Sit Fixed Income Advisors’ Bryce Doty discusses the declining yields on U.S. Treasuries as Apple and Walmart are seemingly affected by the coronavirus outbreak.

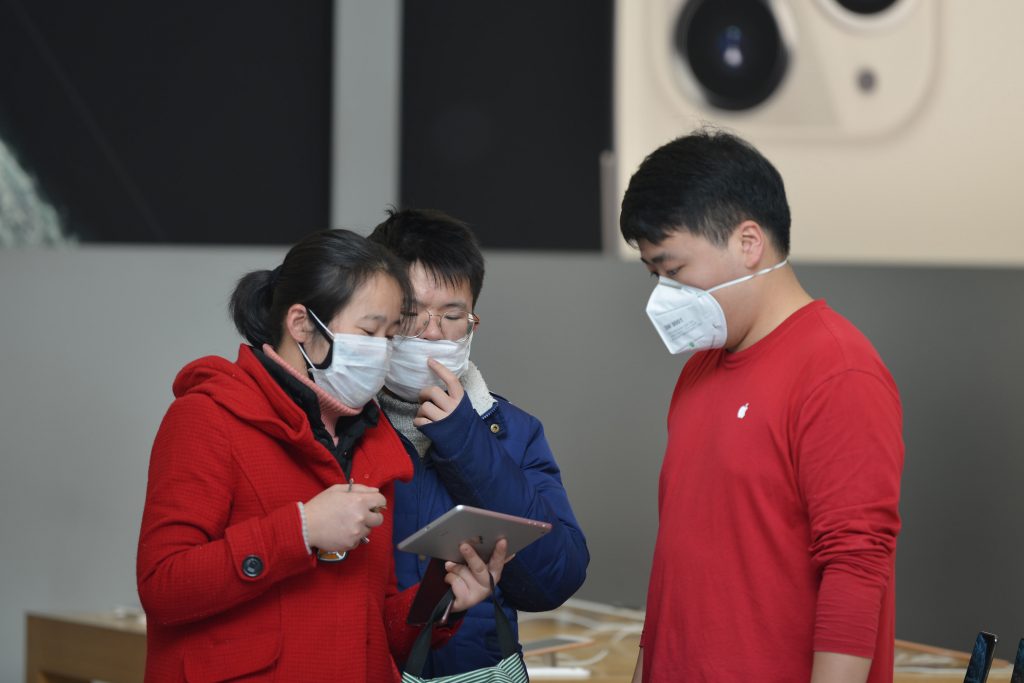

U.S. equity markets opened lower Tuesday after Apple warned production delays caused by the coronavirus outbreak would linger for longer than anticipated.

Continue Reading Below

Shares of the iPhone maker fell after the company warned its second-quarter revenue would miss its guidance of $63 billion to $67 billion. Suppliers in Asia and Europe also fell on the news. Every 1 percent drop in Apple shares will result in the Dow Jones Industrial Average falling 22 points, according to Dow Jones Market Data.

The latest figures from China’s National Health Commission show the coronavirus has sickened at least 72,436 people in the country while killing 1,868.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| SP500 | S&P 500 | 3372.37 | -7.79 | -0.23% |

| I:DJI | DOW JONES AVERAGES | 29296.01 | -102.07 | -0.35% |

| I:COMP | NASDAQ COMPOSITE INDEX | 9712.837413 | -18.34 | -0.19% |

| AAPL | APPLE INC. | 316.63 | -8.32 | -2.56% |

Looking at earnings, Walmart reported earnings and sales that fell short of Wall Street estimates, but hiked its annual dividend.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| WMT | WALMART INC. | 118.93 | +1.04 | +0.88% |

On the deal front, Franklin Resources reached a deal to buy rival Legg Mason for $4.5 billion, or $50 a share. Franklin will assume about $2 billion of outstanding debt.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| BEN | FRANKLIN RESOURCES | 26.57 | +2.21 | +9.09% |

| LM | LEGG MASON | 50.42 | +9.71 | +23.83% |

Elsewhere, Kroger gained after a filing showed Warren Buffett’s Berkshire Hathaway bought shares in the company for the first time.

U.K.-based HSBC Holdings PLC said Tuesday it will cut 35,000 jobs over three years as it downsizes its investment bank, sells $100 billion of assets and revamps its U.S. and European businesses.

Pier 1 Imports filed for Chapter 11 bankruptcy on Monday, and said it intends to sell the company.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| KR | KROGER | 30.23 | +2.00 | +7.07% |

| HSBC | HSBC HOLDINGS PLC | 36.10 | -1.84 | -4.85% |

| PIR | PIER 1 IMPORTS | 3.56 | -0.22 | -5.82% |

Commodities traded mixed, with West Texas Intermediate crude oil down 2 percent near $51.25 a barrel and gold up 0.3 percent at $1,591 an ounce.

U.S. Treasurys rallied, pushing the yield on the 10-year note down by 4.6 basis points to 1.542 percent.

In Europe, Germany’s DAX paced the decline, down 0.8 percent, while Britain’s FTSE and France’s CAC were both down 0.5 percent.

CLICK HERE TO READ MORE ON FOX BUSINESS

Markets were mostly lower across Asia with Hong Kong’s Hang Seng and Japan’s Nikkei down 1.5 percent and 1.4 percent, respectively. Meanwhile, China’s Shanghai eked out a 0.1 percent gain.