The United States will install less solar power than previously expected in coming years as big projects face challenges in the wake of President Donald Trump’s decision to slap tariffs on solar equipment, according to a new report.

The taxes on solar cell and module imports announced earlier this year are dampening demand and compounding other headwinds in the industry, from slower expansion in critical state markets to a financial reckoning for installers who prized growth over balance sheet discipline.

That is the assessment of the Solar Energy Industries Association and clean tech analysis firm GTM Research said in their annual review of the industry.

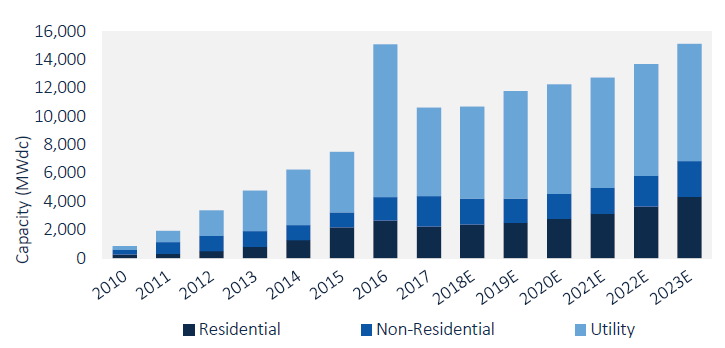

On the bright side, 2017 marked the second straight year of double-digit gigawatt growth in the solar industry. The industry added 10.6 gigawatts of photovoltaic capacity, the most common type of solar power technology.

U.S. Annual PV Installations, 2010-2017, source: GTM Research

“The solar industry delivered impressively last year despite a trade case and market adjustments,” SEIA President and CEO Abigail Ross Hopper said in a press release. “Especially encouraging is the increasing geographic diversity in states deploying solar, from the Southeast to the Midwest, that led to a double digit increase in total capacity.”

But 2017 saw a 30-percent decrease from the record-setting addition of 15 gigawatts in 2016, when buyers rushed to purchase equipment ahead of the expiration of tax credits that were ultimately extended.

The outlook is more sobering over the next five years.

GTM lowered its forecast for solar installations during the 2018-2022 period by 13 percent, chalking up the revision to changes in federal and state policies, a potpourri of market headwinds across the major solar power segments, the fallout from Trump’s tariffs and corporate tax reform impacts.

This year, GTM expects growth to be flat at 10.6 gigawatts. The Trump effect won’t play a big role in 2018 because many buyers purchased solar modules before the tariffs took effect.

This is especially true in the utility-scale segment, which builds large solar farms that feed into electric power markets and essentially work like power plants. GTM Research expects this segment to grow slightly more than it did last year.

But growth in utility-scale solar will be stagnant between 2020 and 2022 because the tariffs will delay and possibly kill some projects.

Project will probably go forward in regulated markets like North Carolina and Florida, where state power authorities guarantee a return on investment. But the tariffs could have a big impact in smaller state markets that are just starting to adopt utility-scale solar.

U.S. PV Installation Forecast, source: GTM Research

Solar installations for residential homes are also seen rebounding in 2018, but the tariffs could cap gains, GTM says.

Growth in residential solar is slowing down because installers are struggling to add new customers in major markets like California and the Northeast. That slowdown is being exacerbated as large national retailers aim to cut costs and overhaul expensive sales strategies that have long weighed on profits.

Growth rates in residential solar could bounce back in the early 2020s if those companies can fix their finances, scale up new sales channels and push into new markets.

The outlook is similar in the solar market for businesses and other non-residential buyers, where GTM forecasts two consecutive years of lower installations. That’s largely because the pipeline of approved non-residential projects will shrink this year and incentives will become less generous in major state markets in 2019.

But GTM said it expects the market to turn in 2020 as states like New York, Maryland and Illinois ramp up solar installations to meet ambitious renewable energy goals. The growing viability of storage solutions like large-scale batteries will also support solar power, the firm says.

Despite headwinds in mature markets, the solar industry did see an encouraging trend: growth of installations in parts of the Southeast and Midwest where there’s less renewable power penetration.

States outside of the top 10 markets now accounted for 21 percent of U.S. solar power capacity last year, up from 16 percent in 2016. The industry saw growth accelerate in 25 of the 44 states the Solar Energy Industries Association tracks.

Last year also saw an “explosion” in community solar, which allows homeowners to benefit from neighborhood projects rather than installing rooftop arrays.

Minnesota added more community solar capacity in 2017 than the entire United States installed in the previous year, according to the report. New York and Maryland are expected to expand community solar projects this year.