Stocks fell on Thursday as investors pored through mixed U.S. economic data and the latest corporate earnings reports.

The Dow Jones Industrial Average dropped 200 points, or more than 0.5%. The S&P 500 slid 0.8% and the Nasdaq Composite slid 1.1%.

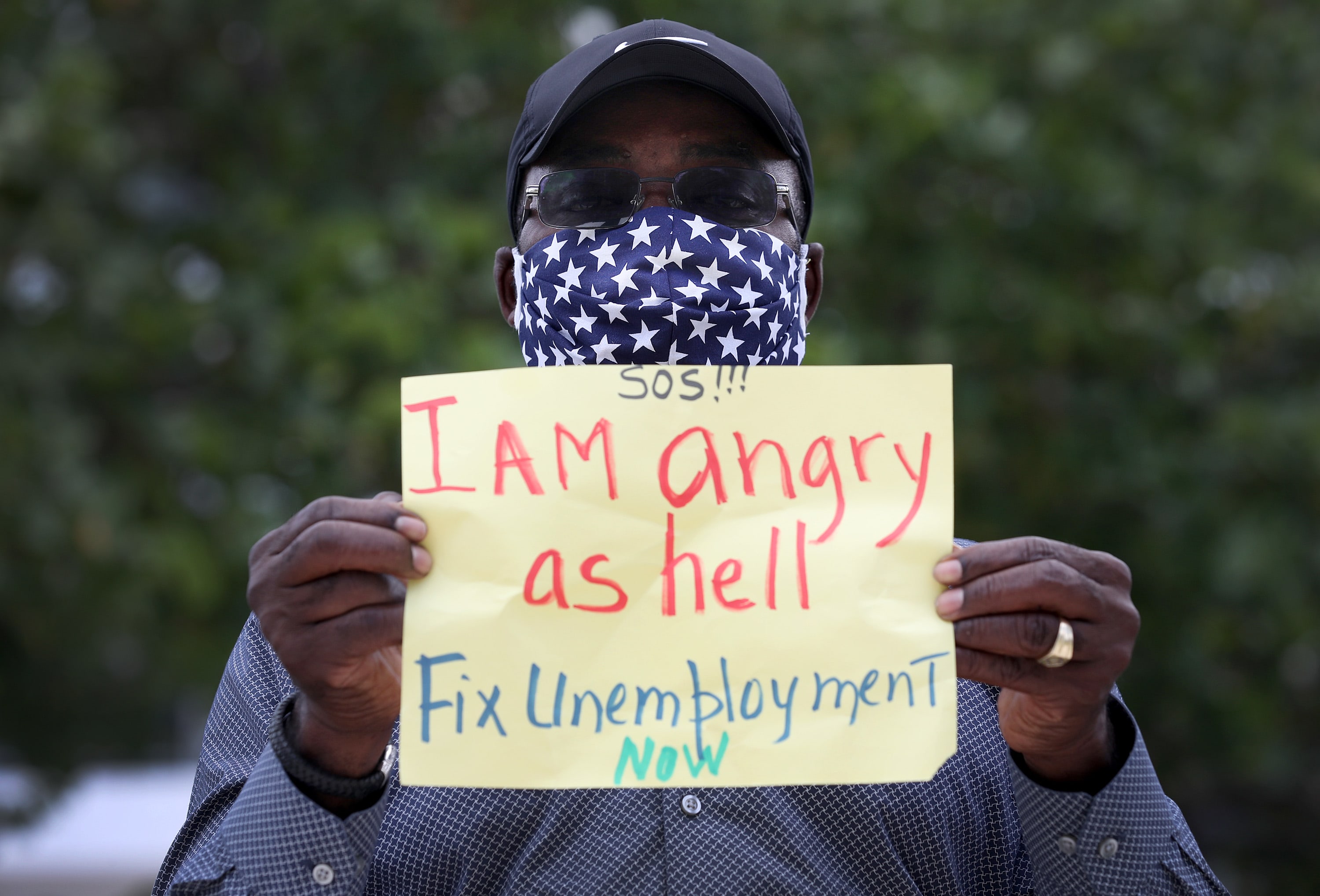

The weekly jobless claims number came in slightly worst than expected. The Labor Department said a total of 1.30 million Americans filed for unemployment benefits last week, compared to Dow Jones estimates of 1.25 million first-time filers.

However, retail sales jumped 7.5% in June, topping expectations of a 5.2% increase per Dow Jones. This reading came after May’s 17.7% surge, which blew past estimates and was the largest reading on record.

Paul Ashworth, chief U.S. economist at Capital Economics, said the U.S. retail sales data could signal a big economic rebound in the third quarter. “But with the new wave of infections leading to renewed closures and restriction in some states, we still think the balance of risks to that third-quarter forecast lie to the downside,” he said.

Meanwhile, the corporate earnings season continued and Bank of America reported better-than-expected earnings for the previous quarter.

However, the stock fell more than 3% as the company set aside $4 billion for coronavirus-related losses. Dow member Johnson & Johnson was flat as its full-year guidance dampened the optimism around its quarterly earnings beat.

Morgan Stanley shares rose 0.3% after the company’s quarterly earnings easily beat analyst expectations on the back of strong trading revenues. Netflix is set to report earnings after the bell.

Thursday’s moves came following a major sell-off in mainland Chinese stocks, which saw the Shanghai composite down more than 4% on the day. That came despite China reporting that the country’s GDP grew 3.2% in the second quarter of the year as compared to a year ago — above expectations of a 2.5% growth by economics in a Reuters poll.

Wall Street was also coming off strong gains from the previous session, as news regarding a potential coronavirus vaccine lifted investor sentiment. Although some investors think expectations should be tempered.

“We are not out of the woods yet and are still far away from returning to pre-Covid-19 economic levels,” said Nate Fischer, chief investment strategist at Strategic Wealth Partners.

“The market is in need of a health-care solution, as the economy was forced to shut down for a health-care issue. So far, we’ve had fiscal and monetary assistance to this problem. Until a real medical remedy is found, the market will remain volatile,” he added.

Subscribe to CNBC PRO for exclusive insights and analysis, and live business day programming from around the world.

—CNBC’s Eustance Huang contributed to this report.