Equity futures will begin the new trading year in the hole on concerns about China’s and overall global growth.

Continue Reading Below

Dow Jones futures were falling by 400 points or 2 percent. The S&P 500 also fell 2 percent and the Nasdaq Composite dropped 2 percent.

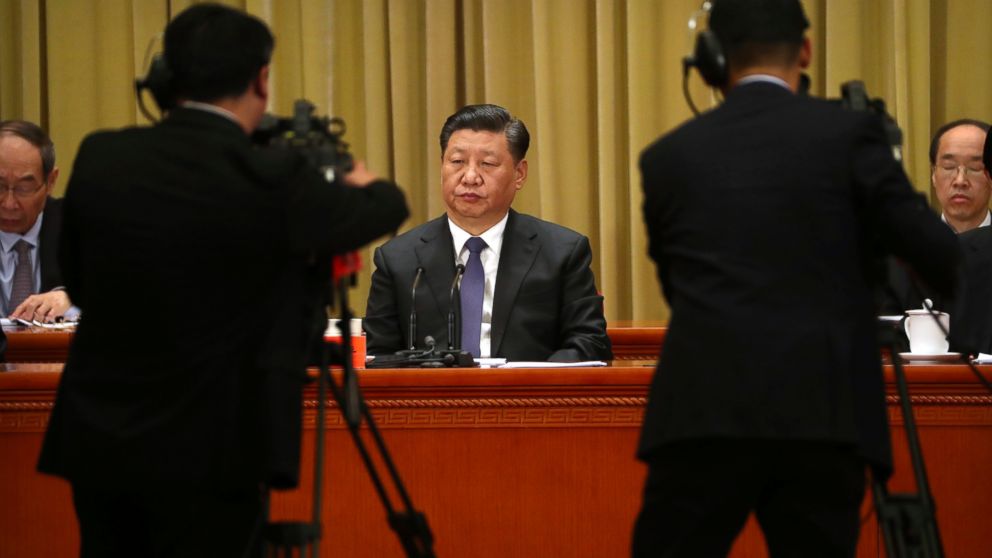

The concern is about data that continues to show a slowdown in China.

That country’s factory activity contracted for the first time in over two years in December, highlighting the challenges facing Beijing as it seeks to end a bruising trade war with Washington and reduce the risk of a sharper economic slowdown in 2019.

China’s Shanghai Composite started the new year with a decline of 1.1 percent.

Hong Kong’s hang Seng plunged 2.8 percent.

Advertisement

Japan’s Nikkei was closed for a holiday.

In European trading, London’s FTSE opened down 1.6 percent, Germany’s DAX declined 0.8 percent and France’s CAC was off 1.9 percent.

More Business News

U.S. Federal Reserve Chairman Jerome Powell will have the chance to comment on the economic outlook when he participates in a joint discussion with former Fed chairs Janet Yellen and Ben Bernanke on Friday.

Also looming are a closely-watched survey on U.S. manufacturing due on Thursday, followed by the December payrolls report on Friday.

U.S. stocks closed higher Monday, the final day of trading in 2018, but wrapped up a volatile year and month lower as a number of worries weighed on investor sentiment.

| Ticker | Security | Last | Change | %Chg |

|---|---|---|---|---|

| I:DJI | DOW JONES AVERAGES | 23327.46 | +265.06 | +1.15% |

| SP500 | S&P 500 | 2506.85 | +21.11 | +0.85% |

| I:COMP | NASDAQ COMPOSITE INDEX | 6635.2774 | +50.76 | +0.77% |

The 30-stock Dow Jones Industrial Average and the broader S&P 500 both ended the year about 7 percent lower, while the tech-heavy Nasdaq Composite closed out 2018 about 4 percent down – its biggest one-year decline since 2008.

For the month the three averages are all down about 10 percent for their worst December since 1931.

The declines reflected investor worries about the effect of a prolonged trade war between the U.S. and China, prospects for global economic weakness and the likelihood of higher interest rates.

Despite the worries, shares over the last five trading days rose about 4 percent.

FOX Business’ Mike Obel contributed to this article.