Rosecliff Capital CEO Mike Murphy, Stifel chief economist Lindsey Piegza and Delos Capital Advisors chief investment strategist Andrew Smith provide insight into the markets, the Federal Reserve, the price of oil and economic recovery in the U.S.

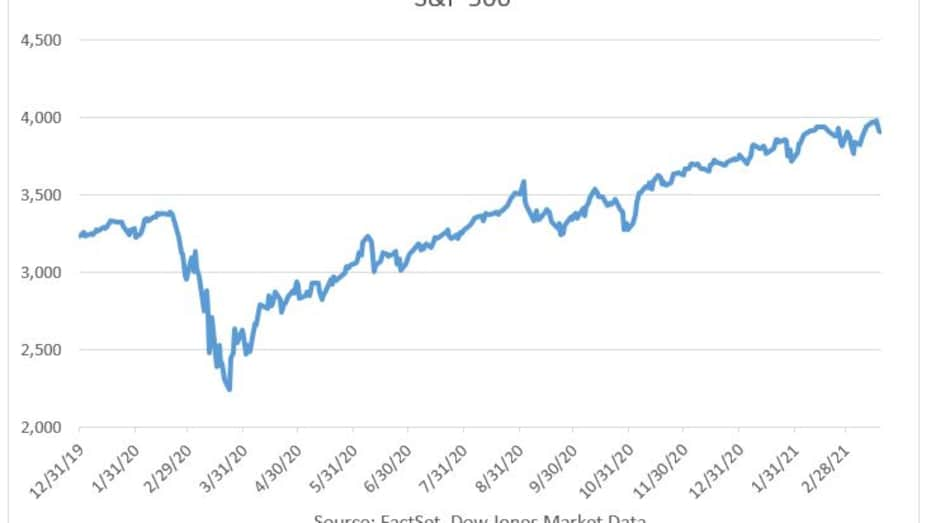

The S&P 500 has come roaring back from the depths of its COVID-19 induced selloff, but the index faces new headwinds as the U.S. economic recovery kicks into a higher gear.

The benchmark index has rallied 75% from its Mar. 23 low through Friday, eclipsing its pre-pandemic peak by 16%. The recovery is the fastest in stock-market history from a selloff of that magnitude.

“You can’t keep this thing down,” said Anthony Saliba, CEO of the Chicago-based Matrix Execution Group, an executing broker-dealer that specializes in options and equities. “It’s like a beach ball in the pool.”

The recent inflation worries have stoked concerns that growth stocks have gotten too expensive as valuations have stretched well beyond their historic norms.

The S&P 500’s price-to-earnings ratio for the trailing 12 months sits at 26.44 compared to its 20-year average of 17.24. Its price-to-book ratio was 4.19 versus a 2.85 average, according to FactSet data.

CORONAVIRUS NO LONGER BIGGEST WORRY FOR FUND MANAGERS

The Federal Reserve’s ultra-loose monetary policy and unprecedented amounts of fiscal stimulus have provided prime conditions for every stock-market dip to be bought.

The Fed, in order to combat the sharpest economic slowdown of the post-World War II era, cut interest rates to near zero and pledged to buy an unlimited amount of assets to support the economy. In addition, Congress has approved nearly $6 trillion of COVID-19 relief, which includes $3,400 in checks to most Americans.

Thirty-seven percent of Main Street investors plan to plow a “large chunk” of the recently approved $1,400 checks, for Americans making $75,000 per year or less, directly into the stock market, according to a recent survey conducted by German lender Deutsche Bank.

“Because there’s nowhere else to put your money, it’s created a level of frothiness in the market that whenever you see high valuations, you’ll often see bubbles bubbling up in different places,” said Joe Duran, head of Goldman Sachs Personal Financial Management.

OVERLOOKED CORNER OF STOCK MARKET OFFERS PROTECTION FROM BOND-MARKET VOLATILITY

Growth stocks like Peloton Interactive Corp., which saw its shares surge by 369% from the March 2020 low, were the biggest beneficiaries of the so-called stay-at-home trade that boosted shares of companies that benefited most as people sheltered at home during the pandemic.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| PTON | PELOTON INTERACTIVE, INC. | 108.31 | +5.57 | +5.42% |

But those high-flying stocks have come under pressure as of late as bond yields have surged while investors fret over the possibility that the seemingly endless wave of stimulus will bring back inflation that has been absent since before the 2008 financial crisis.

In addition to the stimulus that has already been approved, Democrats have begun to pave the way for an infrastructure bill that could cost up to $4 trillion. There’s also the potential for education and healthcare bills, both with price tags in the trillions.

Rising inflation concerns have caused the 10-year Treasury yield to soar by 80 basis points this year to 1.71%, where it is holding near its highest level since January 2020.

US OIL PRODUCERS COULD SURPRISE SAUDI ARABIA, RUSSIA

Economists say the possibility of trillions more in spending is likely to fuel an even sharper rise in bond yields.

The 10-year yield will reach 2% “by the end of the fiscal year” as the government readies additional stimulus measures to be implemented in the new fiscal year begging Oct. 1, said Sri Kumar, president of Santa Monica, California-based Sri-Kumar Global Strategies.

The recent inflation worries have stoked concerns that growth stocks have gotten too expensive as valuations have stretched well beyond their historic norms.

The S&P 500’s price-to-earnings ratio for the trailing 12 months sits at 26.44 compared to its 20-year average of 17.24. Its price-to-book ratio was 4.19 versus a 2.85 average.

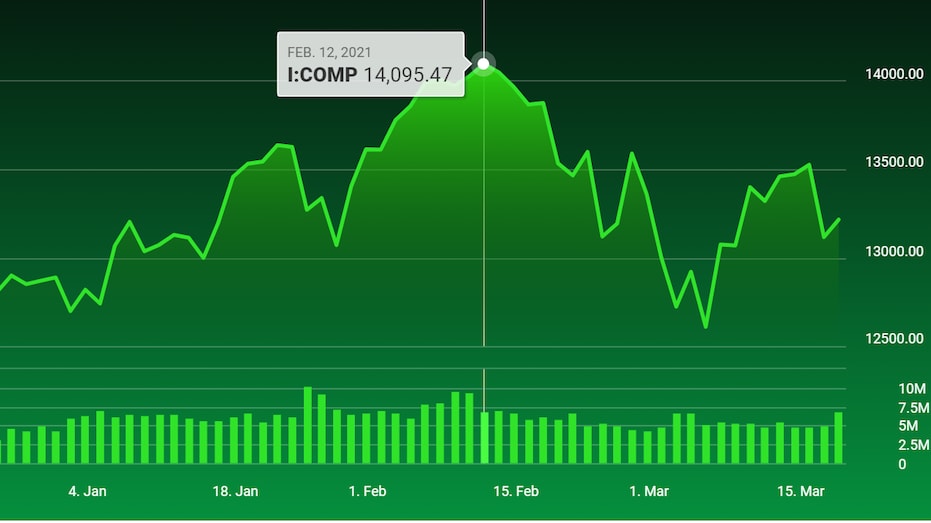

Already investors have begun to flee growth stocks and rotate into value and small-cap names that have lagged throughout the pandemic. The selling pushed the tech-heavy Nasdaq Composite down as much as 11% from its February peak before nearly halving its losses.

Kumar worries that as inflation fears continue to rise, the rising bond yields will cause the tech selloff to seep into the broader stock market. He believes the recent outperformance from value will, “but only in the sense that value falls less than growth.”

Goldman’s Duran warns that the current level of valuations suggests there is a 75% chance for a selloff of at least 10%, but he remains undeterred in his bullish outlook for stocks.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

“There is frothiness, there’s no denying that,” he said. “But we have a lot of good fundamentals driving it [the market] as well.”

Still, Duran says investors need to be mindful of their exposure to the market. He suggests investors consider the maturity of their bonds in the event that rates continue to rise. They should also not forget to rebalance their portfolios in favor of value over growth.

“There’s a lot of good reasons to be optimistic,” he said.