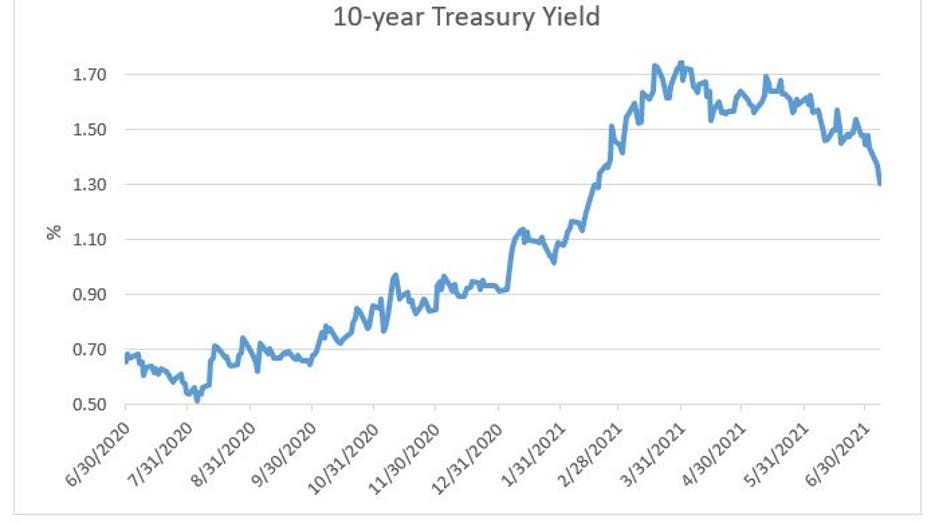

The 10-year U.S. Treasury yield fell as low as 1.25% on Thursday, its lowest point since February, continuing a sharp reversal in the bond market amid growing concern about the pace of the global economic recovery.

The yield on the benchmark 10-year Treasury note fell 6 basis points to 1.261% at 7:20 a.m. ET after reaching 1.25% earlier in the session. The yield on the 30-year Treasury bond dipped 7.6 basis points to 1.868%. Yields move inversely to prices and 1 basis point equals 0.01 percentage points.

The spread of the more transmissible delta variant of Covid-19 has fueled worries about a slowdown in global economic growth, sending investors into the safety of U.S. Treasuries. Japan declared a state of emergency for Tokyo that could reportedly lead to spectators being banned from the upcoming Olympic Games.

The 10-year yield has now dropped about 18 basis points since last Friday, and the 30-year yield has shed a similar amount. In March, the 10-year yield was yielding as much as 1.78%.

The move has mystified investors and some believe it’s largely technical factors driving the decline in yields.

“Inflation expectations have been stable, suggesting economic forces are not at the heart of the slide,” wrote Christopher Harvey, head of equity strategy at Wells Fargo in a Thursday note entitled “Misleading bond market signals.” “Rate players and our Macro team inform us that technical issues related to liquidity, positioning, and forced buying are ‘driving the bus.'”

The decline in long-term interest rates comes even as the Federal Reserve signals it is inching toward possibly tightening its policy stance. Investors expect the central bank’s first move would be to slow its asset purchases while leaving its main rate at historic lows. Short term rates have not fallen at the same pace as long-term rates, causing a so-called flattening of the Treasury yield curve.

The yield decline in recent weeks represents a sharp reversal from a dramatic rise that started in late 2020. After entering January below 1%, the benchmark 10-year yield rose above 1.7% in March before retrenching near the 1.6% level for much of April.

“While the markets expected the Reopening to be something akin to a binary event, what we are witnessing is a staged recovery with asymmetric outcomes. Data from the UK shows wage inflation due to labor shortages along with record high housing prices. Sound familiar? It makes one wonder if the weaker than expected labor recovery is a symptom of reopening rather than idiosyncratic to the US,” JPMorgan’s Andrew Tyler wrote in a note on Thursday.

On Thursday, the U.S. Labor Department is due to release the number of weekly jobless claims for the week ended July 3 at 8:30 a.m. ET. Economists expect to see 350,000 first-time applicants for unemployment benefits for the week ended July 3, according to Dow Jones.

This comes after the Federal Reserve on Wednesday released the minutes from its latest meeting on June 15-16.

Some members indicated that the economic recovery was proceeding faster than expected and was being accompanied by an outsized rise in inflation, both making the case for taking the Fed’s foot off the policy pedal.

However, the prevailing mindset was that there should be no rush and markets must be well prepared for any shifts.

Auctions will be held on Thursday for $40 billion of 4-week bills and $40 billion of 8-week bills.

— CNBC’s Jeff Cox contributed to this market report.