Our goal here at Credible Operations, Inc., NMLS Number 1681276, referred to as “Credible” below, is to give you the tools and confidence you need to improve your finances. Although we do promote products from our partner lenders who compensate us for our services, all opinions are our own.

The chart above shows average prequalified rates for borrowers with credit scores of 720 or higher who used the Credible marketplace to select a lender.

For the month of July 2024:

- Rates on 3-year personal loans averaged 23.60%, up from 23.02% in June.

- Rates on 5-year personal loans averaged 25.06%, up from 24.81% in June.

Rates on personal loans vary considerably by credit score and loan term. If you’re curious about what kind of personal loan rates you may qualify for, you can use an online tool like Credible to compare options from different private lenders.

All Credible marketplace lenders offer fixed-rate loans at competitive rates. Because lenders use different methods to evaluate borrowers, it’s a good idea to request personal loan rates from multiple lenders so you can compare your options.

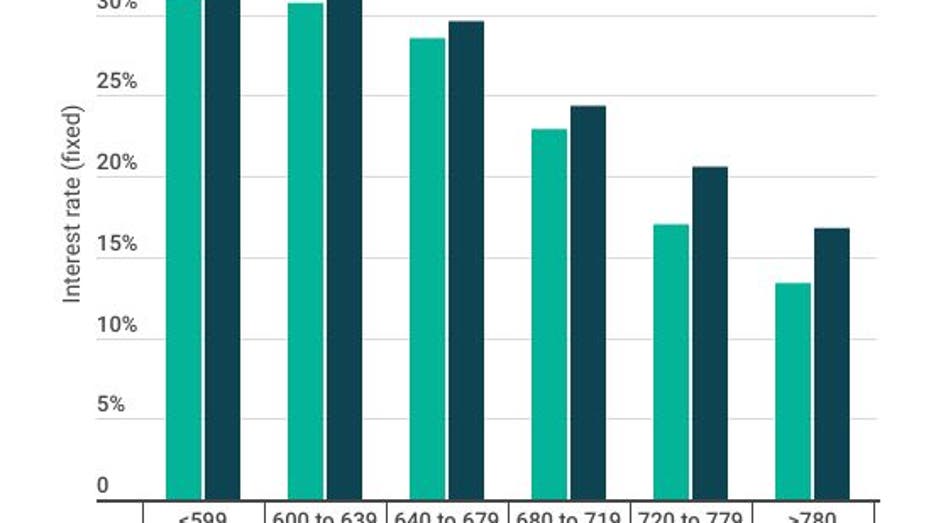

Current personal loan rates by credit score

Juggling multiple maxed-out credit cards? Do these 5 things now