CNBC’s Jim Cramer has been hearing about a potential “thaw” in U.S.-China relations. If it continues, markets could reap the benefits amid the earnings flood next week, he said on Friday.

The news, “coupled with an employment report that showed strong growth and little inflation, … brought in buyers from the sidelines,” the “Mad Money” host observed.

“It’s quite the impressive rally and it could continue if the U.S. government goes a tad softer, recognizing that the Chinese are willing to do some deals here,” he continued.

Apple’s stock led the technology sector higher on news that Warren Buffet’s Berkshire Hathaway purchased 75 million additional shares of the iPhone maker in the first quarter.

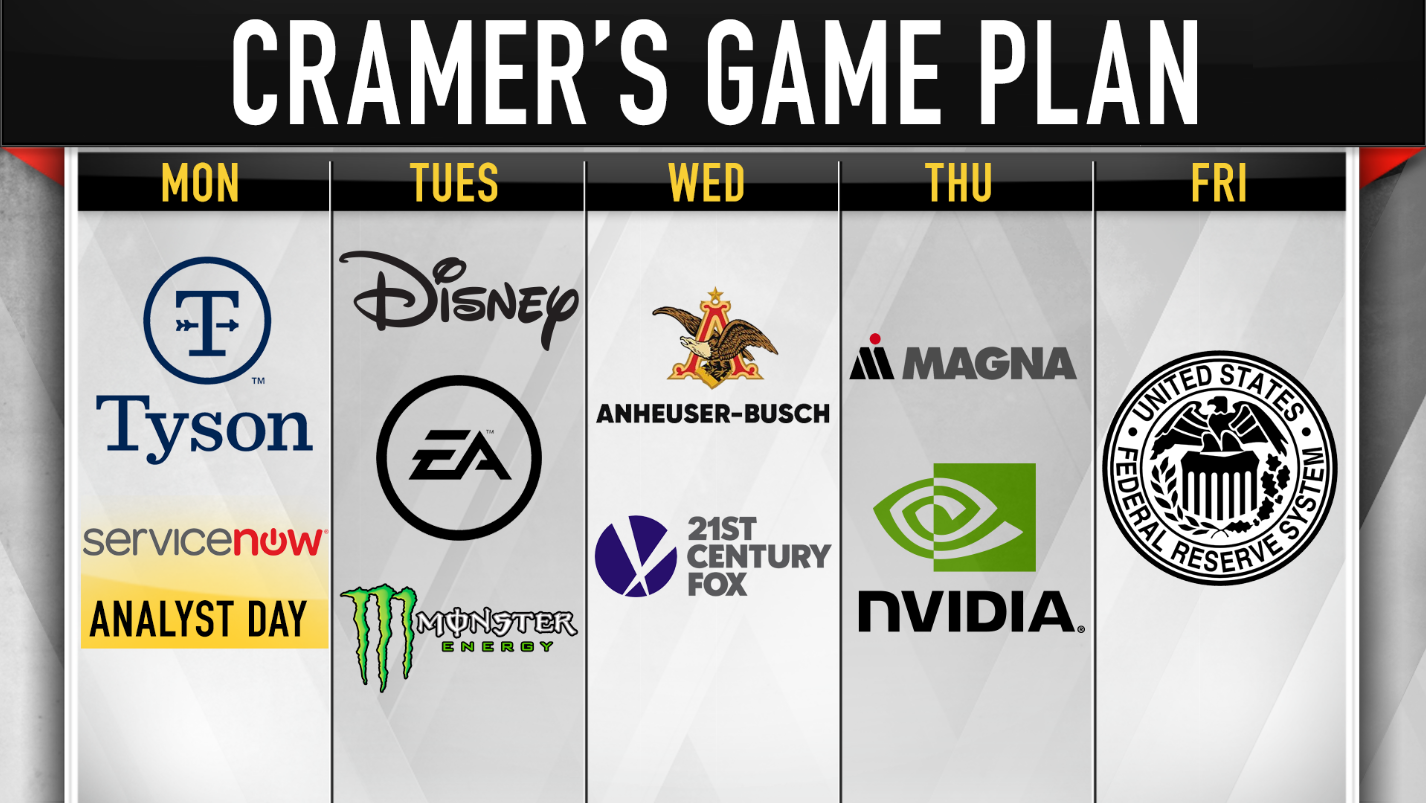

Wondering if the strength could continue, Cramer turned to his game plan for the week ahead:

Tyson Foods: Investors are divided about the fate of Tyson Foods’ stock ahead of its Monday earnings report.

Cramer sees short-sellers worried about rising raw costs and broad-based weakness in the consumer food stocks, but he also sees investors with long positions who believe in millennials’ love for protein and thus believe in the beef and poultry supplier.

“It’s been a terrible stock of late. Maybe it can right itself,” the “Mad Money” host said.

ServiceNow: An analyst meeting at “cloud king” ServiceNow could cause bullish pin action in the rest of the cloud stocks if CEO John Donahoe, formerly of eBay, tells a good story, Cramer said.

Disney: The entertainment colossus will report earnings on Tuesday, but rather than following the market, Cramer wanted investors to look under the hood.

“I think the bears who persist in thinking that ESPN’s declining subscribers will be the real story here are beginning to miss the point: Disney is a hit machine that’s launching a new ESPN online subscription service while it attempts to buy some key Fox properties that will produce even more hits,” he explained.

Electronic Arts: Cramer had some difficulty predicting what the video game maker’s quarterly results would look like. Its biggest competitor, Activision Blizzard, recently issued a seemingly disappointing report that hurt the stock.

Monster Beverage: Though he recently admitted that Monster’s stock is losing steam, Cramer said the energy drink maker’s strong long-term track record could produce a good earnings report.

Anheuser-Busch Inbev: The beer-brewing Bud Light parent will report earnings on Wednseday. Cramer hoped its results would outshine competitor Molson Coors’ numbers.

“I bet it will be better and we’ll be more worried about the price of the aluminum cans than the price of the suds inside,” the “Mad Money” host said.

Twenty-First Century Fox: Cramer wanted more details about potential deals with Disney and Comcast from Fox’s earnings report.

“Comcast could use a lift — a big ‘we’re not going to take it’ about Comcast’s offer might boost the stock of the cable company that owns this network,” he said.

Magna: Car parts supplier Magna will report earnings on Thursday amid pressure on the auto industry.

“[Magna] is, amazingly, just about a dollar off its 52-week high,” Cramer said. “I expect an incredibly strong number here that will perhaps breathe new life into the worst acting group in the entire market, and that’s saying something.”

Nvidia: Cramer-fave Nvidia will also report earnings. The “Mad Money” host lamented how controversial its stock has become given that the company’s graphics chips are leading products in the data center, artificial intelligence, gaming and autonomous car industries.

“So then what’s controversial? Simple: for the last few quarters, Nvidia’s bottom line has been boosted by cryptocurrency mining,” he explained. “But that business, which many people always regarded as a fad, has cooled dramatically.”

But if Nvidia’s stock gets slashed as analysts issue number cuts and downgrades on a weaker cryptocurrency business, Cramer said that his charitable trust, which owns shares, would use the pain as an opportunity to buy more.

“Crypto-mining is a sideshow. It’s just not the real Jensen Huang story,” he said.

James Bullard, the president of the St. Louis Federal Reserve, will speak on Friday, and you bet Cramer will listen.

“I think he may be the least ideological, most common-sensical member of the Federal Reserve,” Cramer said. “We need to hear the following: he favors two tightenings, but if the economy gets stronger, certainly stronger than today’s Labor number, he’s up for three hikes.”

Bullard’s candor could contribute to the market’s strength on Friday provided China-related trade issues don’t get in the way, Cramer said.

“The bottom line? Today showed what can happen if something, even something teeny-tiny small, goes right,” the “Mad Money” host said. “And looking at what’s coming up next week, it’s just possible this strength can continue.”

Disclosure: Comcast is the owner of NBCUniversal, parent company of CNBC and CNBC.com. Additionally, Cramer’s charitable trust owns shares of Apple and Nvidia.

Questions for Cramer?

Call Cramer: 1-800-743-CNBCWant to take a deep dive into Cramer’s world? Hit him up!

Mad Money Twitter – Jim Cramer Twitter – Facebook – Instagram – VineQuestions, comments, suggestions for the “Mad Money” website? madcap@cnbc.com