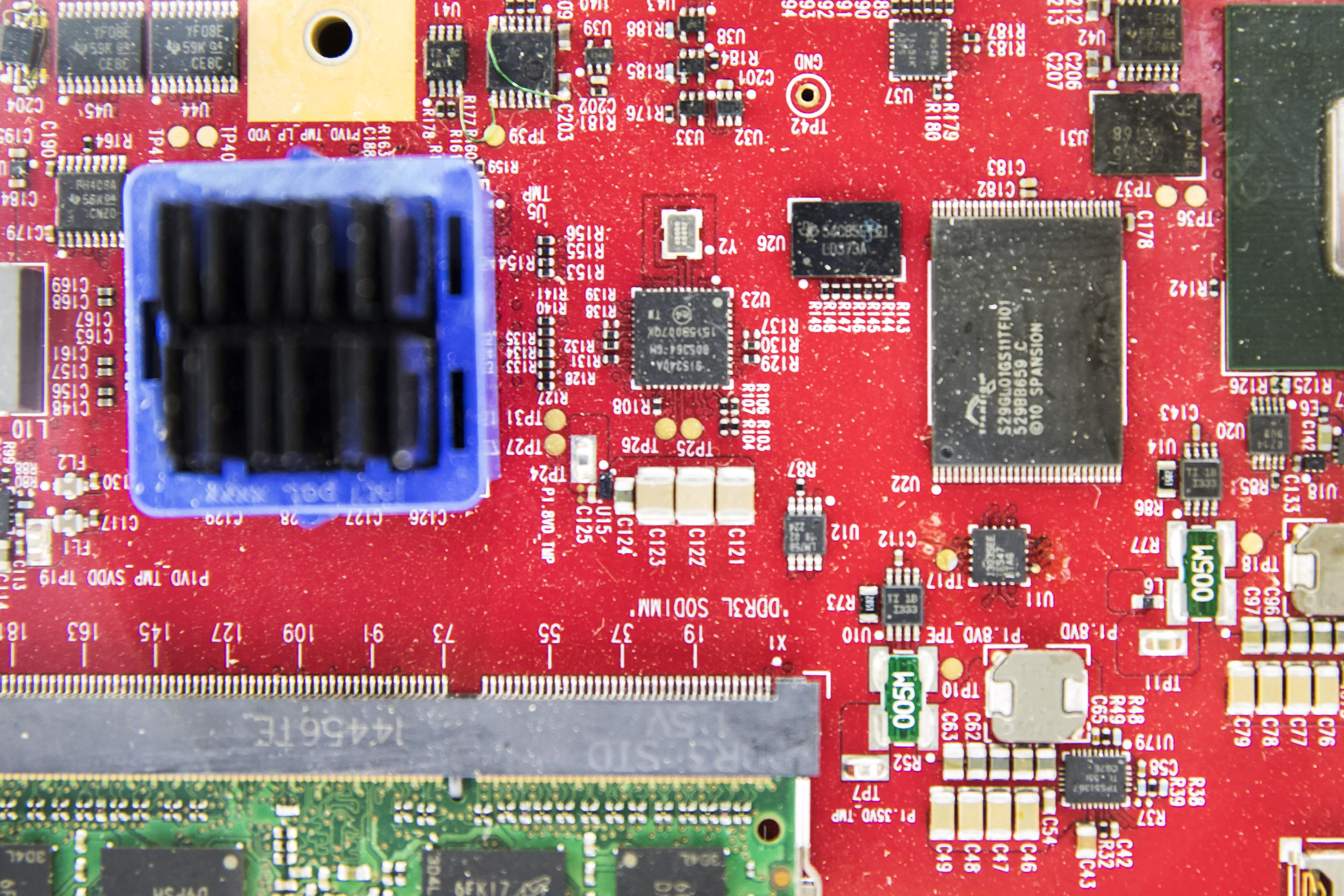

Components are displayed on a circuit board at the Qualcomm Inc. booth at the Mobile World Congress Shanghai in Shanghai, China, on Thursday, June 28, 2018.

Qilai Shen | Bloomberg | Getty Images

U.S. semiconductor stocks have been hit hard in the past month following President Donald Trump’s administration’s blacklisting of Huawei, which has raised the specter of wider restrictions to Chinese firms’ access to American technology.

Semiconductors are one of America’s biggest tech exports and China is a crucial market because of the amount of electronics manufacturers relying on U.S. chips.

Trump signed an executive order last month that gave permission to Commerce Secretary Wilbur Ross to block transactions that involve information or communications technology that “poses an unacceptable risk” to U.S. national security. Huawei was then put on a blacklist that requires American firms to get permission to sell to the Chinese networking equipment and smartphone giant.

The move has hit the businesses and share prices of U.S. chip firms.

Some of Huawei’s U.S. suppliers have come out and said blacklisting the Chinese firm will affect their financial performance. Qorvo, Skyworks and Lumentum, have all downgraded their revenue forecasts for the current quarter. Qorvo shares are 13.6% lower this month, while Skyworks and Lumentum are down nearly 20% and 28.5%, respectively.

Sebastian Hou, an analyst at CLSA who focused on the semiconductor space said that chip stocks rose in the first few months of the year on hopes that the U.S. and China would strike a trade deal, but fell after no agreement was made. The blacklisting of Huawei has further weighed on semiconductor stocks.

“Huawei is blacklisted, which has made investors worry about the (second half of 2019) demand, forced a few tech/semis companies to cut guidance accordingly,” Hou said, adding that the worry of the U.S. restricting technology to Chinese firms is also a — smaller — contributor to the decline.

Meanwhile, China has launched its own blacklist of what it deems “unreliable entities” that could damage the interests of its domestic firms. No announcement has been made yet about any foreign firms on the list, but the fear is that it could target American firms, including chipmakers.

China is also ramping up its own semiconductor industry in a move to reduce its reliance on the U.S., a development experts told CNBC could take a long time, but may ultimately hurt American chip makers.

<![CDATA[

img { max-width: 490px; } .bodycontent { margin-bottom: 20px; } .form-field {margin-bottom: 10px;} @media only screen and (max-width: 780px) { .widget-header > img { width: 100%; max-width: 100% !important; } } ]]]]>

]]>