A farmer collecting grain from a combine harvester during the wheat harvest on a farm near Benfleet, UK, on Monday, Aug. 12, 2024.

Bloomberg | Bloomberg | Getty Images

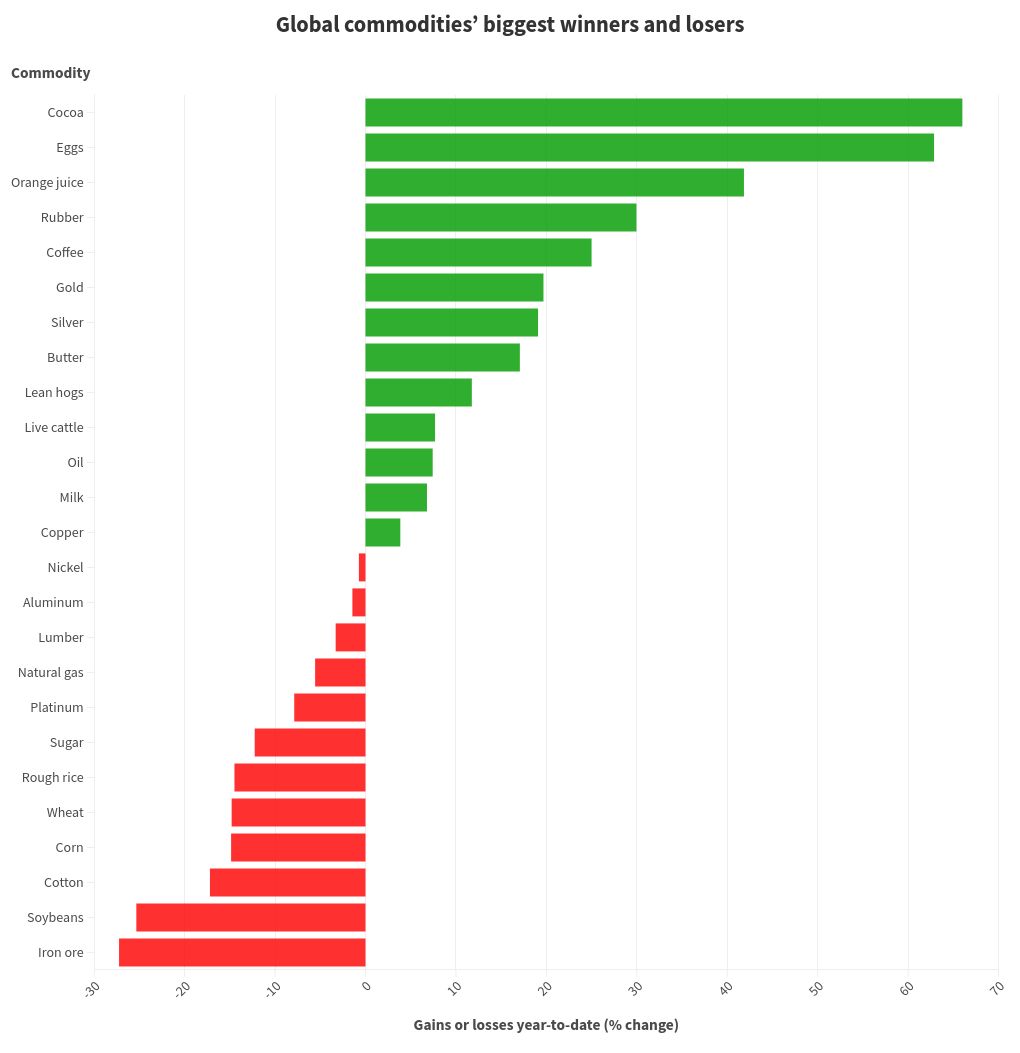

The global commodities market has been volatile this year, with prices remaining largely elevated.

Orange juice and cocoa futures surged to record highs in the first half of the year, while crude oil prices fluctuated with headlines from the Middle East. Gold prices continue to rise, but that of base metals like iron ore slipped considerably.

“Thus far, commodity markets have been sentiment-driven and fickle — in continuous search of the smallest inkling of hope to rise to new highs, only to collapse back down with the slightest hint of possible disappointment,” said Sabrin Chowdhury, director and head of commodities analysis at BMI.

The S&P GSCI, a benchmark for the overall commodity market’s performance, rose as much as 12% in April from the start of the year, before tapering off to a 2.18% climb year-to-date.

According to data pulled from FactSet, the commodities making the most gains year-to-date are a select basket of soft commodities that includes cocoa, eggs, orange juice, rubber and coffee.

Analysts told CNBC these commodities saw strong gains as a result of adverse weather in their main production regions.

Biggest winners

Cocoa

Cocoa leads the charge as prices jumped 66% so far this year, with futures soaring to an all-time high of $11,722 per metric ton in April amid a bean shortage due to supply disruptions from heavy rains and disease in key producers Ivory Coast and Ghana.

Attracted by the profit-making opportunities, hedge funds piled into the market which made price movements even more volatile, said Darren Stetzel, senior vice president of soft commodities for Asia at brokerage StoneX.

While prices have tapered from the record highs, cocoa futures still remain above typical levels, with the September contract last trading at $9,150 per metric ton on the U.S. Intercontinental Exchange.

Stetzel said the cocoa market would stabilize as weather conditions in West Africa improve heading into 2025, though he noted prices would be slow to return to the levels before this year’s spike.

Eggs

A recent resurgence of avian influenza in poultry facilities across the U.S., Japan and other nations has caused prices of eggs to jump over 62% per dozen since the start of the year, according to FactSet data. The spot price of a dozen large white eggs currently stand at $3.57, according to FactSet citing the U.S. Department of Agriculture and Commodity Research Bureau.

About 18.5 million egg-laying hens in the U.S. have been affected by the bird flu so far this year. On the demand front, consumers have also been leaning more heavily on eggs as a more affordable source of protein, said Karyn Rispoli, managing editor at market intelligence platform Expana.

Higher wholesale egg prices are expected as the fall and holiday seasons approach, especially if HPAI infections continue, said Wells Fargo’s Agri-Food Institute sector manager Tim Luginsland.

Orange juice

Orange juice futures surged to a record in May and is currently hovering around historically high levels of $4.49 per pound on ICE. Production declines in Florida — the main producer of orange juice in the U.S. — on top of climate-fueled adverse weather in key orange producing areas of Brazil have pushed the industry into crisis mode.

Orange juice is offered for sale at a grocery store on February 13, 2024 in Chicago, Illinois.

Scott Olson | Getty Images News | Getty Images

And that’s unlikely to change anytime soon. Global orange juice production is set to decline for the fifth season due to continued production declines in Brazil, which accounts for 70% of global production.

“Given the projected orange crop yields for the upcoming season, expectations are that orange juice prices will remain elevated for at least the next 12 months,” said David Branch, Wells Fargo’s Agri-Food Institute sector manager.

Rubber

Prices of rubber have surged nearly 30% since the start of the year as production declines in the world’s largest natural rubber producers, Thailand and Indonesia, due to weather-related issues such as limited rainfall.

The September contract for the benchmark Ribbed Smoke Sheet graded (RSS3) rubber futures are currently trading at 337 yen ($2.29) per kg on the Osaka Stock Exchange.

Coffee

Coffee futures traded on ICE have jumped 25% year-to-date to $2.45 per pound due to adverse weather conditions in coffee growing regions in southeast Brazil, said BMI’s Chowdhury.

El Niño-induced production challenges in Southeast Asia have caused crop declines in key producing regions Vietnam and Indonesia. El Niño is a weather phenomenon which brings about warmer temperatures and more extreme weather conditions, typically lasting between nine to 12 months.

Biggest losers

Iron ore

Iron ore prices declined the most among commodities as China’s property sector remains in the doldrums, leading to weak demand. Worsening steel mill margins in the country, which are an important driver of iron ore prices, also played a part in keeping prices low, said Commonwealth Bank of Australia’s director of mining and energy commodities research, Vivek Dhar. Iron ore is a key component of steel.

The benchmark 62%-grade iron ore last traded at $98.10 per ton on the New York Mercantile Exchange for the contract expiring Aug. 30.

A worker welds steel at a workshop on June 8, 2024 in Hangzhou, Zhejiang Province of China.

Vcg | Visual China Group | Getty Images

“The key drag on China’s steel consumption remains the property sector (~30% of China’s steel consumption)” Dhar said in a recent note.

“With steel mill margins now at levels that strongly discourage production, markets are justifiably worried that iron ore prices may be sustained below $US100/t in the near term,” he added.

Grains

Widely consumed grains such as wheat, corn, and soybeans also saw significant slumps on what appears to be a bumper crop year across the Northern Hemisphere.

“The global grain industry currently has a large surplus in inventory due to consecutive large crops being produced in all the leading grain production regions,” said Wells Fargo’s Luginsland. As a result, more corn and soybeans have flooded the export market, pushing prices lower.

Wheat and corn trading on the Chicago Board of Trade shed almost 15% so far this year, while soybeans dropped close to 25%.

Notable mentions

Gold

Gold prices have rallied to record highs this year, propelled by U.S. interest rate cut expectations, as well as the bullion’s appeal as a safe-haven asset. Gold futures recently hit another all-time high of $2,549.9 per ounce.

Despite volatility in the year so far, the global commodities market remains elevated and is expected to remain so, BMI’s Chowdhury forecasts.

A selection of gold bars and one-ounce gold coins at Gold Investments Ltd. bullion dealers in London, UK, on Tuesday, May 21, 2024.

Chris Ratcliffe | Bloomberg | Getty Images

“We expect prices to be supported by the weakening of the U.S. dollar, especially as the U.S. Fed starts to cut rates later in the year,” she said. Continued weak demand from China will cap price growth across most commodities, with industrial metals expected to lose out further, the analyst added.

Additionally, the global weather pattern is expected to flip from El Niño to La Niña by the end of this year, which could be a crucial event for the global agricultural market, said StoneX’s Stetzel. La Niña usually brings a cooling effect on global temperatures and occurs every three to five years.

“This will mean weather conditions we have seen in the past year will be the complete opposite to what we expect to see heading into 2025,” he said.