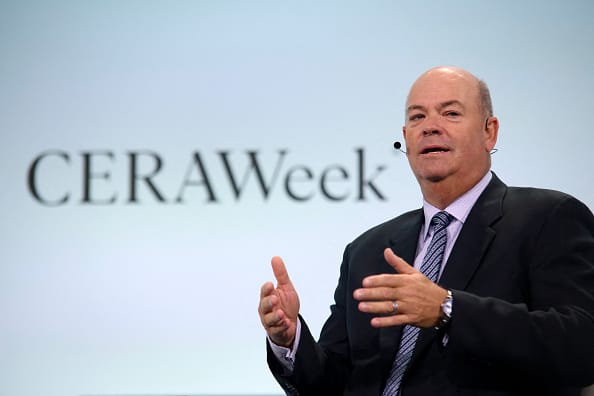

ConocoPhillips Chairman & CEO Ryan Lance speaks during the CERAWeek oil summit in Houston, Texas, on March 19, 2024.

Mark Felix | AFP | Getty Images

ConocoPhillips will purchase Marathon Oil in an all-stock transaction worth $17.1 billion that would strengthen the company’s shale assets.

“This acquisition of Marathon Oil further deepens our portfolio and fits within our financial framework, adding high-quality, low cost of supply inventory adjacent to our leading U.S. unconventional position,” said ConocoPhillips CEO Ryan Lance in a statement.

The acquisition of Marathon Oil will add 2 billion barrels of resources to ConocoPhillips portfolio, extending the company’s reach across shale fields in Texas, New Mexico and North Dakota.

The deal, which is expected to close in the fourth quarter, would immediately grow ConocoPhillips’ earnings, cash flow and shareholder returns, Lance said. ConocoPhillips expects share buybacks worth $7 billion in the first year after the deal closes and $20 billion after the first three years.

ConocoPhillips’ stock was down 3.3% in early trading following the announcement while Marathon Oil shares surged 7.3%.

The U.S. oil industry has undergone significant consolidation over the past year as companies seek to scoop up valuable acreage.

Exxon Mobil’s acquisition of Pioneer Natural Resources for $60 billion recently received the greenlight from the Federal Trade Commission. Hess Corporation shareholders voted on Tuesday to advance the company’s $53 billion merger with Chevron.

This is breaking news. Please check back for updates.