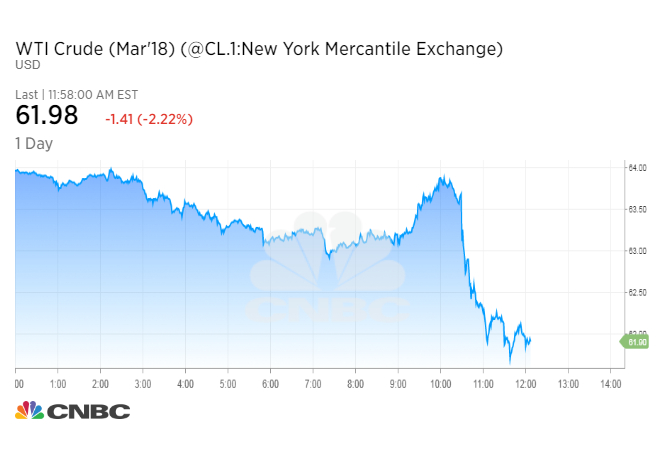

Oil prices gave up the morning’s gains on Wednesday, as official government figures showed U.S. crude stockpiles rose last week, contradicting an earlier industry report that suggested inventories had dropped.

U.S. West Texas Intermediate (WTI) crude futures fell $1.58, or 2.5 percent, to $61.81 a barrel by 12:27 p.m. ET. The contract hit a nearly one-month low and was trading down 5.5 percent this week, on pace for its worst weekly performance since May 2017.

Brent crude futures were down $1.30, or 1.9 percent, to $65.56 a barrel. The contract has not fallen below $66 a barrel since Dec. 26 and is down 4.4 percent for the week.

Crude futures were caught up in a broad market sell-off earlier in the week. But while U.S. share prices continued to rally after a late afternoon rebound on Tuesday, oil prices extended losses after the U.S. government’s weekly inventory report.

U.S. commercial crude inventories rose by 1.9 million barrels to 420.3 million in the week through Feb. 2, the U.S. Energy Information Administration reported.

That was lower than the roughly 3-million-barrel increase analysts anticipated in a pair of surveys. But data on Tuesday from the American Petroleum Institute had shown a decline of 1.1 million barrels, setting market expectations for a drop after the previous week’s big rise.

Stockpiles of gasoline and distillate fuels like diesel also rose by 3.4 million barrels and 3.9 million barrels respectively, the EIA reported, surpassing expectations by a wide margin.

The EIA’s preliminary figures on Wednesday also showed weekly U.S. production hit 10.25 million barrels a day. The rise above the 10-million-barrel mark was telegraphed by last week’s report that November output rose above that level for the first time since 1970.

On Tuesday, EIA forecast U.S. production will average 10.6 million barrels a day this year, enough to continue surpassing output from Saudi Arabia, until recently the world’s second biggest producer. In 2019, EIA sees American output at 11.2 million barrels, enough to rival top producer Russia.

Surging U.S. production threatens to offset the impact of OPEC’s deal with Russia to keep 1.8 million barrels a day off the market through 2018. The goal of the production caps is to shrink crude inventories in developing nations.

The U.S. dollar index rose back above 90 cents, piling further pressure on commodities, said John Kilduff, partner at energy hedge fund Again Capital.

The correlation between the dollar and oil has recently reasserted itself. A stronger greenback makes commodities sold in dollars more expensive to buyers who hold other currencies.

Also on Wednesday, the operator of Britain’s most important oil and gas pipeline announced automated safety systems had shut the 450,000 barrel-per-day system due to an undisclosed issue.

The company, Ineos, said it aims to restart the pipeline overnight, but the incident marks the second time in two months the system, which transports North Seas Forties crude, has shut.