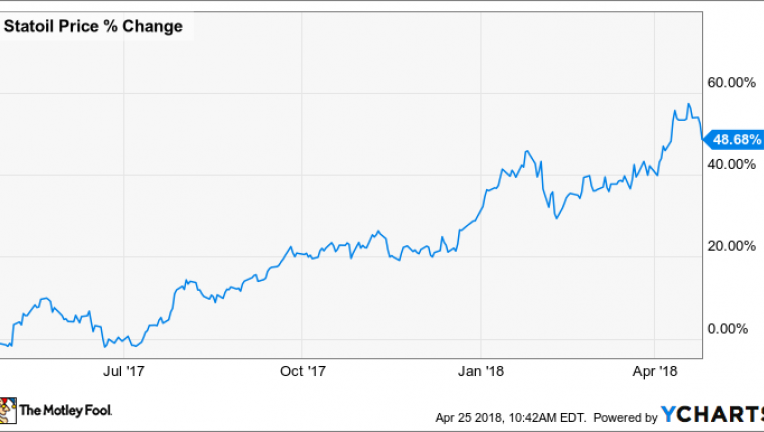

Anyone that has watched oil prices tick up recently has probably expected oil producers to report some impressive earnings results this past quarter, and Statoil (NYSE: STO) did just that with a 21% boost to the bottom line. At the same time, management is using all of its additional cash to do some wheeling and dealing that should help boost its growth possibilities in the nearer term.

Continue Reading Below

Here’s a rundown of Statoil’s most recent earnings results and some of the moves management made this past quarter to set up the company for future success.

By the numbers

| Metric | Q1 2018 | Q4 2017 | Q1 2017 |

|---|---|---|---|

| Revenue | $19.9 billion | $17.1 billion | $15.53 billion |

| Net income | $1.29 billion | $2.57 billion | $1.06 billion |

| EPS | $0.39 | $0.77 | $0.33 |

| Operating cash flow | $7.07 billion | $1.6 billion | $5.71 billion |

It’s astounding what $60 a barrel can do for an oil company’s results these days. It wasn’t that long ago that prices this low would have led to substantial losses. This past quarter, though, Statoil realized an average price of $60 a barrel on every barrel sold, and it generated a mountain of cash. That $7 billion in cash flow for the quarter was enough to cover its capital spending, its dividend payment, a previously announced $1.45 billion acquisition, and still leave an additional $1.5 billion on the balance sheet to reduce its net debt load from 29% to 25%.

As you might expect in a rising oil price environment, Statoil saw a considerable uptick in operating earnings for both its Norway and international exploration segments while its downstream refining and marketing segments saw modestly declining results.

Advertisement

The highlights

- Production for the quarter came in at 2.18 million barrels of oil equivalent per day. That’s a slight uptick both on a sequential and year-over-year basis. Adjusting for maintenance and other work that shut in production, management estimates that underlying production was up 2%; primarily from higher production in the U.S. This quarter’s 799,000 barrels per day from its international segment was a company record.

- Management reiterated its guidance for $11 billion in organic capital spending for 2018, with another $1.5 billion dedicated to exploration expenses. This doesn’t include acquisitions such as the most recent acquisition of Total‘s (NYSE: TOT) interest in the Martin Linge field and the Garantiana discovery in the Norwegian part of the North Sea.

- Continuing the trend of being very active in the acquisition and auction markets, the company won a 40% working interest in the North Platte oil discovery on the U.S. side of the Gulf of Mexico as part of the Cobalt International Energy bankruptcy auction. Statoil will partner with Total, which increased its interest in the field to 60% and took the operatorship of the project.

- Statoil also was part of various consortiums — including partners Petrobras, ExxonMobil, and BP — that won four offshore blocks in the most recent Brazil offshore auction.

- As part of its effort to diversify its business, the company also signed an agreement to acquire a 50% stake in two offshore wind projects off the coast of Poland that combined will generate 1,200 MW of electricity.

- The board of directors has proposed Statoil change its name to Equinor as part of its strategy to become more than just an oil and gas company. Shareholders will vote on the proposed name change in May.

What management had to say

To cover all of the things going on at Statoil in one public statement would take a couple of pages, so CEO Eldar Saetre did his best to give a brief overview of the things Statoil is working on now and some of the projects it expects to bring on stream in the near future.

Takeaway

Statoil’s — soon to be Equinor’s? — first quarter result is a sign that the oil market is picking back up. With prices in the $70-$75 per barrel range, many projects are much more economical than they were just a few months ago. At the same time, though, Statoil and others appear to be erring on the side of caution by keeping capital budgets flat and maintaining low-cost operations to trim debt loads and generate value for shareholders.

It’s a little too presumptuous to assume that oil prices will remain this high for the remainder of the year, so investors should remain focused on the fundamentals of the business. Based on this earnings report, Statoil is delivering.

10 stocks we like better than StatoilWhen investing geniuses David and Tom Gardner have a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has quadrupled the market.*

David and Tom just revealed what they believe are the 10 best stocks for investors to buy right now… and Statoil wasn’t one of them! That’s right — they think these 10 stocks are even better buys.

Click here to learn about these picks!

*Stock Advisor returns as of April 2, 2018

Tyler Crowe owns shares of ExxonMobil and Total. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.