FILE PHOTO: Warren Buffett, CEO of Berkshire Hathaway Inc, pauses while playing bridge as part of the company annual meeting weekend in Omaha, Nebraska U.S. May 6, 2018. REUTERS/Rick Wilking

November 16, 2020

By Jonathan Stempel

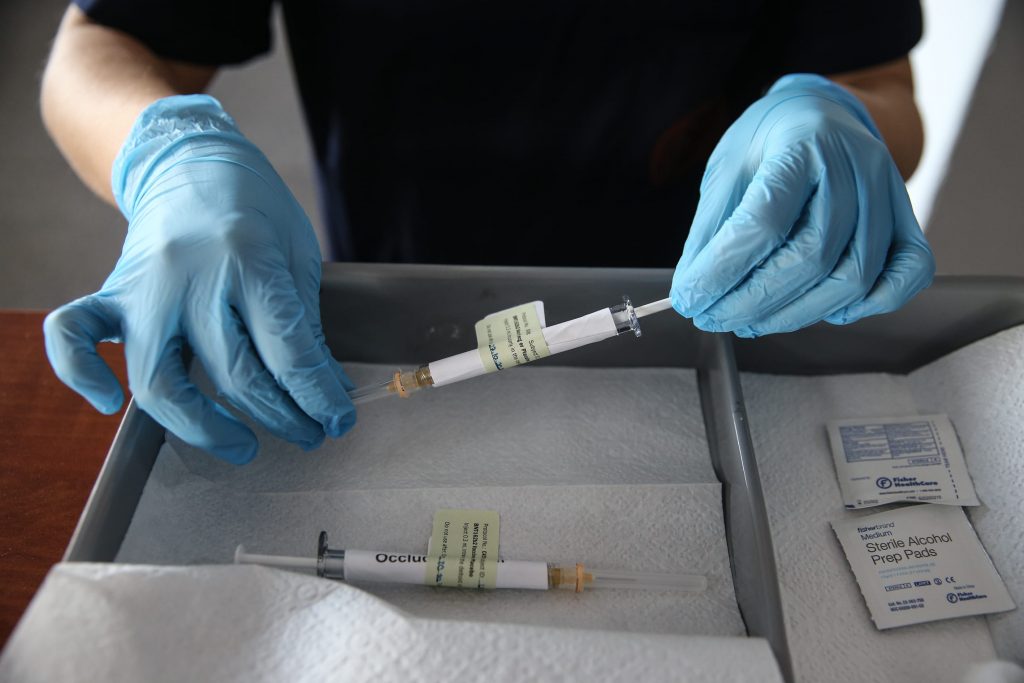

(Reuters) – Warren Buffett’s Berkshire Hathaway Inc said on Monday it has begun investing in the stocks of four large drugmakers, betting on an industry that could benefit as the world tries to emerge from the coronavirus pandemic.

In a regulatory filing detailing its U.S.-listed investments as of Sept. 30, Berkshire disclosed new stakes in Abbvie Inc, Bristol-Myers Squibb Co and Merck & Co of more than $1.8 billion each, and a new $136 million stake in Pfizer Inc.

Berkshire also revealed a new $276 million stake in wireless phone company T-Mobile US Inc.

During the third quarter, Berkshire also sold a $1.3 billion stake in Costco Wholesale Corp, which has benefited as people stocked up on groceries and home supplies, and pared holdings in four banks: JPMorgan Chase, Wells Fargo, PNC and M&T.

The JPMorgan stake fell by 96%. Berkshire also confirmed it trimmed its Apple stake and bought more Bank of America stock.

Shares of the four drugmakers rose in after-hours trade, reflecting investors’ confidence in Buffett’s bets.

Monday’s filing signals where Buffett and his portfolio managers Todd Combs, who is also a JPMorgan director, and Ted Weschler see value. Larger investments are normally Buffett’s.

Berkshire did not immediately respond to a request for comment.

The healthcare bet is structured similarly to the more than $6 billion wager that Buffett made on the airline industry.

Buffett sold Berkshire’s airline holdings in April, saying the pandemic had changed the industry and made its outlook uncertain.

Berkshire bought $17.6 billion and sold $12.8 billion of equities in the quarter, making it unusually active.

Other new investments included a $6 billion stake in five Japanese trading houses and a $1.5 billion wager on newly public data storage company Snowflake Inc.

Berkshire also has more than 90 operating units including the Geico car insurer, BNSF railroad and Dairy Queen ice cream.

(Reporting by Jonathan Stempel in New York; Editing by Chris Reese, Sandra Maler and Sam Holmes)