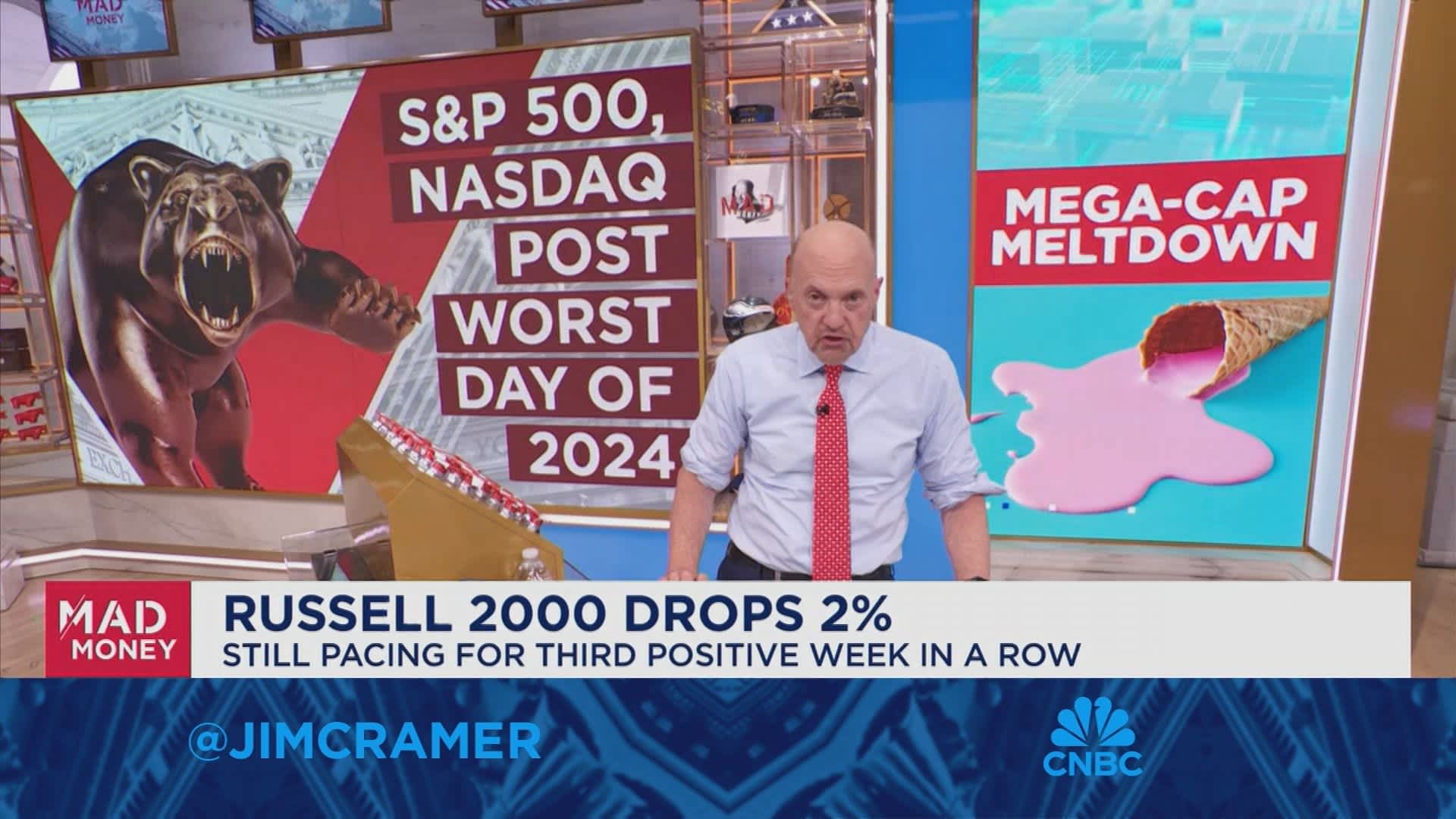

CNBC’s Jim Cramer looked at what might have spurred Wednesday’s Big Tech sell-offs, reviewing why investors may have been disappointed with earnings from Alphabet and Tesla.

“Wall Street, it looks like it’s had it with the mega caps, doesn’t it? We don’t want to hear about the ‘Magnificent Seven’ anymore,” he said. “Everyone thinks these stocks have gone to unsustainable levels, so that they want to lock in gains and pivot to groups that have room to play catch-up, like the small caps.”

The S&P 500 and the tech-heavy Nasdaq Composite posted their worst days since 2022, with the former tumbling 2.31% and the latter shedding 3.64%. Alphabet was down a little over 5% by close, while Tesla plummeted more than 12%.

Even though Alphabet reported an earnings beat, its YouTube advertising revenue missed expectations. Cramer was impressed with the strength in the company’s search business, as well as its Google Cloud revenue, which topped estimates at $10.35 billion. He suggested YouTube’s performance faced a “tough comparison” to last year when outfits like Temu and Shein were flooding streaming platforms with ads.

Tesla’s earnings missed Wall Street’s expectations and like last quarter, automotive sales declined. But Cramer said CEO Elon Musk “told a great story of self-driving technology, sorely needed energy production, not to mention humanoid robots.” Cramer suggested both Alphabet and Tesla might not have declined if the market wasn’t in the midst of a broader rotation out of tech.

Cramer also examined stocks that have been seeing gains on the S&P 600 — the S&P’s small cap index — as investors sell the mega caps. He named Fabrinet, ATI, Ensign Group, SPS Commerce and Mueller, among others.

“After today, many of the Mag Seven have gotten hammered so badly that they’re actually cheaper than almost all the small-cap stocks I just gave you on a price-to-earnings basis,” Cramer said. “Then again, until we work through this brutal rotation, that newfound cheapness probably won’t be enough to save the big caps — only lower prices will accomplish that.”

Sign up now for the CNBC Investing Club to follow Jim Cramer’s every move in the market.

Disclaimer The CNBC Investing Club Charitable Trust holds shares of Alphabet.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer’s world? Hit him up!

Mad Money Twitter – Jim Cramer Twitter – Facebook – Instagram

Questions, comments, suggestions for the “Mad Money” website? madcap@cnbc.com