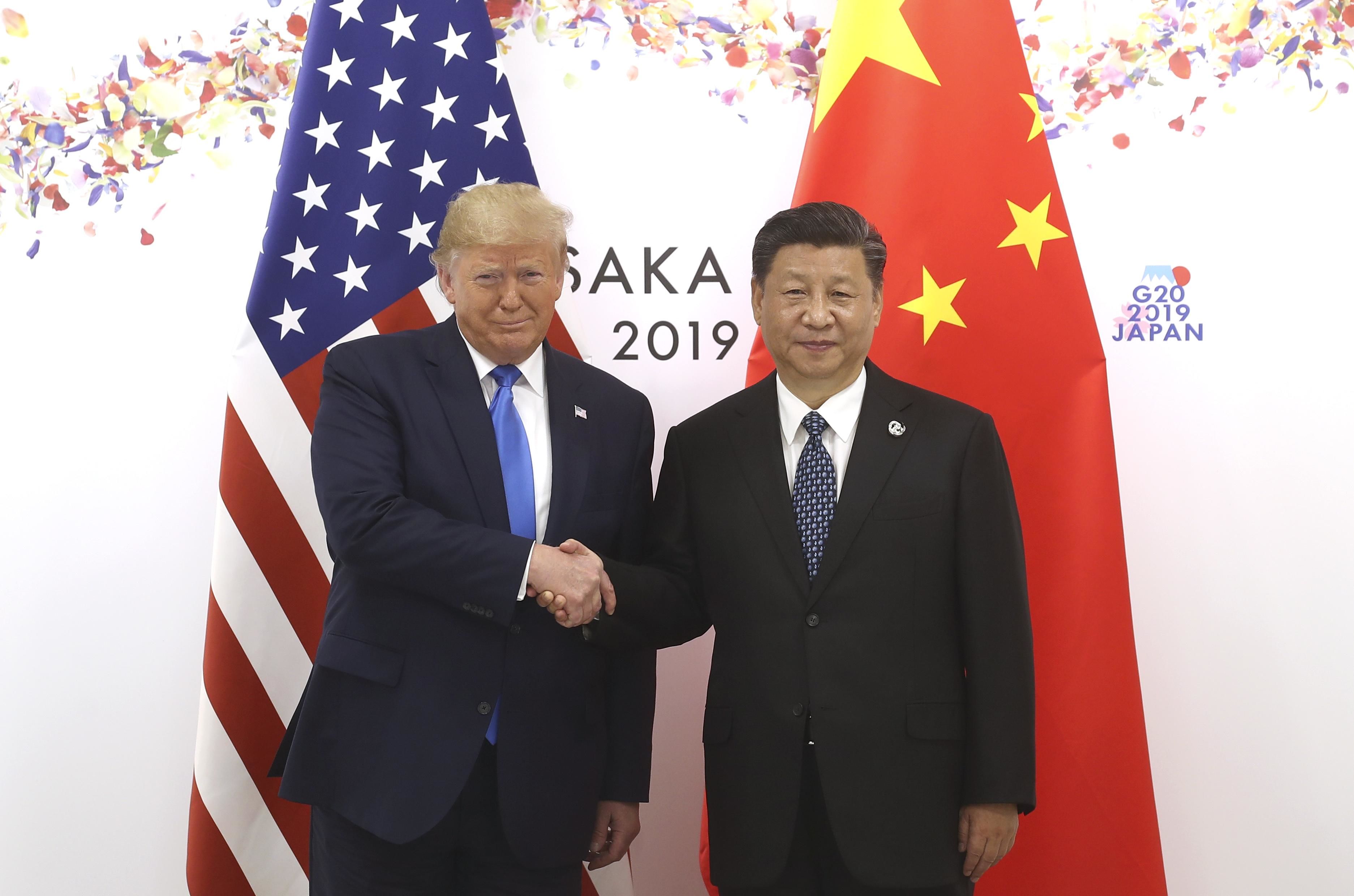

The S&P 500 launched to a record high as Wall Street applauded a trade truce between President Trump and Chinese President Xi Jinping over the weekend.

This agreement comes as the S&P 500 closed out its best first half in two decades. Here’s what five experts think lies ahead for the second half of the trading year:

Gene Goldman, chief investment officer at Catera Investment Management, said three things are causing the market to give mixed signals:

“Number one, you look at economic data starting to cool, but at the same time though we’re still very expansionary. Number two, valuations are a little bit elevated, but earnings growth could weaken especially with an earnings recession this quarter and potentially next quarter. And three, you’re seeing the bond market… we have an inverted yield curve, suggesting a weaker growth down the road. All of this is going to create a lot of market volatility.”

Steven Wieting, chief investment strategist at Citi Private Bank, said the trade truce is good news for the market and believes corporate earnings will rise.

“I’ll take good news. In the event that the economy finds some strengthening here and our trade issues are put behind us, and the Federal Reserve then does not cut, then I would certainly take that. And I think that we will see corporate earnings in the United States in the quarter just passed and the rest of the year rise some. We could derail that if we had a serious worsening of trade issues around the world. If we don’t then I would take that as a positive.”

Jason Hunter, head of global fixed income at J.P. Morgan, said the economy needs to repeat what it did in the late fourth quarter and first quarter to solidify the rally.

“It was defensives that led the move to utilities, consumer staples and it was largely because the very front end of the treasury market repriced 60 basis points in a short period of time. That helped boost the S&P, but more important the rate sensitive groups weren’t really around like the utilities. So, our point was that if the rally is going to continue, if the S&P is really going to break out of the range it requires a rotation to cyclical type groups and you haven’t seen that up until probably early Monday – Tuesday of last week. Semis started to go because there was some individual company news, even things like copper started to rally a little bit. We need to see more of that to get the S&P to continue to rally up. This is clearly a trade story – those are the groups that are the most sensitive to the trade story. So, basically, we need to repeat what we saw in the late fourth quarter and first quarter of this year where it was semis starting to lead the market – copper really starting to move. All those things point to improving PMI [Purchasing Manager’s Index], we basically have to redo that same story all over again here to put a solid foundation underneath the rally. “

Barry Knapp, managing partner at Ironsides Macroeconomics, expects a good second half to the year.

“The risks still remain on the upside. I think we’ll have a pretty decent second half. There was a couple of things that happened in the last few weeks that really forced the issue on getting to a trade détente. One was the Chinese data two weeks ago was weaker than expected, but the composition was really disturbing for China. In as much as any strength you had in industrial production or fixed asset investment was only in heavy industries state owned enterprises. Now they’ve cut individual tax rates – they’re trying to spur credit to go to SME’s [small medium enterprises], they’re having no success with that whatsoever. The PMI that came out over the weekend showed orders for small – medium businesses are really close to 45 – just showing no signs of bouncing. So China needs a deal to provide a cover to reform the economy. I think that data actually strengthened the hands of the reformers. We’ll get some sort of a deal with China undoubtedly.”

Jason Draho, head of asset allocation for UBS Wealth Management, said moving forward it is all about the data and what it signals to the Fed that will drive the markets.

“What the markets are going to begin to immediately focus on going forward is the economic data. You saw the ISM this morning was fine. Some parts were a little better than expected, other parts were worse. The focus will be on job growth going forward and ultimately what does this mean for the Fed and how much they might cut. So, in the near term those are the biggest catalysts for the market … If both are okay then the outlook for equities and for the markets overall is still reasonably positive because its tail wrist is coming down – it’s contained. For the next term, it’s really the growth and Fed outlook that’s going to drive the markets.”