Tax legislation will dominate markets in the week ahead, as Congress works to push through a bill that will include a dramatic cut in corporate taxes and reduce individual taxes for many taxpayers.

Investors will also be on the lookout for more headlines about the Russia probe, now that Michael Flynn, former national security advisor, pleaded guilty to lying to the FBI and agreed to cooperate with investigators.

Both taxes and Flynn made for volatile markets in the past week, with stocks sharply higher on Thursday on the promise of a Senate tax bill and extremely choppy on the downside Friday, when headlines suggested Flynn could point to others in the White House.

On the data front, Friday’s employment report will get the most attention, and it will be watched more for what it says about wages than hiring. If there is a pickup in wages, that could be an early sign for higher inflation.

The stock market is expected to continue moving ahead if the bill looks like it will be made law, after a Senate vote, which was expected Friday night.

“We have been expecting a consistent, upward trend in the market with the expectation if tax reform gets done, we will get a one-time pop over the next two to three months,” said Krishna Memani, chief investment officer at Oppenheimer.

Meanwhile, Congress could add some negative volatility to the market if it doesn’t deal with Friday’s deadline on a possible government shutdown. Daniel Clifton, head of policy research at Strategas, said he expects Congress to pass a short term extension for spending authorization to Dec. 22, averting a shutdown, but it may take it down to the wire.

But President Donald Trump, already in the past week, got into a clash with Democratic leadership after he tweeted that it would not be possible to make a deal with them. Both House minority leader Nancy Pelosi and Senate minority leader Chuck Schumer dropped out of a meeting at the White House after his comments. Trump also reportedly told confidants that a government shutdown could be good for him politically.

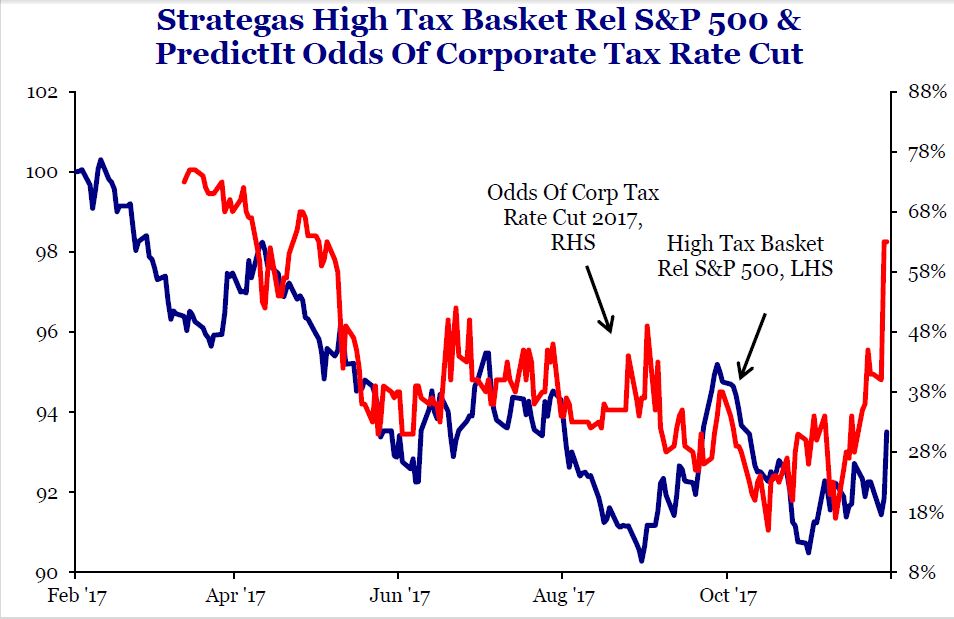

Clifton said stocks this past week finally started to price in some aspects of tax reform. Industrials and other companies that pay high taxes outperformed others, like tech, on the promise of tax breaks. He expects Congress to move quickly on coming up with tax legislation both the House and Senate can approve.

“We don’t know how this is going to play out…the Senate wants the House to accept their bill immediately. The House wants to go to a conference. This thing could happen much faster than people anticipate — even if there is a conference,” said Clifton. “My sense is they want to get it done by the end of the week.”

Some analysts said stocks have run up so much that they may actually sell off on the news of the tax plan.

S&P 500 companies on average pay a tax rate of about 27 percent, and the new tax rate of 20 percent should boost earnings. “That income could return to stockholders, in share buybacks, but it could also be capital spending and higher pay for employees. … It gives them flexibility in terms of pricing. They can compete on a price basis because they’re being taxed less. Those are positives,” said Michael Materasso, senior vice president and co-chair of Franklin Templeton’s fixed income policy committee.

“At a high level, you can say this is great,” he said, but Materasso also said the tax plan brings some uncertainty. For instance, in high-tax states, which are a big chunk of the U.S. economy, the elimination of state and local tax deductions and reduction in the property tax deduction could change consumer behavior if they view their taxes as rising. There have been concerns that home prices will also drop in those states, mostly New York, California, Connecticut and New Jersey. Businesses could also find those states less attractive and leave, he said.

“These are the things that occur over time, not in a quarter or two,” he said.

But for now, the market could ride higher on the tax bill, but John Velis, macro strategist at State Street, says November’s strong performance may have taken away some of the potential December gains.

“I think the Santa Claus rally might actually have been a turkey rally. A lot of the work was done in November. I don’t think it’s going to be a traditional Christmas rally. I think we brought it forward by a month,” he said.

The S&P 500 was up 2.8 percent for the month of November, and is now up 18 percent for the year. The S&P 500 was up 1.5 percent in the past week, finishing Friday at 2,642.

What to Watch

Monday

Earnings: Ascena Retail, Coupa Software

10:00 a.m. Factory orders

Tuesday

Earnings: AutoZone, Toll Brothers, Barnes and Noble, Lands’End, Dave and Buster’s IDT, HD Supply Holdings

8:30 a.m. International trade

9:45 a.m. Services PMI

10:00 a.m. ISM nonmanufacturing

10:00 a.m. QFR

Wednesday

Earnings: Brown-Forman, H&R Block, American Eagle Outfitters, Broadcom, Lululemon Athletica

8:15 a.m. ADP Payrolls

8:30 a.m. Productivity and costs

Thursday

Earnings: Dollar General, Dell Technologies, Ciena, American Outdoor Brands, Vail Resorts

8:30 a.m. New York Fed President William Dudley

8:30 a.m. Jobless claims

10:00 a.m. QSS

3:00 p.m. Consumer credit

Friday

8:30 a.m. Employment

10:00 a.m. Consumer sentiment

10:00 a.m. Wholesale trade