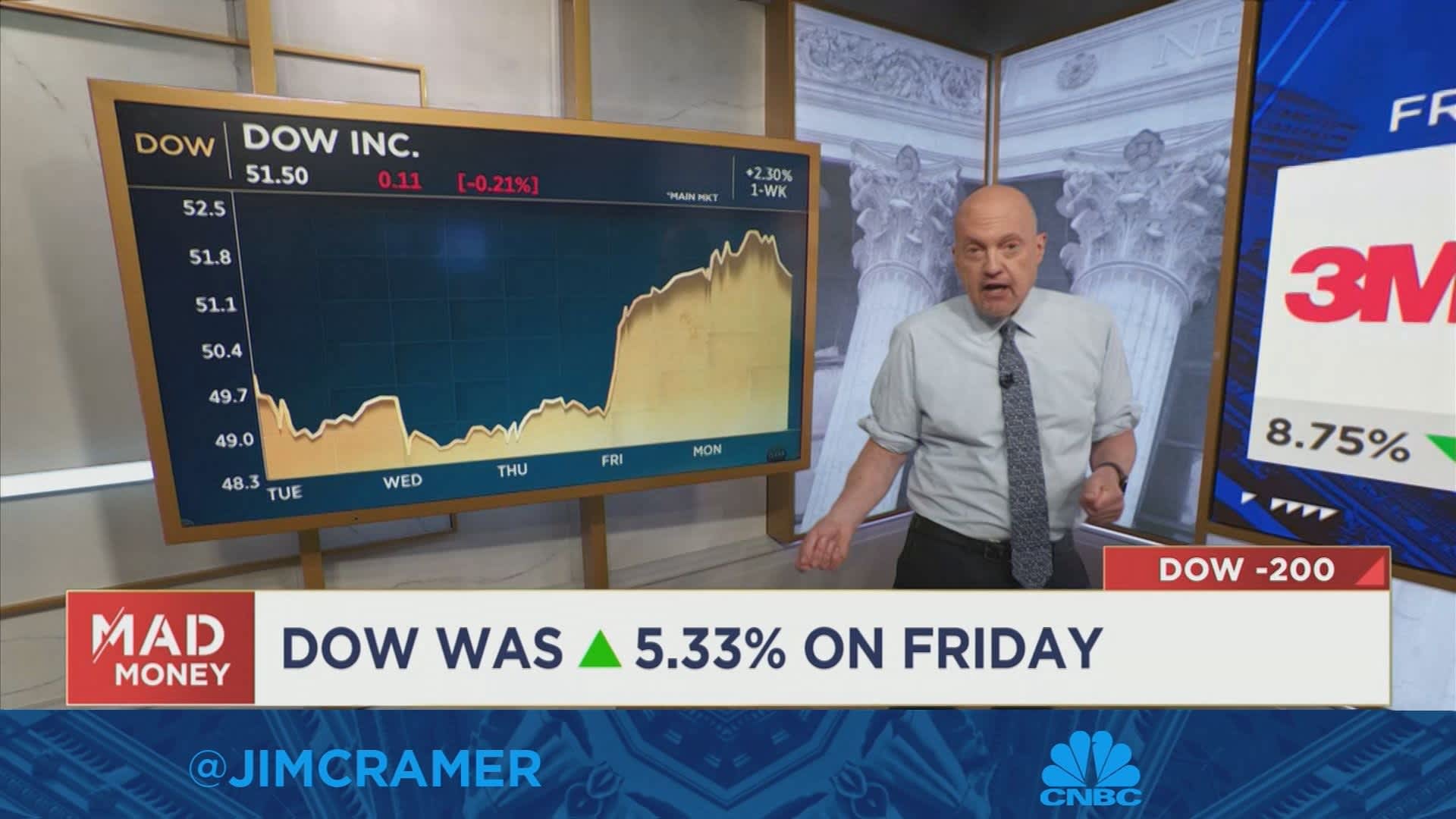

CNBC’s Jim Cramer explained that last week’s debt ceiling resolution may have paved the way for a Dow resurgence, even though the index closed lower by about 200 points Monday.

“With the default fears off the table, maybe this is a market where the once mighty Dow can actually lead again,“ Cramer said.

He noted that the Dow performed better than the tech-heavy Nasdaq on Friday, turning in its second-best day of the year so far. With the exception of Tesla, most of Cramer’s “Magnificent Seven” didn’t outperform on Friday like they have been doing so far this year.

“Friday’s rally was important, not just because it was a huge run, but because of its composition,” Cramer said. “Even when the ‘Magnificent Seven’ take a breather after their tremendous gains, it turns out there are plenty of other potential winners that could power the next leg of the market’s move higher.”

Although Cramer chalked up most of the Dow’s Friday success to lawmaker’s debt ceiling compromise, he also pointed out that nothing exists in a vacuum — the “goldilocks” labor report may also be a factor in last week’s Dow rally, as well as China’s stimulus package. However, if not for the deal, the Federal Reserve might still be feeling pressure to pass steep hikes at their next meeting, which would throw the market out of whack, Cramer said.

In looking at a more Dow-focused market, Cramer highlighted several stocks that roared on Friday, including technology company 3M and construction manufacturer Caterpillar.

After flying high on Friday, 3M was down more than 4% at Monday’s close. 3M is in the middle of a cancer-causing “forever chemical” ground contamination lawsuit, which was postponed on Friday, likely to give both parties more time to reach a settlement. Cramer is optimistic the settlement will not bankrupt the company, and that its stock will perform well once litigation is over.

Cramer believes Caterpillar is largely misunderstood by Wall Street, and traders treat it as an old-fashioned cyclical stock. To Cramer, however, Caterpillar was successfully diversified by CEO Jim Umpleby into a business less reliant on the global economy. Caterpillar’s stock kept running on Friday due to China’s stimulus plan, but Cramer noted that China represents less than 5% of the company’s current business.

“Now we just need to figure out which of these new winners really does have staying power beyond just Friday, but remember,” Cramer said, “Please don’t be greedy — the biggest money in this leg of the bull market has already been made.”

Sign up now for the CNBC Investing Club to follow Jim Cramer’s every move in the market.

Disclaimer The CNBC Investing Club Charitable Trust holds shares of Caterpillar.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer’s world? Hit him up!

Mad Money Twitter – Jim Cramer Twitter – Facebook – Instagram

Questions, comments, suggestions for the “Mad Money” website? madcap@cnbc.com