Saudi Aramco CEO Amin Nasser, who runs the world’s largest oil company, is taking the rise of electric vehicles in stride.

Growing adoption of electric vehicles stands to put a big dent in oil demand in the coming years. Barclays recently forecast that cleaner-burning cars could wipe out crude consumption nearly equal to annual output from Iran, OPEC’s third-biggest oil producer, by 2025.

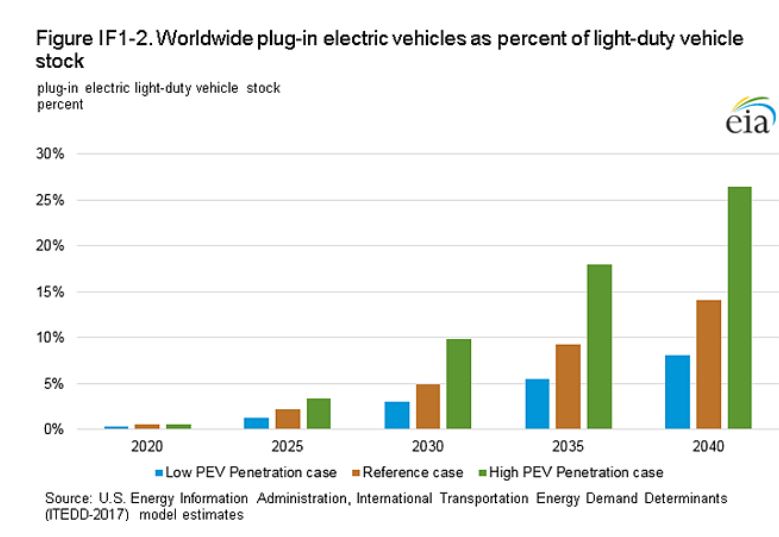

But while electric vehicle manufacturers are making “good progress,” battery and hybrid cars still account for just a fraction of the overall market, Nasser told CNBC in an exclusive interview. They won’t account for a significant part of the global fleet for years to come, he said.

The number of electric vehicles grew to just more than 2 million in 2016, up nearly 60 percent from the previous year, according to the International Energy Agency. They now make up about 0.2 percent of all cars on the road — a “very small percentage,” in Nasser’s view.

Nasser also points out that hybrid-electric vehicles with gas engines make up a big chunk of the total. There were about 805,000 plug-in hybrid electric cars in the world in 2016, according to IEA. That’s 40 percent of all electric vehicles.

By 2030, IEA projects the electric fleet could grow to 160 million, he noted. By that time, there will be 2 billion vehicles overall, Nasser estimates.

“So the number of conventional vehicles still in the market, even though they are more efficient for sure, is still a lot compared to what we have today,” he told “Squawk Box” anchor Andrew Ross Sorkin in an interview conducted on Sunday from the command center at Saudi Aramco headquarters in Dhahran.

“So electric vehicles will continue to grow. They will take good market share, but it will be decades before they shoulder a significant percentage of the energy mix,” he said.

In a more conservative scenario, electric vehicles total 56 million by 2030, IEA reports. In another scenario in which the world tackles climate change aggressively, the electric vehicle market exceeds 200 million by that year.

The energy industry, in general, is making sure it has the right reserve levels and oil production capacity to prepare for the future and to supply the world with adequate energy, Nasser said. Crude oil will continue to play a major role in heavy shipping, aviation and petrochemicals, he added.

Saudi Aramco is also identifying new uses for crude oil, particularly in the petrochemicals sector, which uses byproducts from fossil fuels to create plastics and specialty chemicals.

“The chemical business grows at about 3 percent, much more than the growth of the transport sector. What can we do to grow that even further by identifying a new usage?” he said.

More from Global Investing Hot Spots:

The ‘sweet spots’ fueling the US shale oil boom ‘will not last forever,’ Saudi Aramco CEO says

Saudi Aramco’s IPO, the world’s largest ever, is ‘on track’ for 2018, CEO Amin Nasser says