One of the main ways hedge funds make money is betting against companies they believe are overvalued, so investors should be wary of stocks with high levels of short interest.

S3 Partners’ Ihor Dusaniwsky shared which stocks professional managers and investors are short selling the most in an email to CNBC on Friday.

Shorting is a trading strategy that involves selling borrowed shares with a view that the stock will drop in value and the shares can be bought back later and returned for a profit.

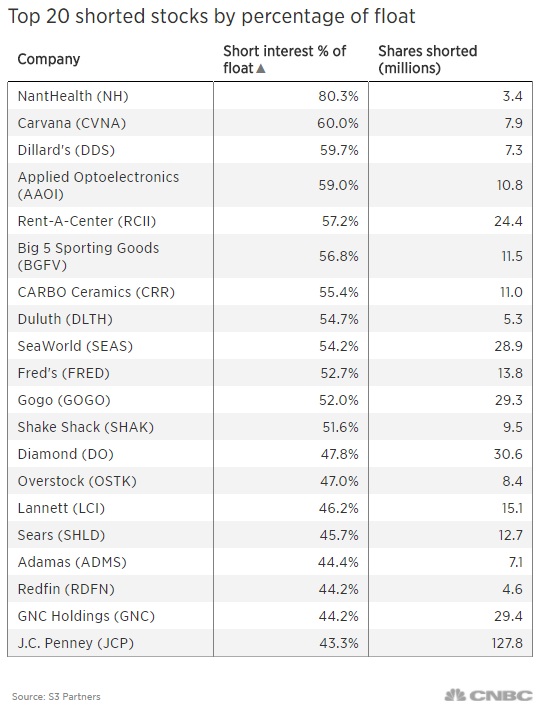

Here are the top 20 stocks in the Russell 3000 with the highest short interest as a percentage of the company’s float, according to S3:

On an absolute dollar basis, S3 said Tesla, Apple, AT&T, Amazon and Intel had the highest level of notional short interest in the market.

In terms of sectors, software and services, retailing, pharmaceuticals/biotech and energy were the industries hedge funds were betting against the most.