Oil prices spiked higher on Friday, heading toward 2½-year highs the morning after two dozen crude-producing nations agreed to limit their output through the end of 2018.

U.S. West Texas Intermediate crude prices rocketed up 98 cents per barrel, or 1.7 percent, to $58.38 by 11:15 a.m. ET. That put the contract within striking distance of $59.05, its peak for this year and the highest level since July 2015.

International benchmark Brent crude surged $1.11, or 1.8 percent, to $63.74, not far off last month’s high of $64.65 that marked the best intraday level since June 2015.

“Prices have been supported in the aftermath of the OPEC meeting,” said John Kilduff, partner at energy hedge fund Again Capital told CNBC.

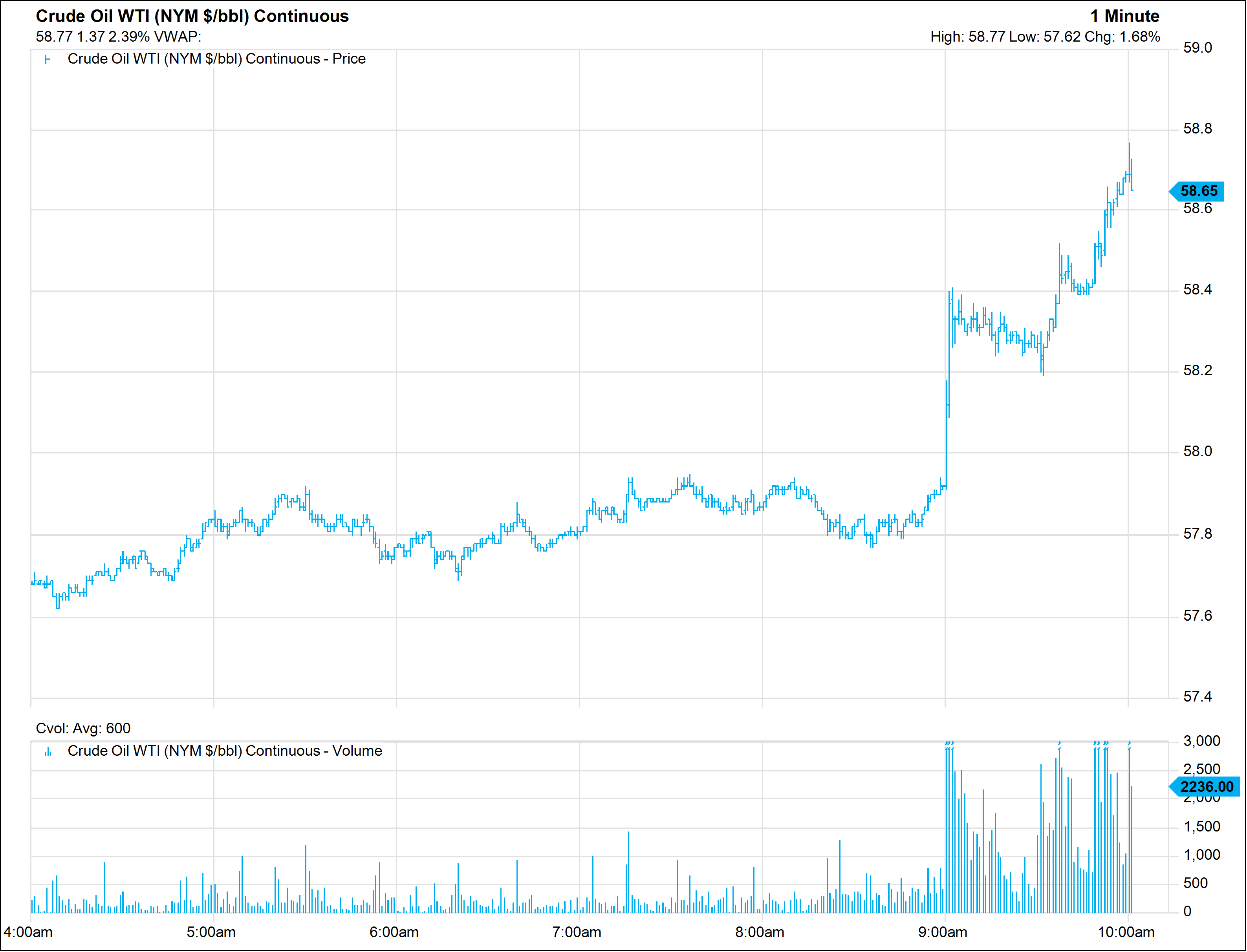

U.S. crude intraday

Futures spiked higher around 9 a.m. ET, the technical start of the trading day when many big firms start putting in buy and sell orders. Kilduff said the market appeared to be keying in on Saudi Oil Minister and current OPEC President Khalid al-Falih’s resolve in securing a deal among the 24 producers who met in Vienna on Thursday.

“The market is giving a tip of the hat to him right now,” he said.

The 14-member OPEC cartel, Russia and nine other producers agreed on Thursday to extend their deal to keep 1.8 million barrels a day off the market through the end of 2018. The producers reached the agreement last winter in a bid to drain a global crude glut and boost prices. They had extended the agreement once already.

Analysts earlier this week told CNBC they expected oil prices to fall even if the producers delivered the nine-month extension the market had been anticipating. That is because the extension was largely baked into prices.

But Falih exceeded expectations by securing output limits from Nigeria and Libya’s cooperation, two OPEC members that have so far been exempt from the deal, according to Helima Croft, global head of commodity strategy at RBC Capital Markets.

“Throughout the year he earned a reputation as a tough compliance enforcer,” she told CNBC on Thursday.

Prices had slumped throughout much of the week as questions over Russia’s commitment to a full nine-month extension sent jitters through the market.