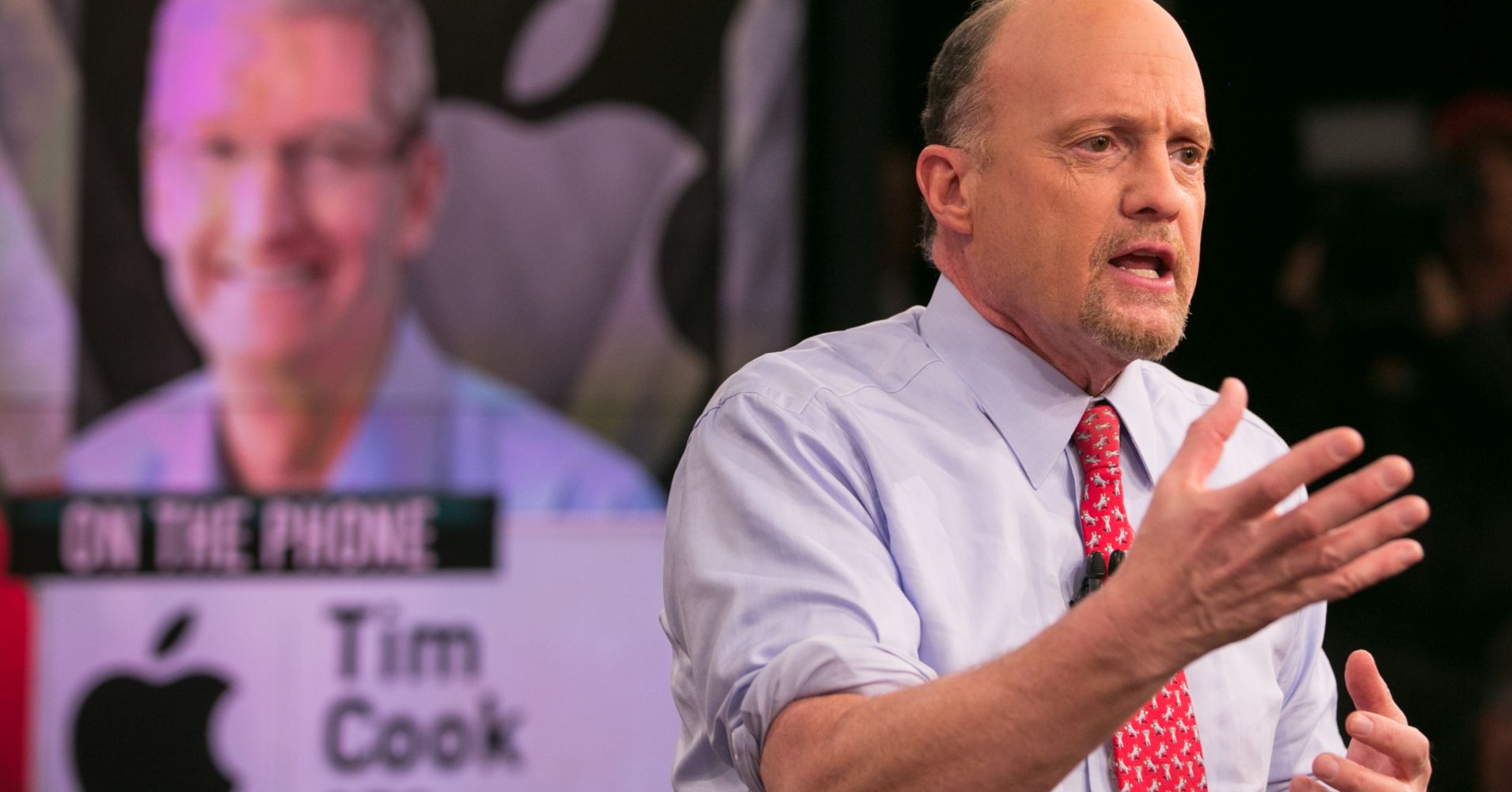

CNBC’s Jim Cramer said on Thursday Apple hitting a $1 trillion market value reflects the company’s transition to being recognized as a consumer products maker that just happens to be great at technology.

To that end, Cramer said, Apple stock needs to trade at higher price-to-earnings multiple because 17 times next year’s profit is too low.

He said Apple stock should trade at a higher multiple when looking at a best-in-class consumer products company like Clorox that has a PE of about 25 times.

“The market is struggling with how much to pay, but it knows it can’t pay this little given the fact this is a consumer products company,” Cramer told CNBC’s “Fast Money Halftime Report.”

“Should [Apple] get a 25 multiple like Clorox? I would think people would think that’s fanciful because the number is so high,” Cramer argued. “So maybe we should put a 20 multiple [on Apple].”

When Apple stock hit $207.05 at around 11:48 a.m. ET, it went over the $1 trillion market value threshold.