All that glitters is gold this month.

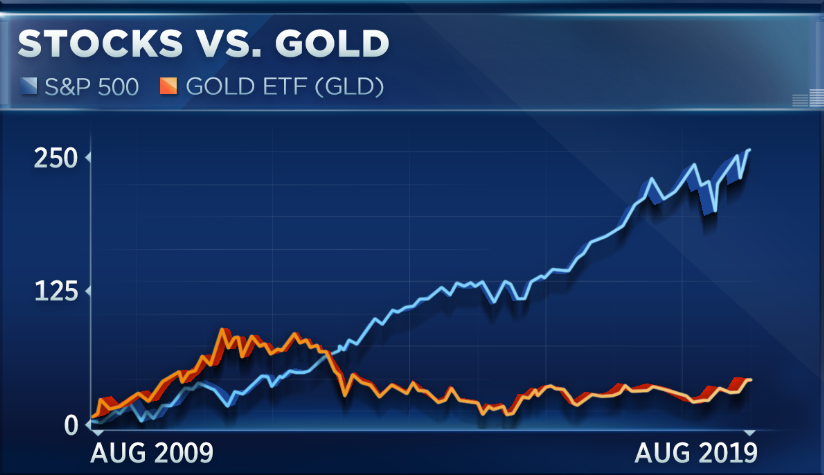

Gold prices have surged 5% in August as the S&P 500 has tumbled 2%. Its rally has pushed the yellow metal above $1,500 to reach the highest level in more than six years.

Don’t buy into this rally yet, said Craig Johnson, chief market technician at Piper Jaffray.

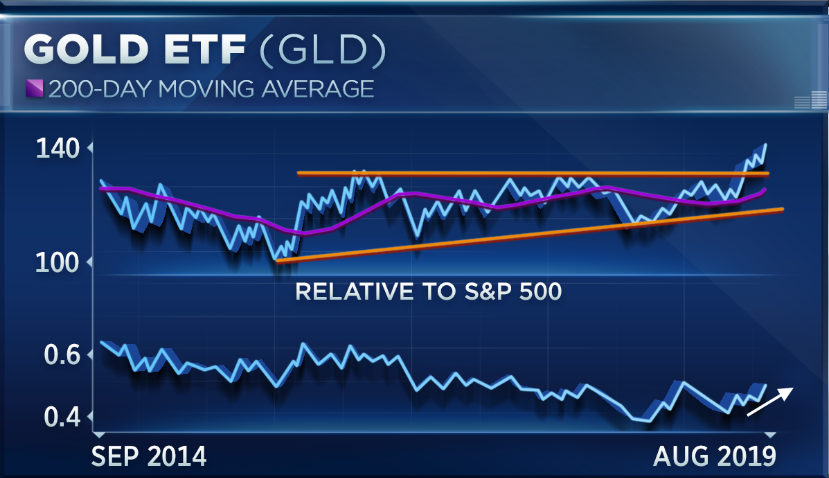

“It’s starting to get a little bit ahead of itself,” Johnson said Thursday on CNBC’s “Trading Nation. ” “I would trade it this way – I’d wait for this stock, take profits here and now, wait for it to pull back to about $130 on the GLD, then I’d be a buyer on that pullback and confirmation of support.”

The GLD gold ETF peaked at $142.47 earlier this week. It would need to fall 8% from current levels to reach Johnson’s $130 target.

“On the longer-term setup, you can see that there could be measured objective towards about $160 here. Because this is a very meaningful topside break out of a nice consolidation range,” Johnson added.

A move to $160 on the GLD ETF implies 13% upside. It last traded above that level in 2013.

Nancy Tengler, chief investment strategist at Tengler Wealth Management, said in mid-July that the gold trade would work as a near-term play. Since that call, the GLD ETF has rallied 5%.

However, she’s not ready to buy the long-term bull case.

“If I believe that slowing global growth is going to infect the U.S., that interest rates are going negative, then I buy gold,” Tengler said Thursday on “Trading Nation.” “If I think, as I do, that things will consolidate — we’ll ultimately get a China deal, not great, and equities will begin to rally and outperform — then you sell here, and invest in dividend-paying stocks.”

The GLD ETF remains 24% below its all-time peak in September 2011.